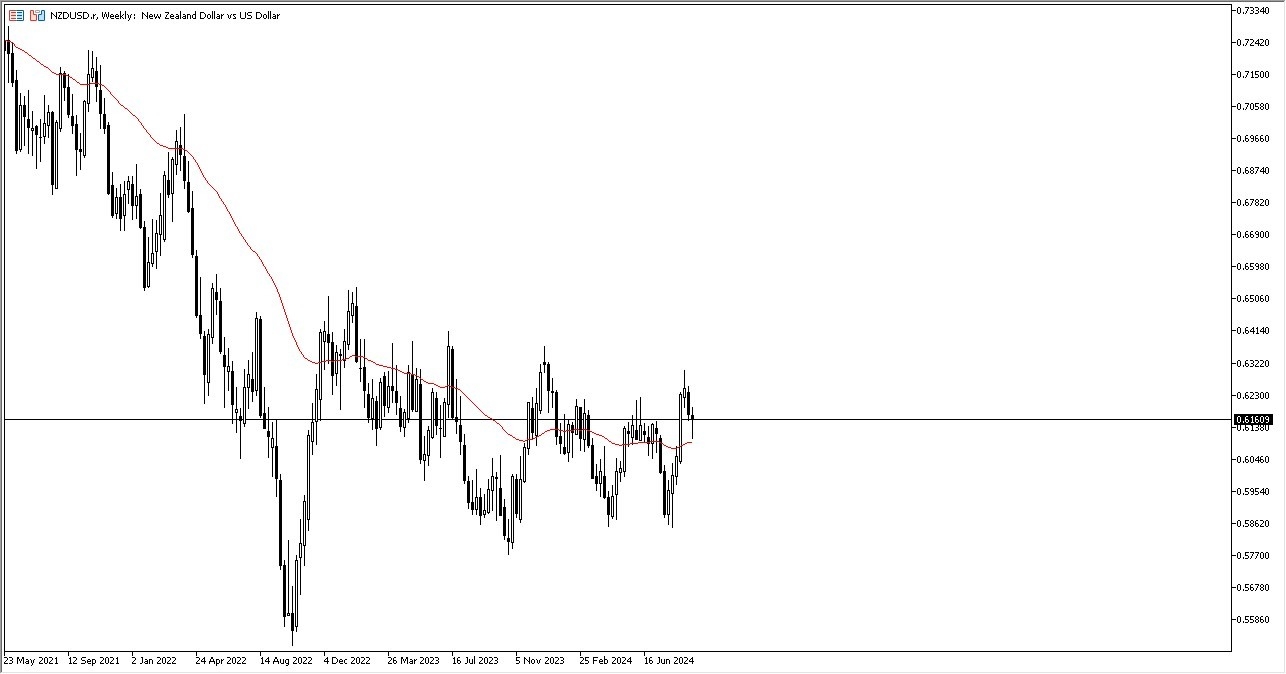

NZD/USD

The New Zealand dollar initially fell during the course of the trading week, only to turn around and show signs of life. By turning around the way it did, the market ended up forming a bit of a hammer, and that does suggest that perhaps there is a little bit more bullish pressure just waiting to happen. The 50-Week EMA offered support, and now it looks as if the 0.63 level above is going to end up being a bit of a barrier. If we can break above there, then the New Zealand dollar should continue to go much higher.

USD/CHF

The US dollar has rallied a bit during the course of the week, but having said that, it’s also worth noting that the Friday session was a bit negative. All things being equal, looks like the 0.84 level is going to continue to be a major support level, as it has been important multiple times. All things being equal, this is a market that I think continues to see a lot of volatility as the US dollar might be the riskier of the 2 currencies in this particular pair. Because of this, it’ll be interesting to see how this plays out, because we have a lot of concerns when it comes to the global economy, so I think we continue to see this market try to break out to the upside, but I also think that we continue to see it be somewhat sluggish.

Top Forex Brokers

Dow Jones 30

The Dow Jones 30 took off to the upside during the week, and we now find ourselves testing the recent all-time high. I think we will continue to go much higher, and eventually we will break out above the 41,800 level, looking at the 42,000 level as the initial target. The alternative scenario course is that we pull back a little bit, perhaps down to the 40,500 level, simply chopping back and forth. There are a lot of concerns when it comes to global growth out there, but at the same time we have the Federal Reserve likely to cut rates on September 18.

Gold

Gold markets have rallied again for the week, as we have seen a very impulsive candlestick form for the week. That being said, I do think that we will get a pullback sooner or later, if for no other reason than we have the FOMC interest rate decision on Wednesday that will cause a lot of volatility. Once we get through that, it’s very likely that we will continue to see the gold market go much higher. I am a buyer of dips and have no interest whatsoever in trying to short this market.

VIX

Looking at the VIX, it’s easy to see that it collapsed during the week after seeing such a massive surge during the previous week. I think what this sets up is a market that’s going to get somewhat complacent. While most people don’t trade this futures contract, it is worth paying attention to if you are going to trade stocks in the United States. I suspect that if we break down below the 15 level, it’s time to start being cautious about buying stocks again, and perhaps time to start taking profit in long position that you may already have on.

Silver

Silver has rallied rather significantly during the course of the week to break well above the $30 level. Keep in mind this is a market that is extraordinarily volatile and has a lot of noise behind it, but the size of the candlestick leaves no doubt that the buyers have stepped back in and taken the reins of the silver market. I think we will probably get a little bit of a pullback due to the FOMC meeting in the middle of the week, but that should end up being a nice buying opportunity for those who are looking for more long term. The $20.50 level should be a significant amount of support just waiting to happen.

USD/CNH

The US dollar rallied a bit during the course of the week against the Chinese yuan but seems to be struggling near the 7.13 level yet again. We have seen this pattern play out over 3 weeks now, that every time we rallied, sellers come back into the market and start shorting the greenback. With that being said, the market is likely to continue to see a lot of support underneath, especially near the 7.07 level, an area that has been extraordinarily supportive over the last couple of months. Keep in mind that this is a risk on/risk off type of scenario, with the US dollar being the ultimate safety currency.

EUR/USD

The euro initially dipped during the week, only to turn around and show signs of life again. By doing so, the market ended up forming a bit of a hammer, which suggest that the 1.10 level underneath is going to continue to be supported. If we break down below there, then we have the 200-Week EMA worth paying attention to. On the upside, the 1.12 level above is a significant amount of resistance just waiting to happen. I think we continue to be somewhat sideways overall, perhaps with a slightly bullish attitude in the EUR/USD market.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.