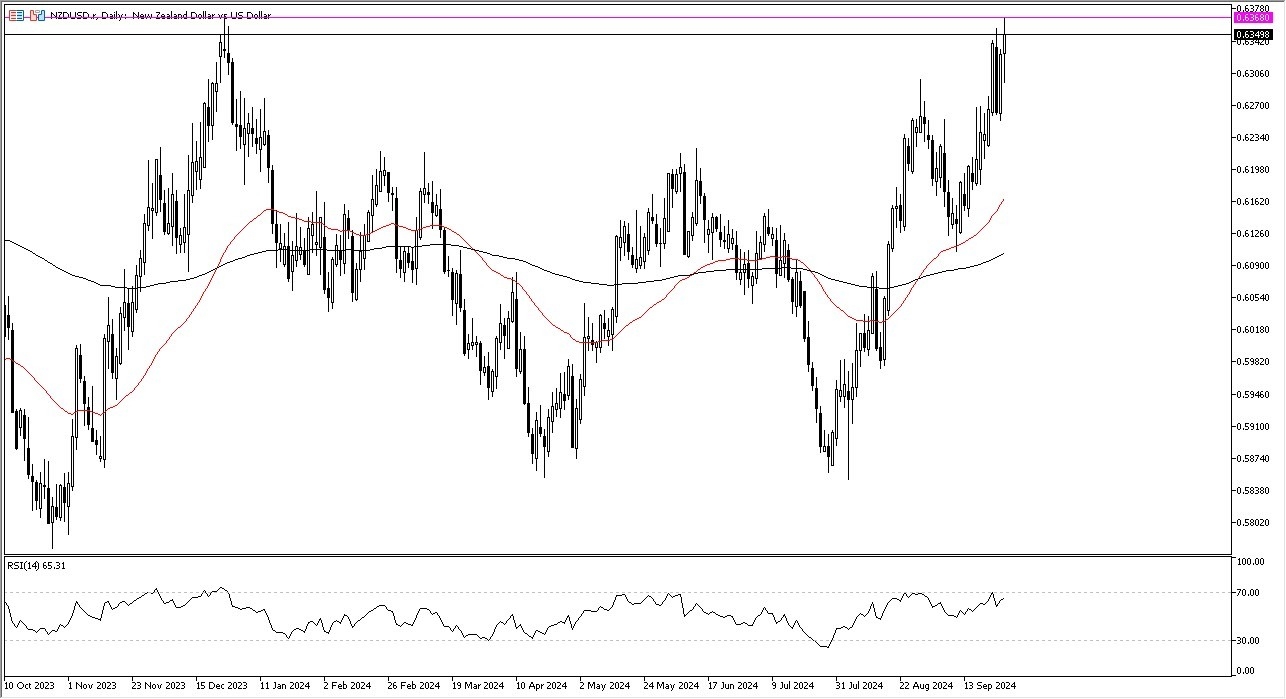

- The New Zealand dollar initially pulled back a bit during the Friday session, only to turn around and show signs of life again.

- The 0.6368 level has been an area where resistance has occurred.

- Therefore, it's likely that we will continue to look at that area as a potential double top, but I think it's likely that we will eventually break out to the upside.

If we do, the 0.64 level will be the first target, followed by the 0.65 level. Keep in mind that the New Zealand dollar is highly sensitive to risk appetite and therefore we need to see other markets around the world rally in order to make this an attractive currency to own. If we pull back from here, there should be a significant amount of support near the 0.6250 level, and I think that continues to be a major support barrier that a lot of people will be cognizant of. In general, keep an eye on the US dollar in general, as the US dollar is considered to be a safety currency, and it does tend to move in the same general direction overall.

Top Forex Brokers

If you understand where the US dollar is going, you understand where risk is going

If we start to see the US dollar strengthen against multiple currencies, then the New Zealand dollar probably won't be any better. I do expect a significant amount of noisy behavior, but I also suspect that this is a market where the momentum is most certainly to the upside. So given enough time, it wouldn't surprise me at all to see the New Zealand dollar take off.

This will be especially true, of course, if the Federal Reserve continues to suggest that we are going to continue to loosen monetary policy. All things being equal, it’s worth noting that the Federal Reserve is probably going to do everything it can to drive down the value of the US dollar in the short-term, but longer term we may get a bit of a panic in the markets that could end up turning things around quite viciously.

Ready to trade our daily Forex forecast? Here’s some of the best New Zealand forex brokers to check out.