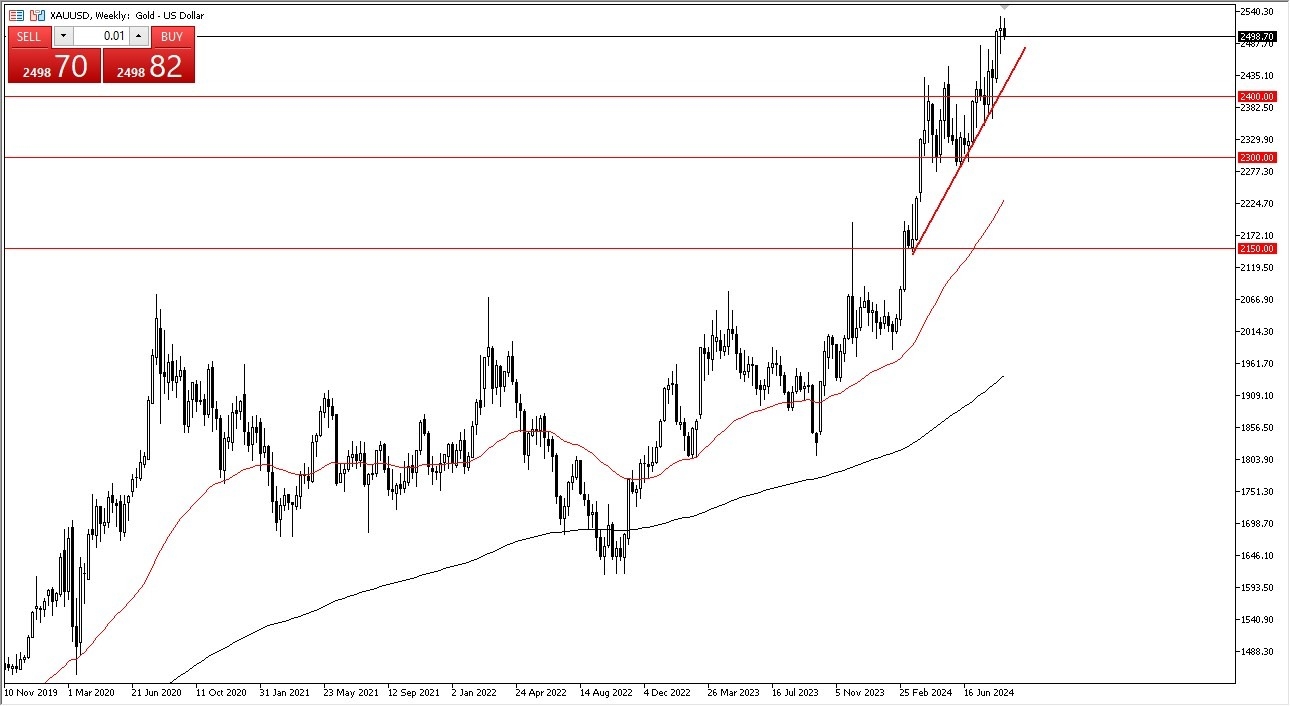

Gold

Gold markets initially tried to rally during the course of the week, but then turned around to show signs of weakness. By doing so, it looks like the market is a little stretched, but quite frankly I think this is a situation where we have had a lot of bullish pressure, but at this point in time, we are a very bullish market that might have digestive gains. Furthermore, Friday was leading into a three-day weekend in the United States, so I would not read too much in this pullback. Ultimately, gold is still going to attract inflows.

USD/JPY

The US dollar has rallied quite significantly during the course of the week, as we have bounced from a major trend line. All things being equal, I think that the USD/JPY market continues to see a lot of volatility and noise, but it also looks like we are trying to turn things around and show signs of life. The uptrend line of course is an area that people will be paying close attention to, and the fact that we have stabilized near could be the beginning of a turnaround.

Top Forex Brokers

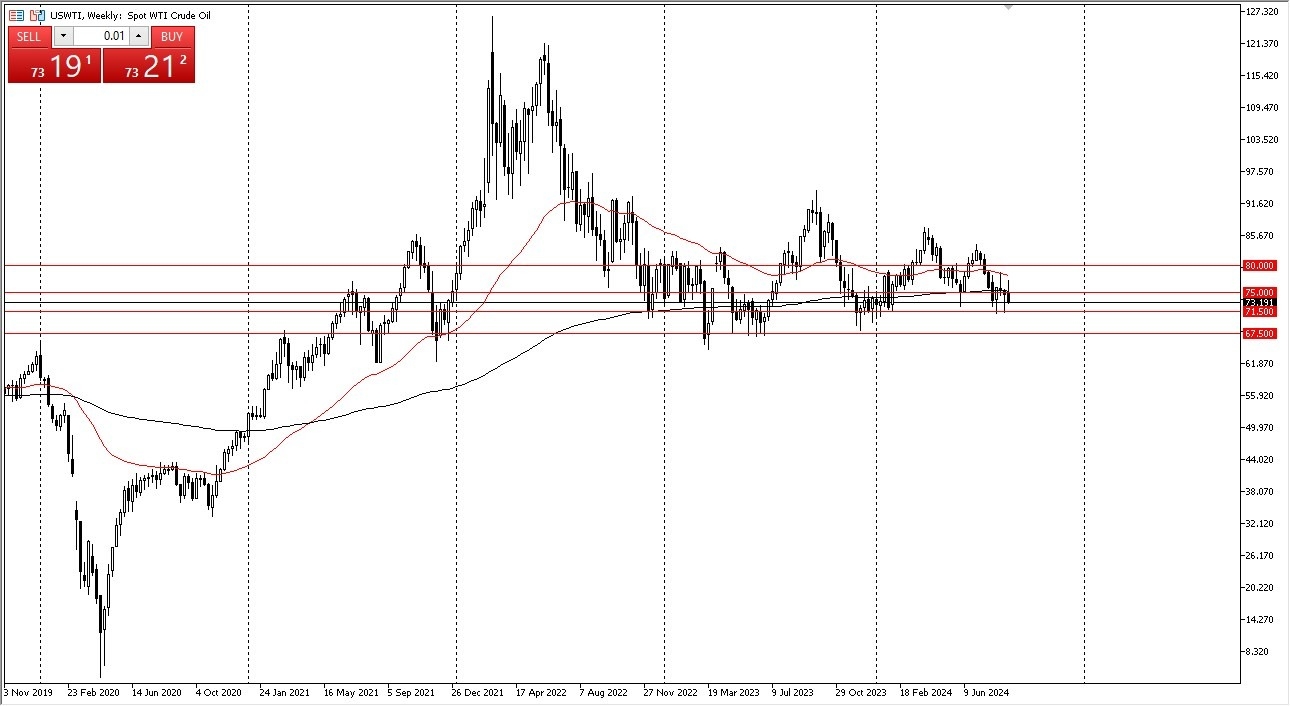

WTI Crude Oil

The West Texas Intermediate Crude Oil market is one that initially tried to rally during the course of the week, only turning around to show signs of weakness. All things being equal, this is a market that has been range bound for a couple of years now, therefore I think you have to look at this through the prism of the $75 level being a bit of a magnet overall. I think we continue to go sideways, as traders simply do not have any major momentum to push the market back and forth.

Silver

Silver initially tried to rally during the week but fell apart on Friday. With that being the case, the Silver market is likely to continue to see a lot of noisy behavior, and with this being the case, I think you will continue to see traders shy away from silver. That being said, the $28.50 level underneath is a significant support level, as it had been previous resistance. With this being the case, the market is likely to continue to see a lot of “buy on the dip” traders out there, but we also need the US dollar to continue to weaken.

DAX

The German index rally during the course of the week yet again, and even managed to make a new all-time high. That being said, we did give back a little bit of the gains, but short-term pullbacks are more likely than not going to continue to attract a lot of attention. With that being the case, I think we continue to go much higher, but we are a little stretched, so don’t be surprised if we get a little bit of a short-term dip. Over the longer term, I believe that we go much higher given enough time.

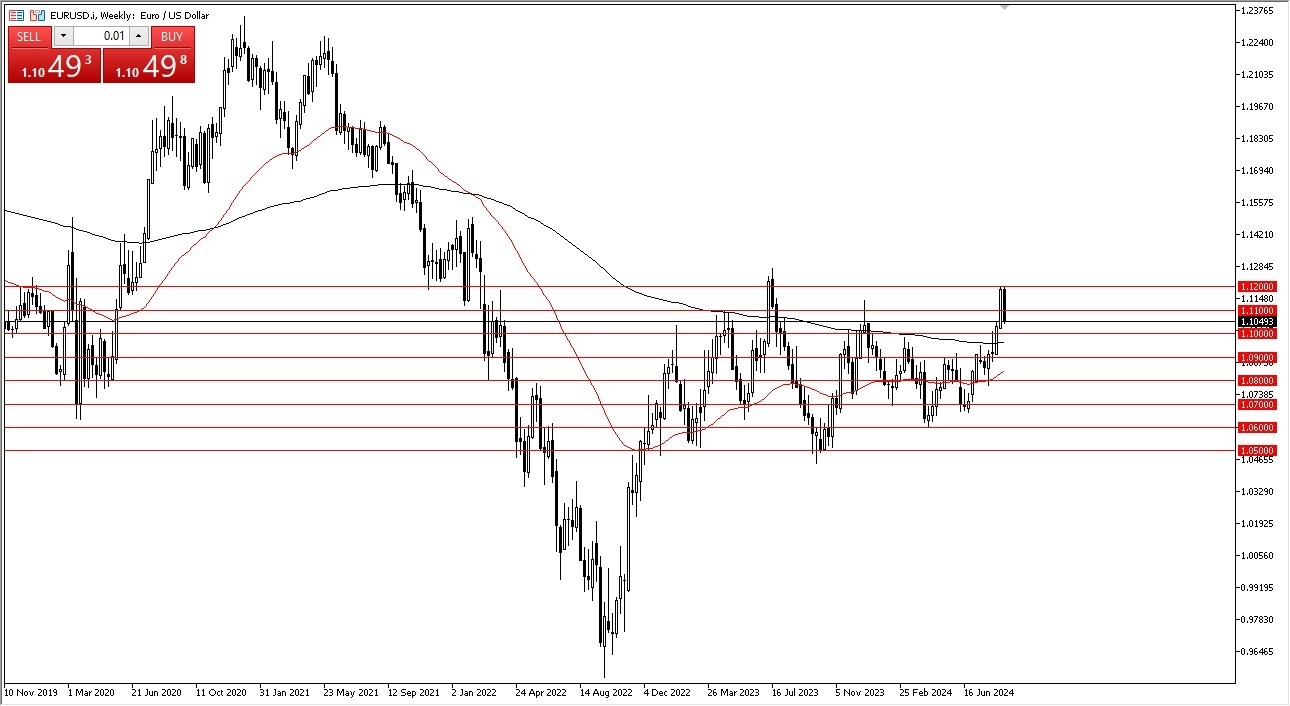

EUR/USD

The euro has pulled back significantly from the 1.12 level, an area that has been important more than once. In fact, we not only pull back from there, but we collapse. The question now is whether or not the euro will continue to find buyers on dips, or do we continue to drop? I think at this point in time it’s an open question, so I’d be very cautious with the EUR/USD currency pair, and quite frankly I have no interest in trying to trade the market. However, if the market were to break lower, it might give you an idea that the US dollar is strengthening against everything else. Because of this, it would have a major influence on other FX pairs. On the other hand, if the euro turn things back around, then it’s likely that the US dollar will sell off against everything else. In other words, it is an indicator to be used with other trades.

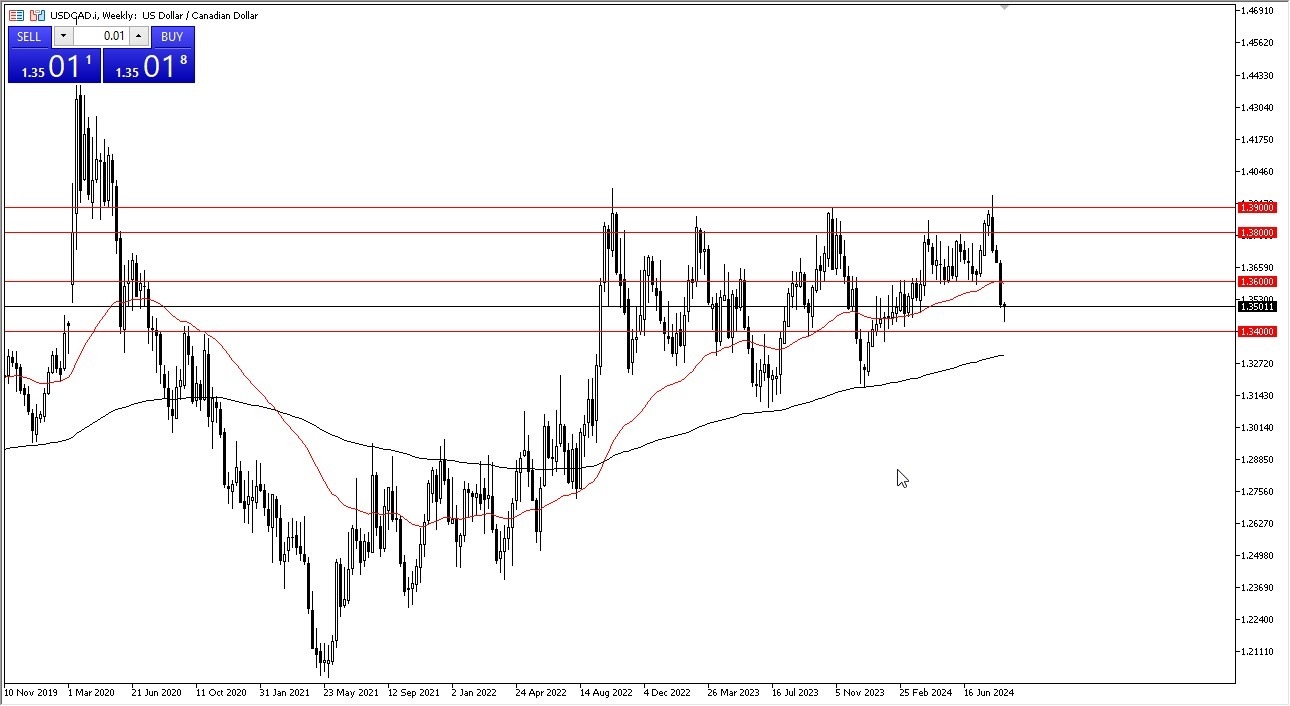

USD/CAD

The US dollar initially dipped against the Canadian dollar during the course of the week, only to turn around and show signs of life. Ultimately, it looks like we are forming some type of hammer for the week, and that suggests that we are overstretched, and that the market is ready to bounce. Furthermore, I believe that the 1.34 level underneath will offer a significant amount of support, so pay close attention to that as well. I believe that the Canadian dollar may soften a bit, due to the fact that the GDP numbers in Canada were lower than anticipated on Friday.

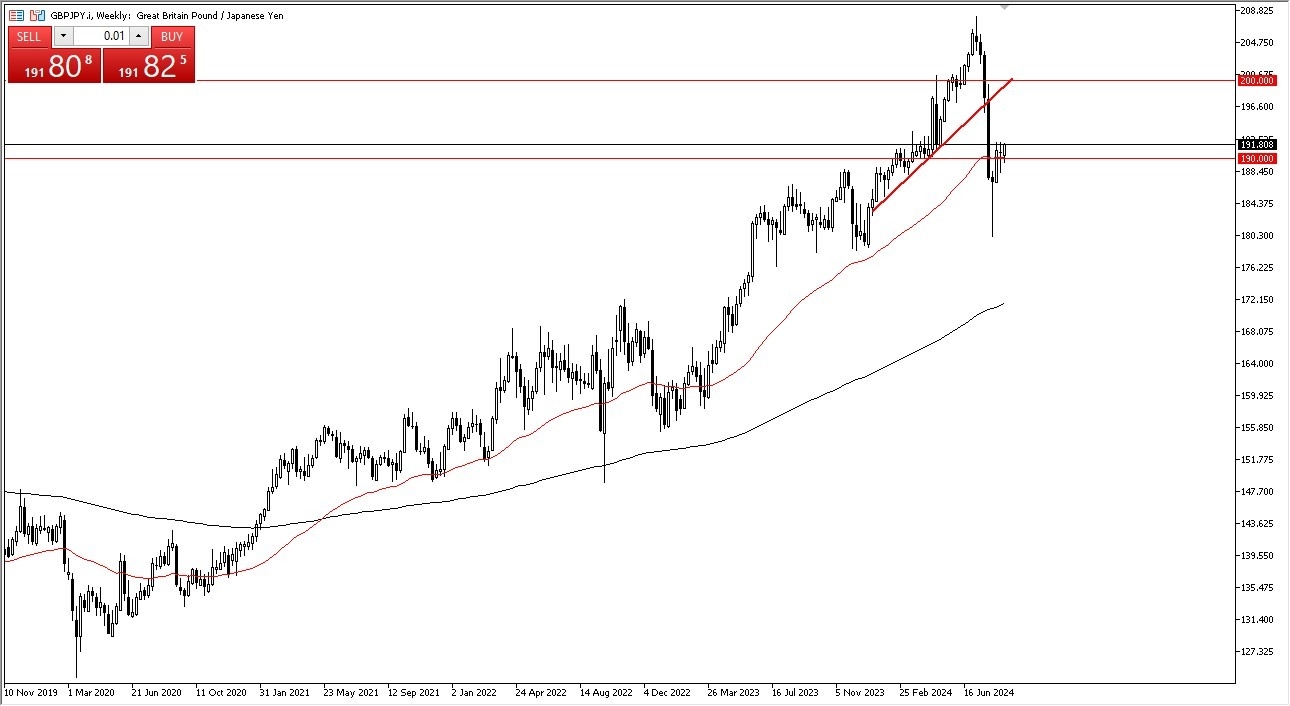

GBP/JPY

The British pound initially pulled back a bit during the course of the week, using the ¥190 level as a significant support level. That being said, the market has turned around to show signs of life, and now it looks like we are trying to revive the carry trade. If we get it, then the Japanese yen will probably sell off against almost everything. I think this might be one of my favorite trades if we do in fact see it return.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.