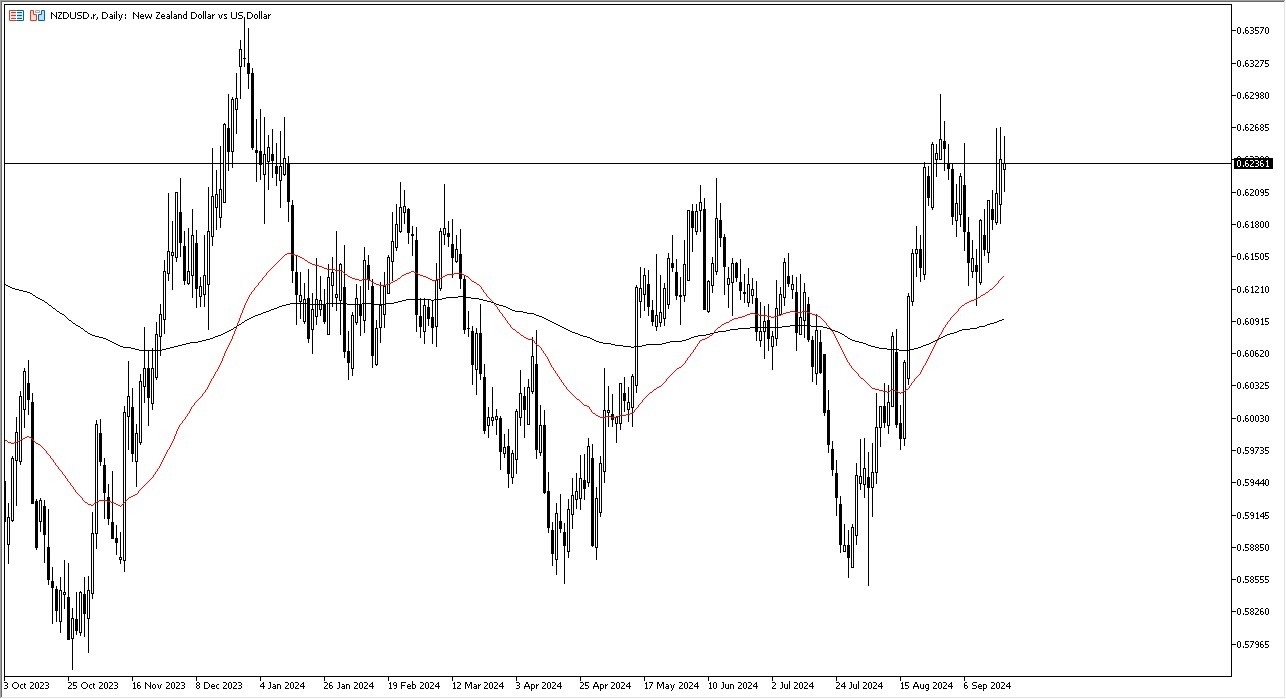

- The New Zealand dollar has rallied initially during the trading session on Friday, but it continues to see a lot of noise near the 0.63 level.

- While we have had a 50 basis point interest rate cut coming out of the Federal Reserve people reacted very positively as far as risk appetite is concerned.

- Furthermore, you saw the US dollar get hammered as a result so it all tracks pretty well.

However, when the Federal Reserve cuts 50 basis points that's generally a bad sign for the economy and in that environment, it makes sense that people might be rushing toward the treasury markets. In this environment, it's possible that we could see the US dollar strengthen quite a bit, although we will have to wait and see. The New Zealand dollar has faced a significant amount of resistance near the 0.63 level and the 0.6350 level. The New Zealand dollar is highly sensitive to commodities and of course Asian growth or weakness. So that comes into the picture as well.

Top Forex Brokers

Technical Analysis

From a technical analysis standpoint, it's a bullish market still, but the overhang cannot be ignored. And that tells me that perhaps we could continue to see a lot of choppiness or perhaps even see selling on some type of concern or fear.

In general, I think you've got a scenario where traders continue to look at this as a market that might be somewhat range bound until we make a bigger decision on what we're going to do with the information that the Federal Reserve ended up doing essentially two rate cuts. In the past, this has generally been the beginning of something rather dire, so it’ll be interesting to see if that ends up being the case yet again as people begin to digest the fact that the Federal Reserve did in fact have to come in and ease so aggressively.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.