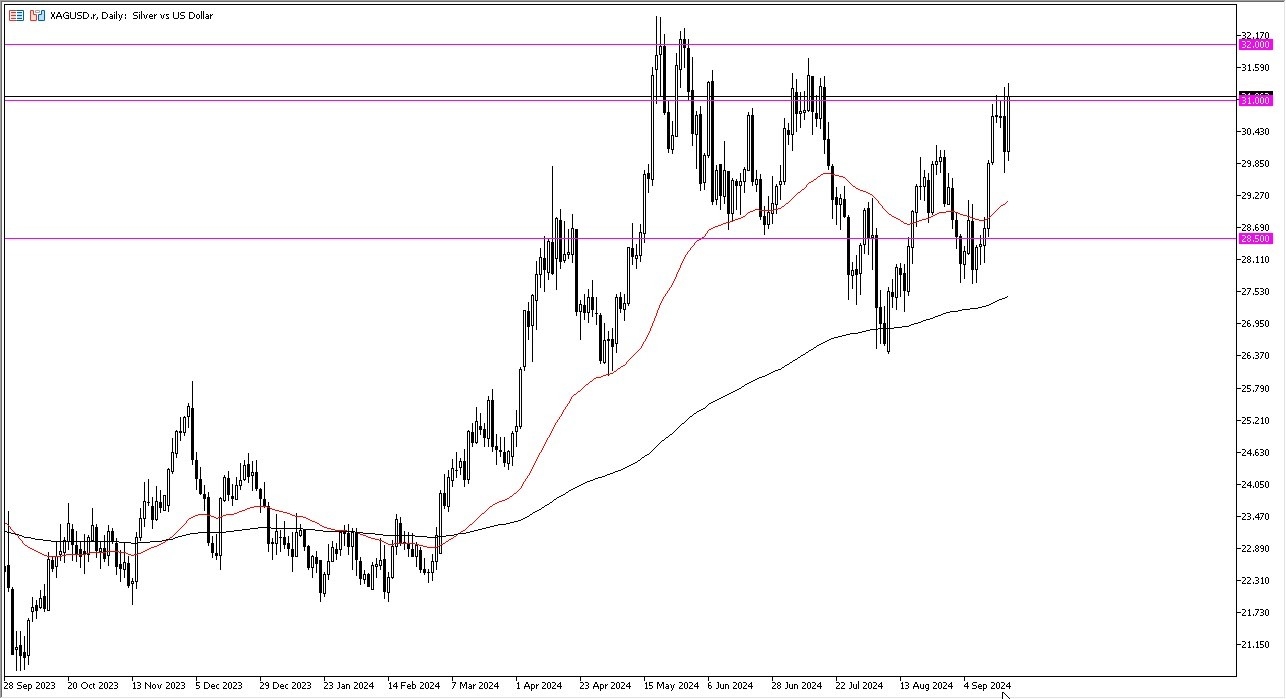

- In my daily analysis of the commodities markets, the silver market has stood out a bit due to the fact that it had not only turned around quite drastically, but it also wiped out all of the losses from the previous session.

- Because of this, I think you have a situation where perhaps the silver market might lead the charge higher in risk appetite, but it’s also worth noting that we are in the midst of a lot of confusion, mainly due to the fact that the Federal Reserve decided to cut rates by 50 basis points instead of 25.

At this point in time, there are some questions to be asked as to why the Federal Reserve felt it was necessary to cut this deep. After all, they have historically only done this when there was some type of problem, and with that being the case although the market is starting to celebrate in the short term, this has happened before where the market rallied rather significantly after a massive rate cut, only to turn around and fall apart from a risk appetite perspective.

Top Forex Brokers

Big moves could be expected in this type of environment, and quite frankly I think you need to be very cautious with an asset like silver under the best of circumstances. These are not the best of circumstances currently.

Precious and Industrial Metal

Keep in mind that this is both a precious and an industrial metal, so it is worth noting that although we have a certain amount of questions about the overall attitude markets around the world, as although the Federal Reserve cut rates and it could stimulate more demand, it can also show traders that perhaps they are bit more concerned about the US economy than they are letting on, which of course would be a very negative turn of events. This could lead to a lot of “risk off behavior”, which of course would punish silver. It is because of this that you need to be very cautious about jumping in with a huge position. Nonetheless, it certainly looks as if the market is supported at the moment.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.