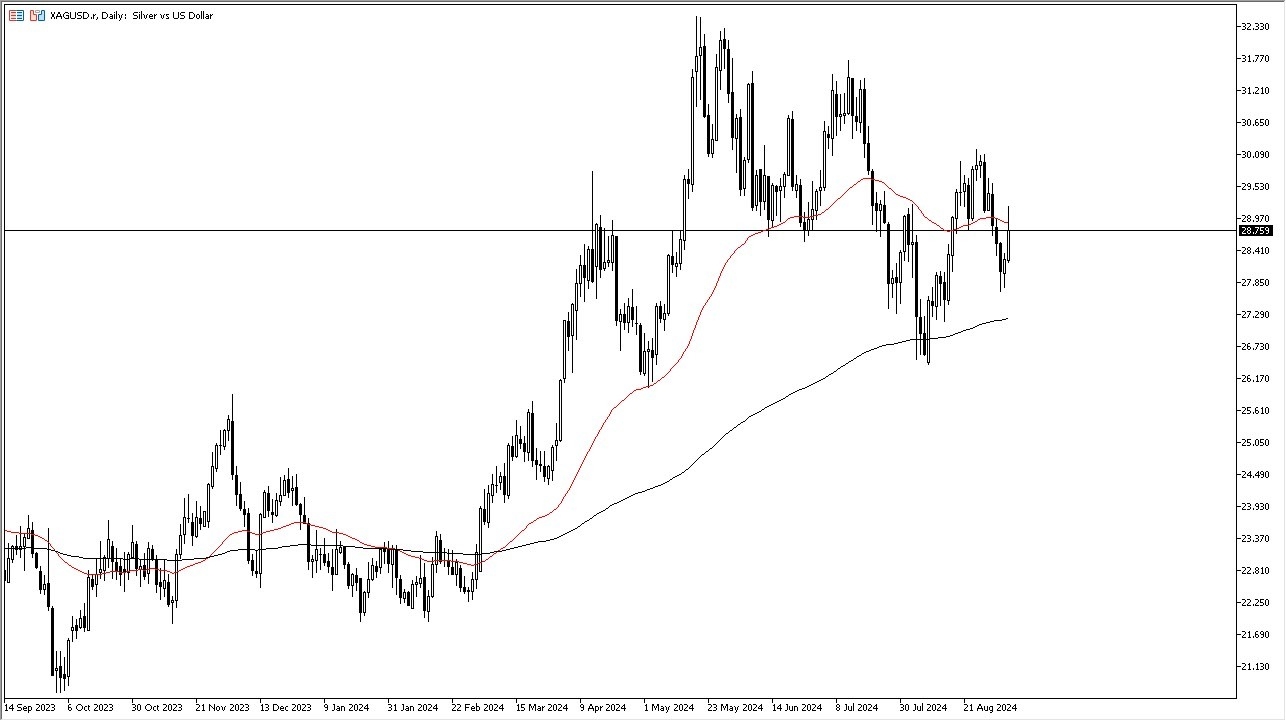

- As you can see, the silver market rallied rather significantly during the course of the trading session on Thursday, breaking above the 50 day EMA before turning around and showing signs of hesitation.

- With this being the case, the market is likely to continue to see the market show a lot of noisy behavior, but I do think that given enough time, we have a situation where traders are probably going to try to find some type of value anytime, we drop.

- It is worth noting that the $28.50 level is an area that's been important more than once.

- So, I do think that you have a situation where traders are going to continue to see this as maybe a midpoint or a fulcrum if you will.

Risk Appetite Drives Silver

So, with that, I think you've got to look at this through the prism of whether or not risk appetite is doing well or not. Remember, silver is not only a precious metal, but it's also an industrial metal and therefore a lot of things can happen, and you have to pay attention to global growth.

Top Forex Brokers

I do recognize that if we break above the top of this candlestick, the $30 level has to be targeted. And that probably offers quite a bit of resistance. If we turn around and break down below the $28 50 cents level, then we could go to the $27 75 cents level, and then possibly the 200 day EMA level after that.

Keep in mind that it appears that industrial demand is starting to drop in general, so I think this will probably make silver much less reliable as far as an uptrend is concerned in comparison to gold. Retail traders tend to make the mistake that they believe silver is a precious metal, but in the last 10 years or so, we have seen more industrial demand coming out of green technologies. Because of this, the behavior of silver has fundamentally changed, and you should be aware of that.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from.