NASDAQ 100

NASDAQ 100 traders have been very bullish for the week, but it looks like we are struggling with the 19,950 level, an area that has been difficult to overcome multiple times. If we can break above there, the market is likely to continue going higher, perhaps reaching the overall highs that we had formed during the previous couple of months. Short-term pullbacks at this point in time should continue to be buying opportunities, with the 18,300 level underneath being a major support level.

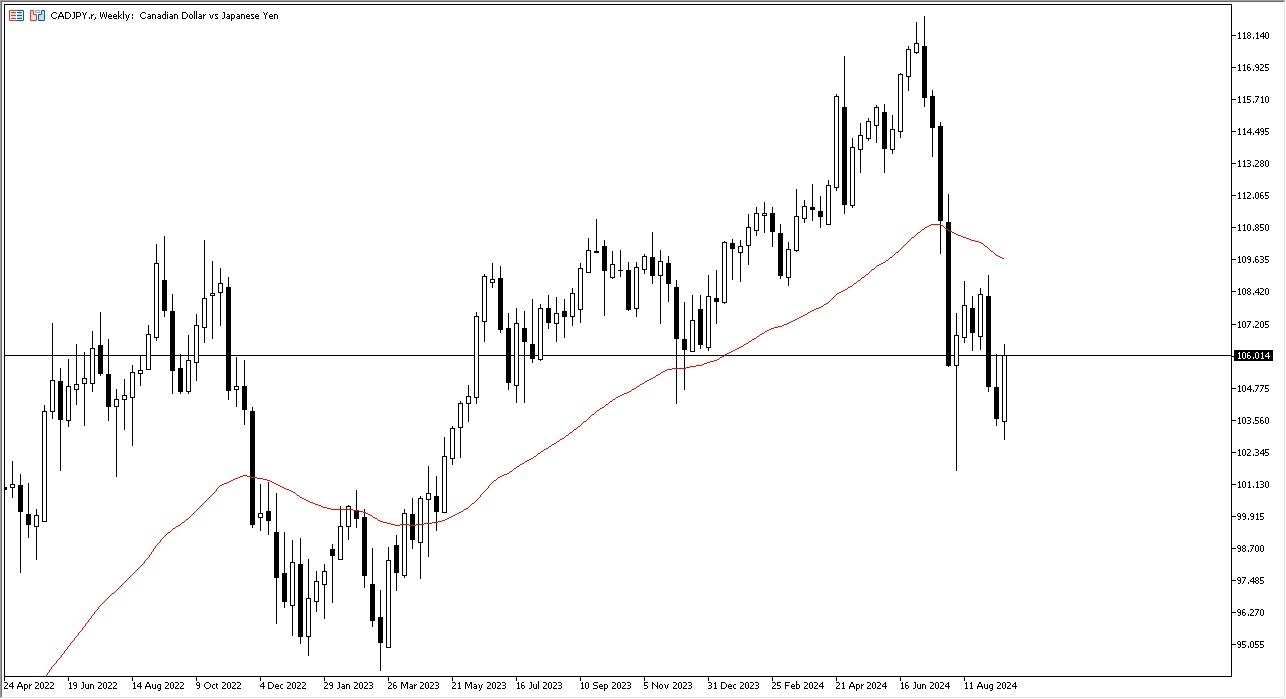

CAD/JPY

The Canadian dollar initially pulled back just a bit during the trading week, only to turn around and rip to the upside as the risk appetite has picked up. After all, the Federal Reserve is cut interest rates, just as the Bank of Japan has stated that it will stay pat, meaning that we should continue to see the Japanese yen get hit. We may have just bottom, but it’ll be interesting to see whether or not we do it quickly, or if we see short-term pullbacks as potential buying opportunities. The ¥103.50 level is an area that will continue to be important, and as long as we can stay above there, I think that this is a market that still in a bottoming pattern.

Top Forex Brokers

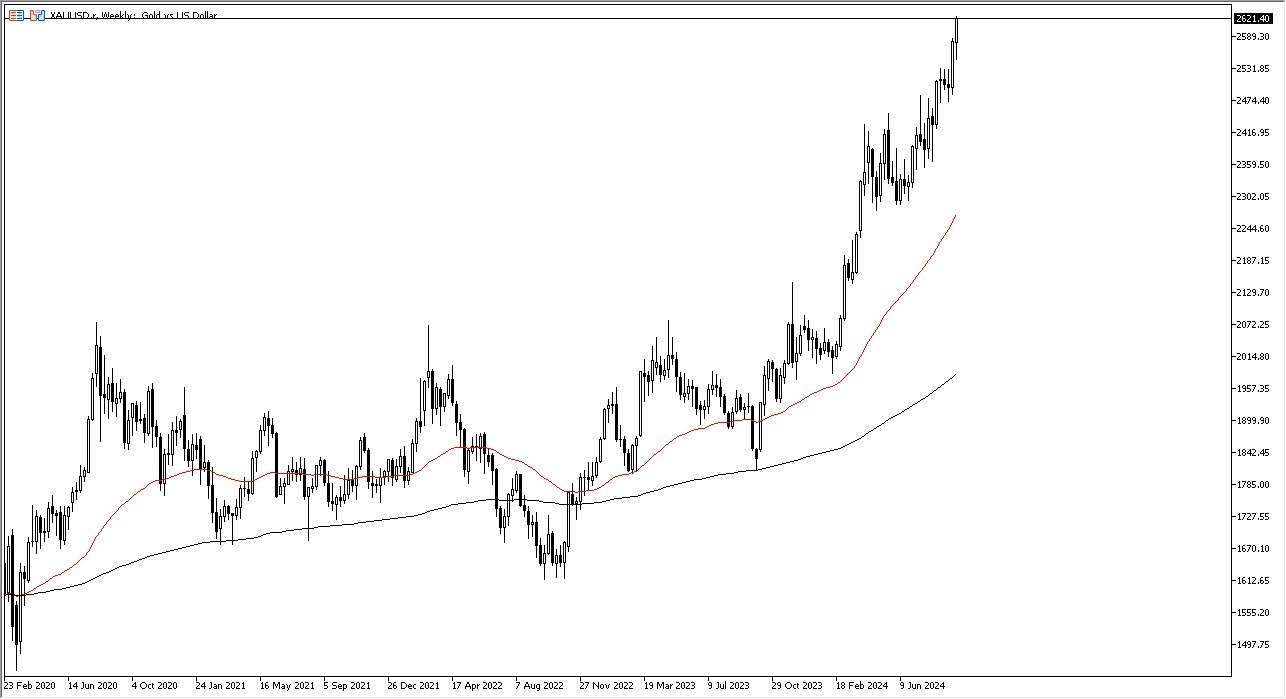

Gold

Gold markets continue to rip to the upside as we have seen so much in the way of bullish pressure that it’s difficult to imagine a scenario where the short term pullbacks will continue to get bought into. If that’s going to be the case, and of course with the Federal Reserve reasserting its desire to stoke inflation again, it makes a lot of sense that gold will continue to go higher. If we break out from here, and it looks like we are going to, I suspect that sooner or later gold will go looking to the $3000 level.

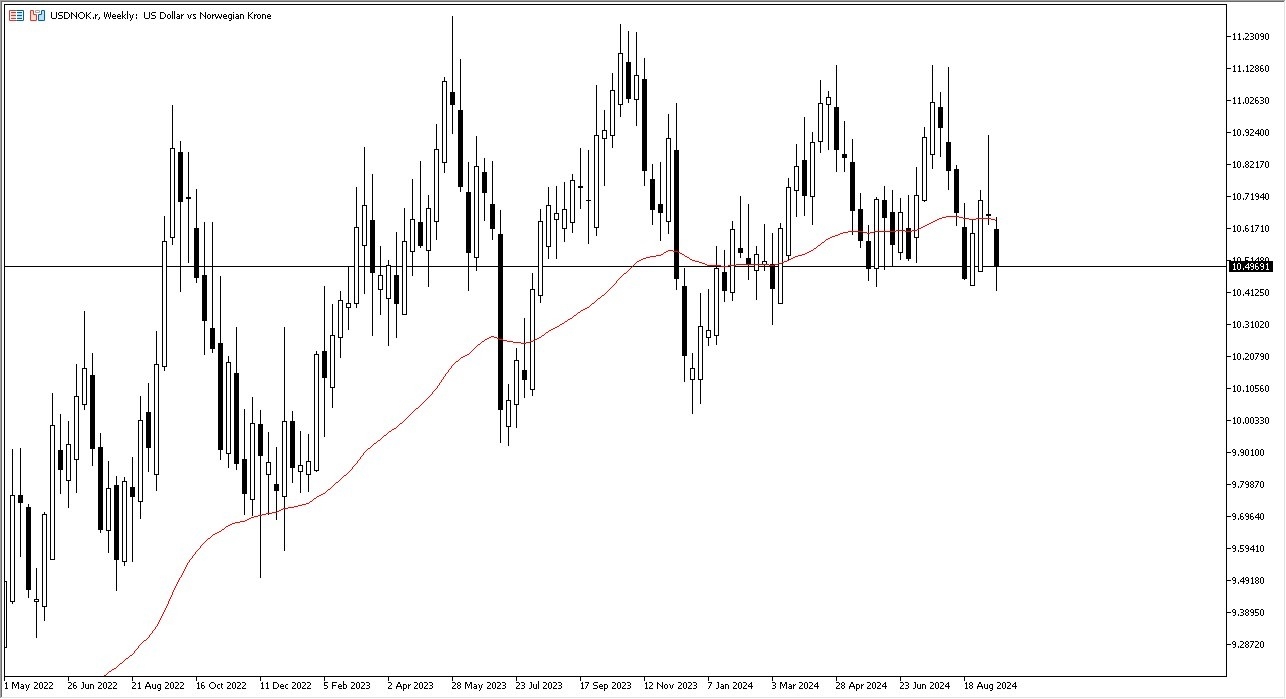

USD/NOK

The US dollar has fallen a bit against the Norwegian krone, testing the 10.45 level, an area that has offered support multiple times. At this point in time, as long as we can stay above there, then it’s likely that buyers will come in and try to pick this market up, perhaps reaching toward the 50 Week EMA. On the other hand, if we break down below the 10.40 level, then I think the US dollar could drop down to the 10.20 level over the next couple of weeks.

NZD/USD

The New Zealand dollar has rallied during the course of the week, breaking toward the 0.6250 level. This is an area that’s been important multiple times, and I do think that if we can break above there, then we have an even more aggressive resistance area near the 0.6350 level. It’s not until we break above that level that I think the New Zealand dollar is going to continue to be very strong. In the short term, it’s worth noting that the Stochastic Oscillator has rolled over in the overbought condition on the weekly chart so we may get a short-term pullback.

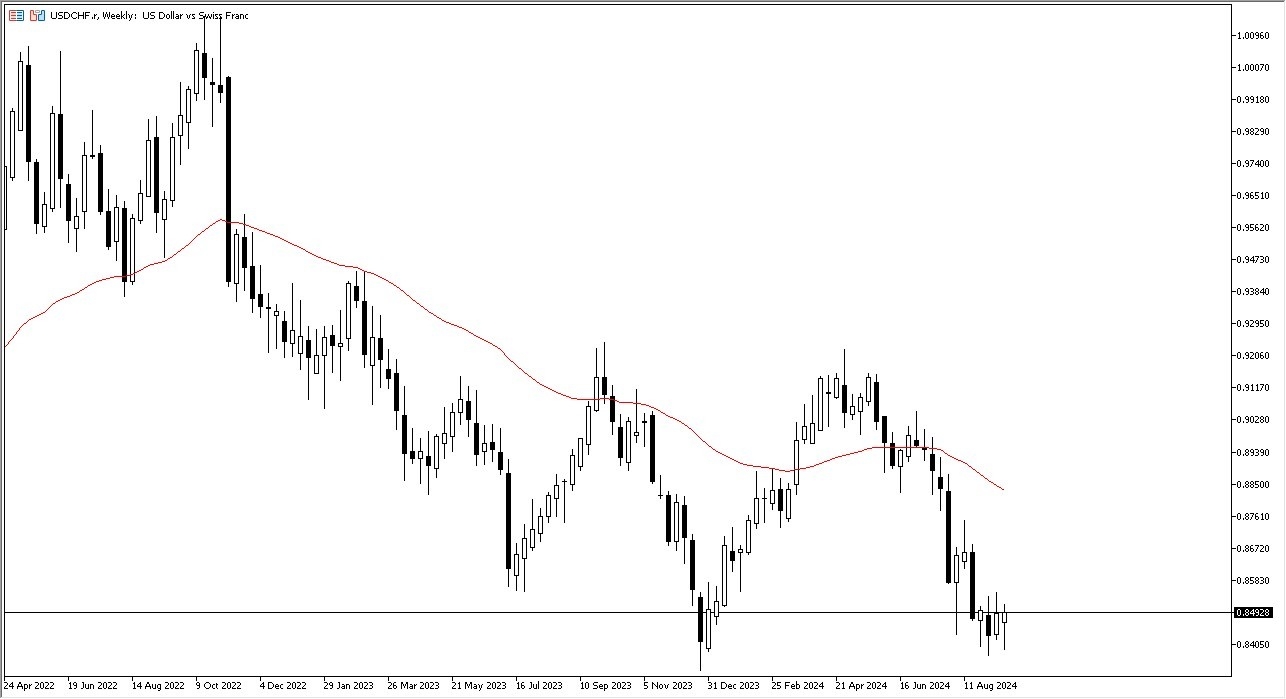

USD/CHF

The US dollar has fallen a bit during the course of the trading week to test the crucial 0.84 level, which is an area that I think is a major area to watch as it has been important multiple times. By turning things around to form a hammer, I think you’ve got a situation where we might see buyers come in and try to pick up the US dollar, which would be more of a “risk on move”, considering that the Swiss franc is considered to be the “ultimate safety currency.”

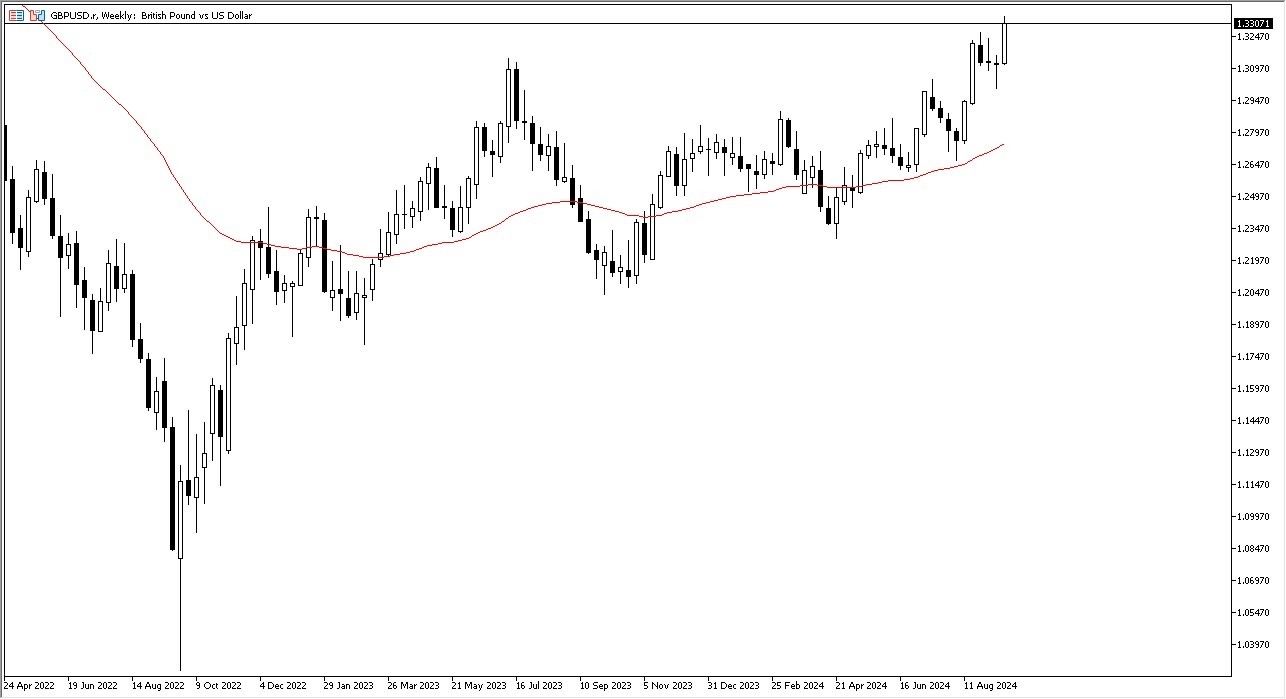

GBP/USD

The British pound has rallied significantly during the course of the trading week, to finally get above the 1.3250 level. This is an area that I think a lot of traders had been paying attention to, so it is worth noting that the strong close for the week is a sign that the British pound could continue to go higher, and as the Bank of England has not cut rates while the Federal Reserve has this week, I think that’s a positive sign for the GBP/USD currency pair in general. Short-term pullbacks should be buying opportunities going forward.

USD/CAD

The US dollar continues to chop back and forth against the Canadian dollar (USD/CAD pair) near the 50 Week EMA, which suggests to me that this is a market that will continue to be somewhat sideways and therefore I think you’ve got a situation where we are in the middle of a consolidation range between 1.3150 on the bottom, and the 1.39 level at the top. In other words, I’m very neutral and ambivalent on this pair going forward. Overall, I probably will wait until we get to the outer edges of this consolidation area before putting money to work.

Ready to trade our Forex weekly forecast? We’ve made this forex brokers list for you to check out.