Dow Jones 30

The Dow Jones 30 has fallen rather hard during the course of the trading week, and now that we have seen such an ugly turn of events when it comes to the jobs number, it’s not a huge surprise that we could continue to see more downward pressure. However, there is a massive amount of support underneath that will eventually come back into the picture, as we have seen a strong uptrend line. I suspect that we see a little bit of follow through, only to turn the market right back around again as traders start to focus on the idea that the Federal Reserve may get even more aggressive with interest rate cuts.

Silver

Silver markets continue to be very noisy, and did initially tried to rally for the week, but then collapsed as we are now starting to see a lot of negativity out there, and I think it’s probably only a matter of time before traders trying to find a bit of value in this market, but if we do see continued negativity, I think it’s probably a situation where we will have to pay close attention to the $26.50 level, because that is your next major support level. If we turn around and recapture the $28.50 level, then silver could recover. However, it’s becoming more and more likely that we may continue to see downward pressure.

Top Forex Brokers

DAX

The German index has seen quite a bit of negativity during the course of the week, sliding through the €18,650 level, and now it looks like it is heading toward the €18,000 level. This is a market that I think continues to see a lot of noisy behavior but given enough time I think we also will continue to see a lot of questions asked about global growth, and that of course has a direct effect on Germany itself. With this, I like the idea of waiting to see what happens at the €18,000 level with this market, because it could tell us where we are going for the longer term.

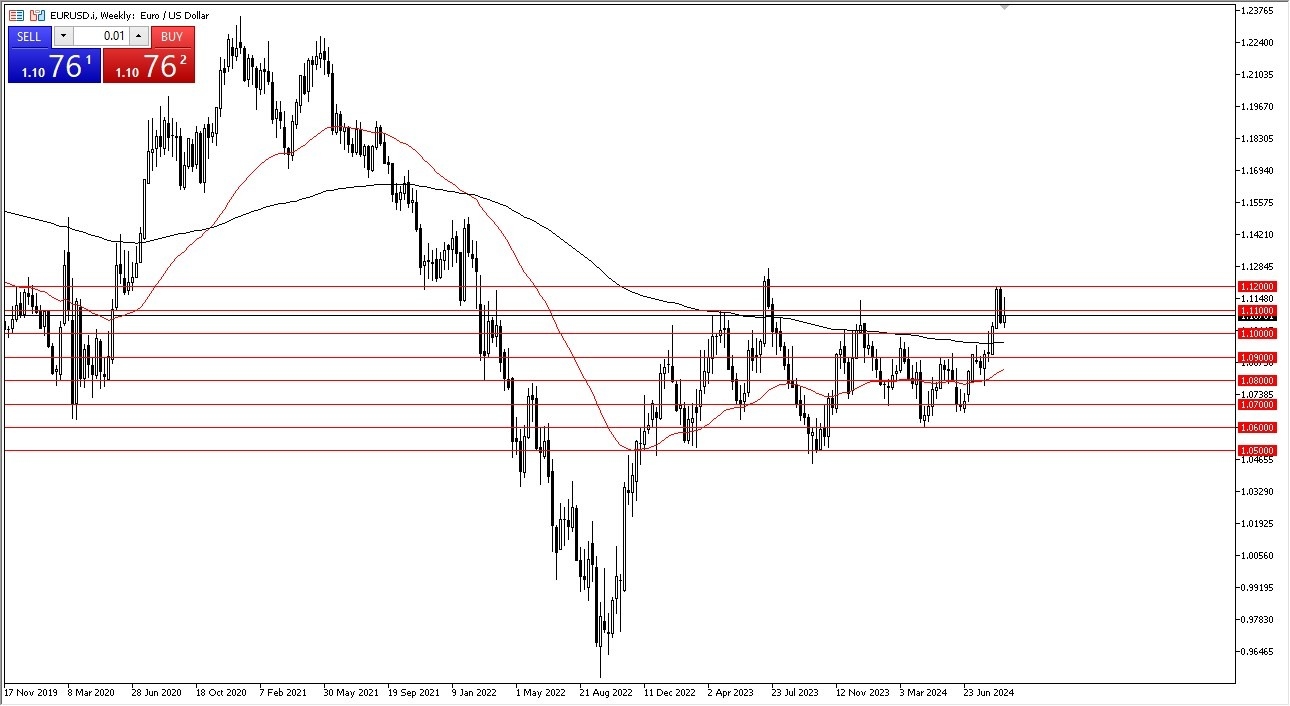

EUR/USD

The euro initially rallied during the course of the trading week to break above the 1.11 level, but then turned around to show signs of extreme weakness. By doing so, the market is likely to continue to see a lot of volatility, and with the jobs number coming out as week as it did in the United States, it’ll be interesting to see where we go from here. I think you’ve got a situation where traders will have to pay close attention to what’s going on, but they also will have to pay close attention to whether or not risk appetite starts to disappear. If it does, that could turn this thing around and have the US dollar strengthening quite drastically. All things being equal, I expect a very choppy and noisy EUR/USD market.

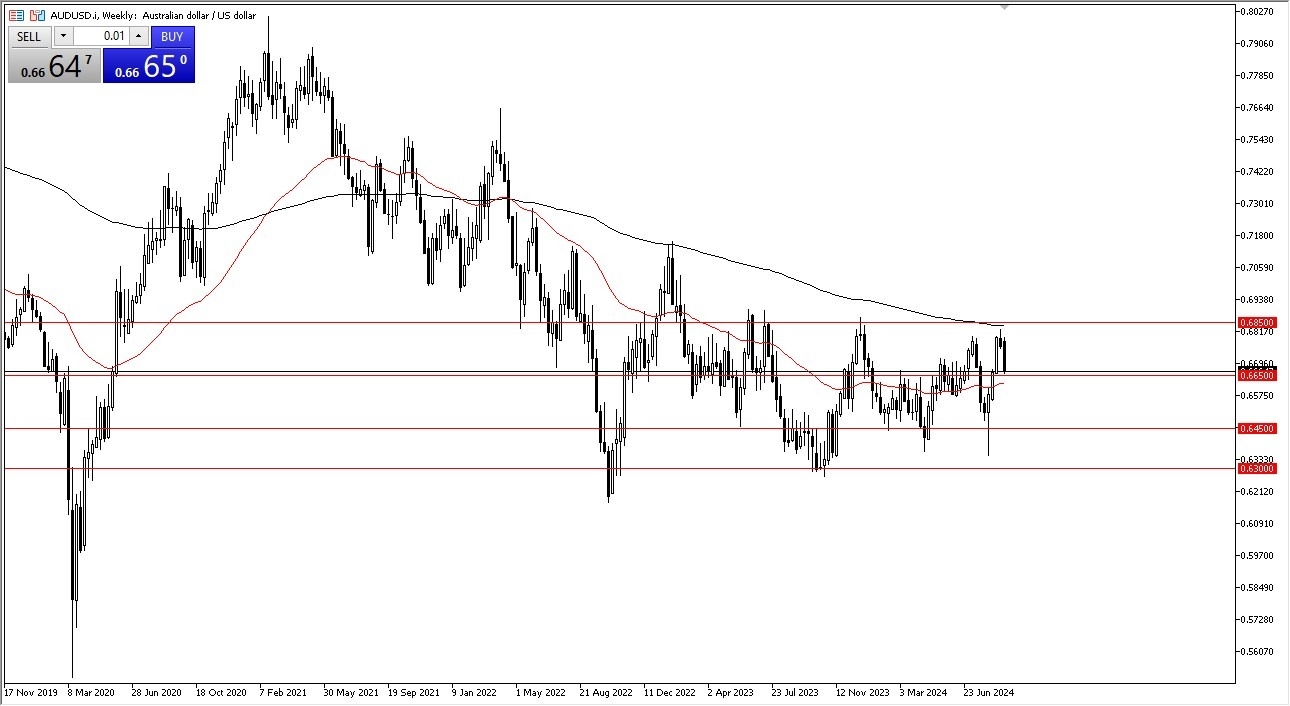

AUD/USD

The Australian dollar has plunged during the week on bad economic news around the world. Chinese demand has slowed down, and now the US jobs numbers came out weaker than anticipated. This suggests that perhaps the market might be looking at a global slowdown, and that will have a major influence on Australia itself. I do think at this point in time you need to pay close attention to the AUD/USD market, because it is more likely than not going to be a barometer of risk. If the Australian dollar starts to strengthen again, that would be good for other markets. The 0.6650 level is a significant support level.

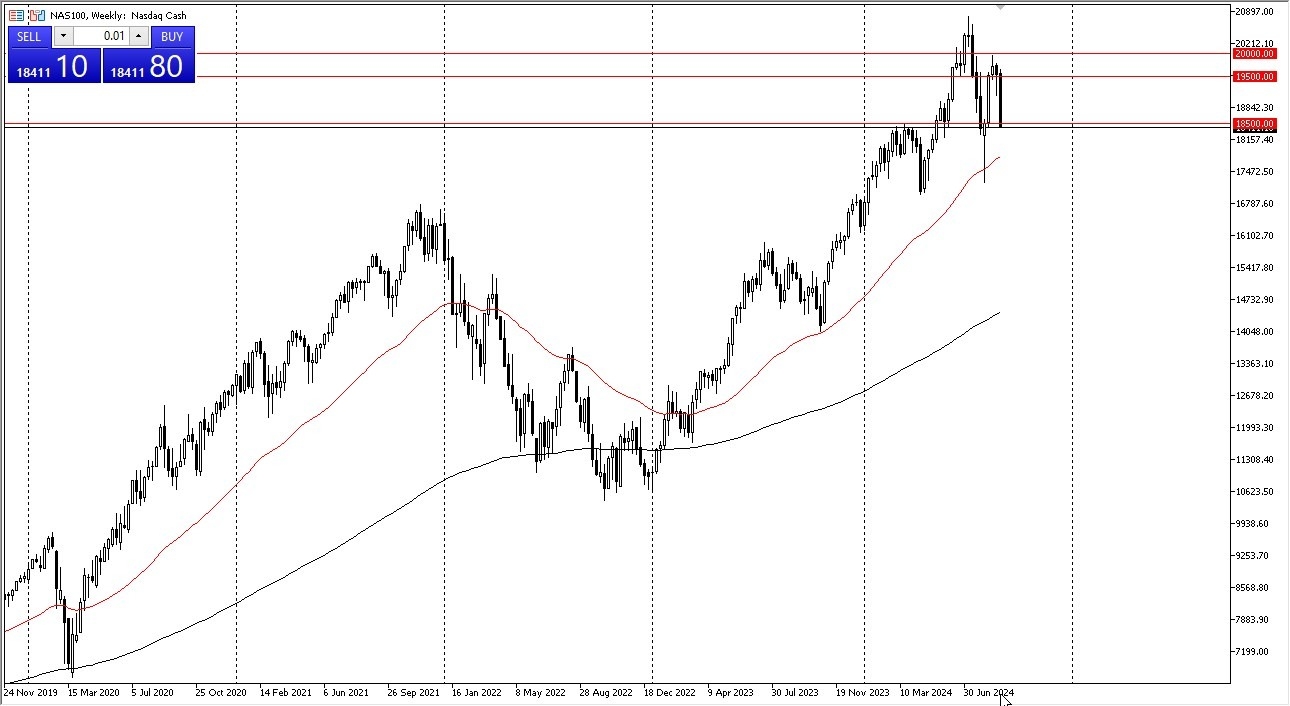

NASDAQ 100

The NASDAQ 100 has plunged during the week to crack below the 18,500 level, and now it looks like we are asking questions as to whether or not there is enough support here to turn the market back around. If it is going to continue to go lower, this could be the beginning of something rather ugly, and I think a lot of traders would start to bail on anything remotely close to risk appetite. In general, this is a very dangerous level, and we need to be very cautious about trying to get into the market at this point and are better off letting the market tell us which way it’s going to go.

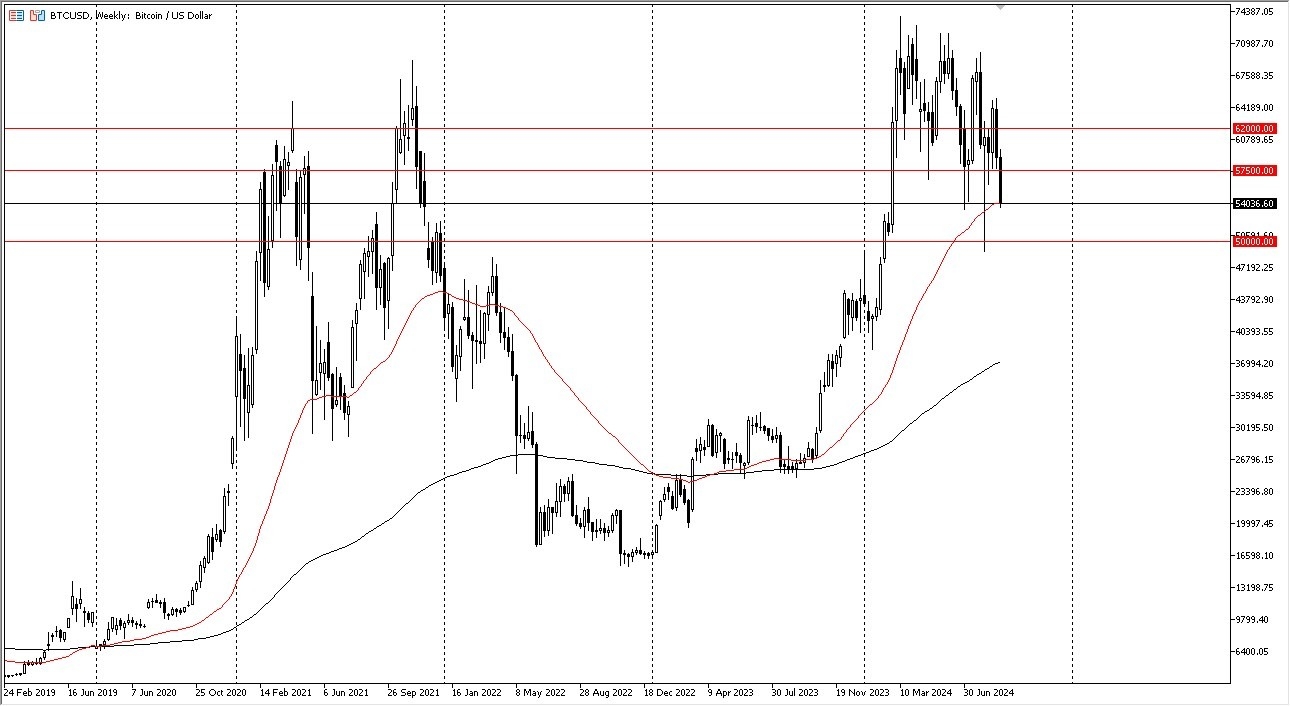

Bitcoin

Bitcoin has had a tough week, and I think at this point in time we are more likely than not going to go down to the $50,000 level, which of course is a large, round, psychologically significant figure, and an area where we have seen a lot of action in the past. If we were to break down below the $50,000 level, that would be a horrific turn of events for the bitcoin market, and I think we plunged much deeper to the downside. At this point, we need to recapture the $57,500 level to get bullish again.

USD/JPY

The US dollar has initially tried to rally against the Japanese yen (USD/JPY currency pair) during the week but has turned around to show signs of life again as it looks like we are trying to determine whether or not the ¥142 level will continue to offer support, as well as the massive uptrend line that we had seen previously. As long as those hold, then things are probably somewhat okay in this pair, but if we were to break down below the ¥141 level, that is a major breach of support and could send this pair plunging.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.