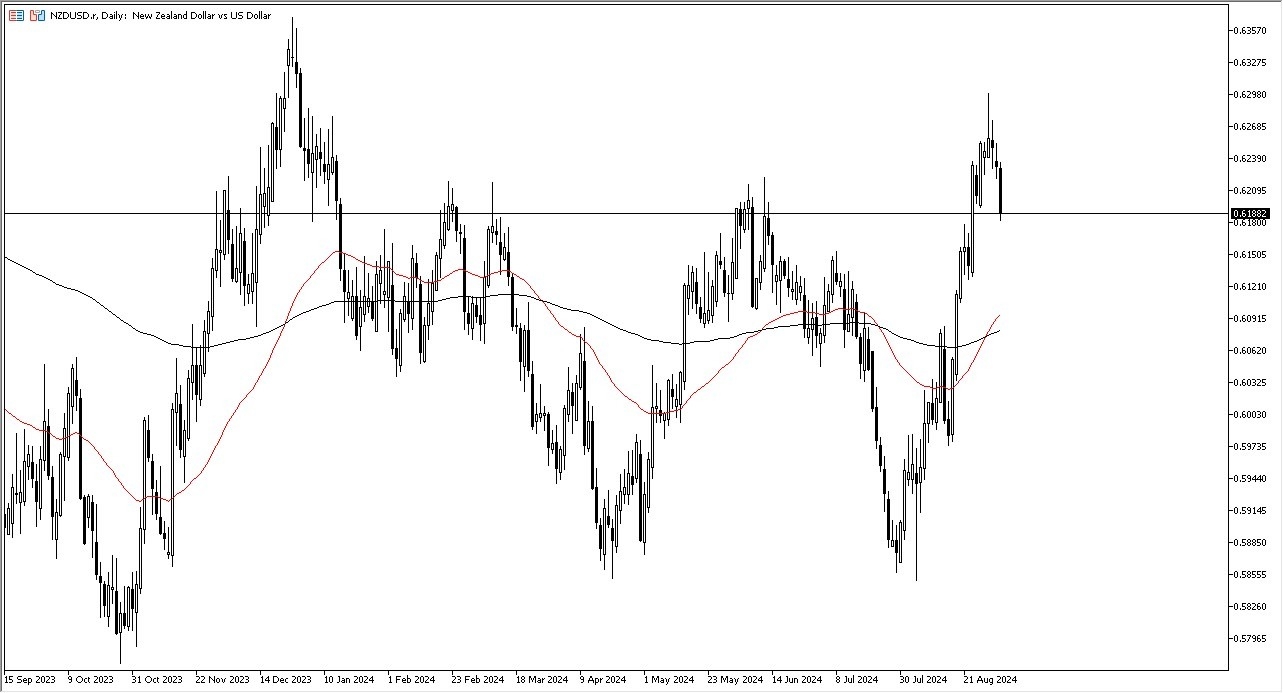

- The NZD/USD pair looks very week, as we had stretched far too high in the air, and now it looks like we are starting to drift a bit lower.

- This makes a certain amount of sense, because the market cannot go in the same direction forever, and of course we had ended up testing a major resistance barrier in the form of the 0.63 level.

- With that being said, the market is likely to continue to look at that as a crucial barrier, so the fact that we shied away from that level makes quite a bit of sense.

In general, I think this is a market that will probably continue to look vulnerable, because quite frankly the global growth situation is very week, and the New Zealand dollar is something that is very sensitive to the global growth situation, as New Zealand is basically a commodity-based economy. Furthermore, it is also very sensitive to Asian growth or weakness, and it’s worth noting that overnight we had seen Chinese demand for crude oil being reported as very weak. While this does not directly influenced any exports out of New Zealand, it does suggest that their biggest customer might be running into a bit of a significant economic headwind.

Top Forex Brokers

Buying the Dip?

It’s possible the traders out there will be buying the dip, and I would pay close attention to the 0.6150 level underneath. This is an area that previously had been important, so I think it is worth looking at through the prism of whether or not we bounce from that area. The candlestick for the trading session on Tuesday is rather ugly, and as a general rule, I find that these types of candles don’t happen in a vacuum, and there will more likely than not be a continuation of the negativity given enough time. Because of this, I do think that we continue to drop from here, but whether or not it ends up being something a little bit more substantial remains to be seen. I’d be very cautious with my position size in this pair now.

Ready to trade our Forex daily analysis and predictions? Check out the most trusted forex brokers NZ worth using.