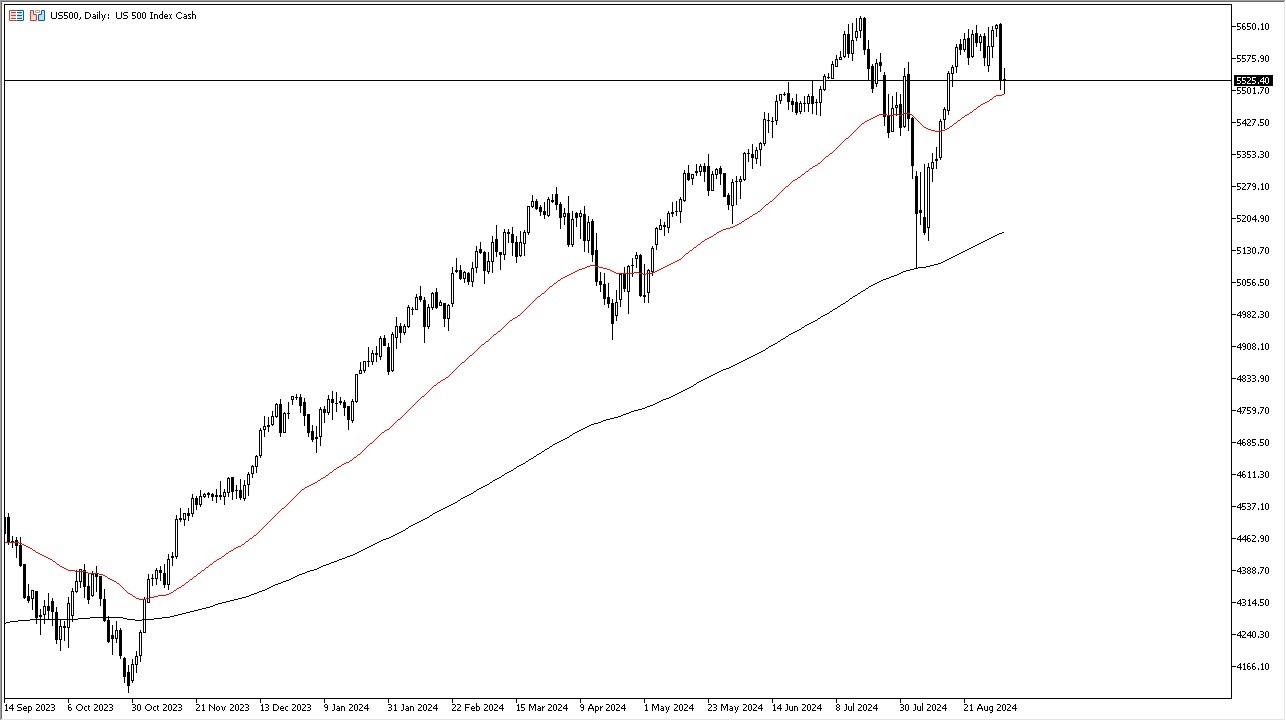

- The S&P 500 appears to be stabilizing a bit during the trading session on Wednesday as it looks like we are going to continue to see a lot of noisy behavior.

- That being said the 50 day EMA underneath continues to offer a lot of support and it's probably worth noting that the market is probably one that is trying to determine whether or not that massive sell off on Tuesday was overdone.

Here, fairly neutral is a good sign, and if we can break above the top of the candlestick for the daily candlestick, then I think we go back towards the highs. The alternate scenario, of course, is that perhaps we just formed a little bit of a double top, but I think it's a little early to call that. You could make an argument that the moving average convergence divergence indicator is starting to roll over a bit, but really at this point, I think it all comes down to how traders feel about the global economy. The US economy is most certainly slowing down. And the question now is, will the Federal Reserve come and cut rapidly so that they can save their friends on Wall Street? The answer of course is yes. And therefore, it comes down to a psychology question.

Top Forex Brokers

The Real Question About This Market

Are traders going to be looking at this through the prism of cheap and easy money to gamble with or are they going to be concerned about the underlying economy? Because after all, once the Federal Reserve starts cutting rapidly, that is generally a sign that they have fallen behind the curve and things may be a lot worse than people realize. Keep in mind, this is a market that desperately needs some type of directionality. Until we get clarity, you probably need to be very cautious with your position size. After all, there is a lot of uncertainty at the moment, and that’s not to be ignored.

Ready to trade our stock market forex analysis? Here’s a list of some of the best CFD trading brokers to check out.