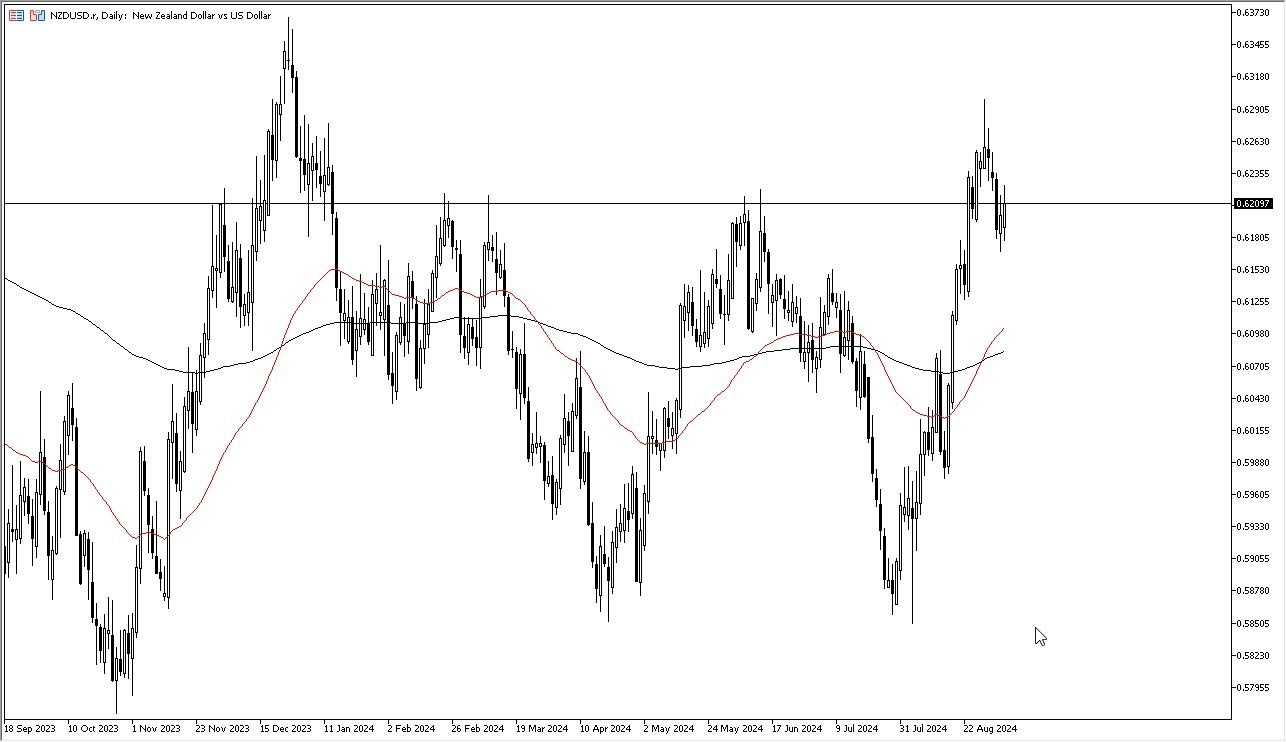

- In my daily analysis of the New Zealand dollar, the first thing that captures my attention is that we have had another day of positivity, which of course is a very bullish sign.

- However, we are currently dancing around the 0.62 level, an area that has been important than once.

- The market continues to be a situation where we are looking at risk appetite being all over the place, and therefore it does make a certain amount of sense that we would continue to see a lot of uncertainty and therefore choppy behavior.

At this point in time, it’s worth noting that the New Zealand dollar is highly sensitive to Asia and out what’s going on with the Asian economy, as well as the global economy as the New Zealand economy is so heavily influenced by commodities in general. Ultimately, this is a market that I think will continue to follow the overall sentiment of traders more than anything else, because quite frankly the New Zealand economy isn’t necessarily poor, but it doesn’t necessarily drive where we go. I believe that more likely than not we are going to continue to see the US dollar be the main driver of where we go next.

Federal Reserve

Top Forex Brokers

The Federal Reserve of course is front and center at the moment, and traders are worried about whether or not the Fed will cut rates enough to ease fears in the markets. While we certainly should see some type of interest rate cut, presumably 25 basis points, in September, the reality is that if we start to see the Federal Reserve cut rapidly, then it could cause a bit of a panic, and it would make a certain amount of sense that we would see the US dollar pickup strength, not because of interest rate differential, but the fact that people would be running toward the bond market in America for safety. That being said, at the moment it looks like we are still away from that possibility.

At this point in time, the market looks more or less positive but grinds higher than anything else. If we were to give up the 0.6150 level to the downside, that could cause a bit more selling pressure. That being said, I expect more volatility than anything else going forward.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using.