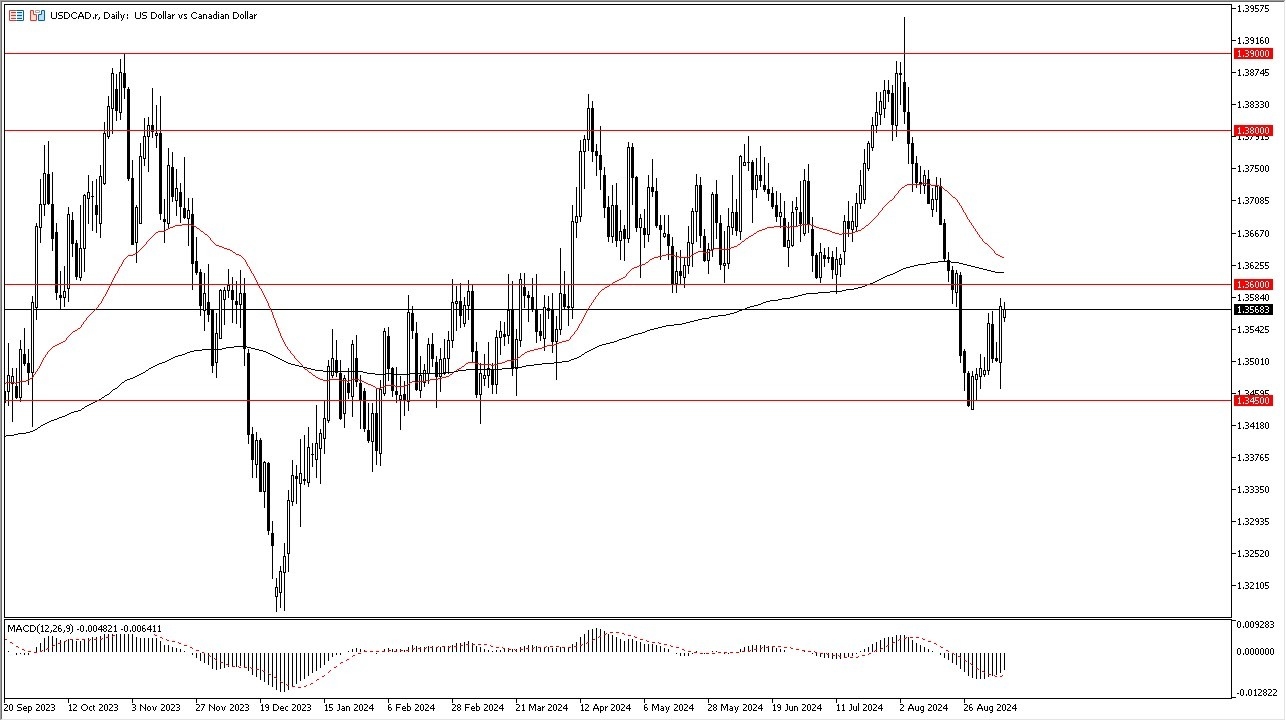

- The US dollar has been quietly positive against the Canadian dollar during the early hours on Monday as it looks like we are trying to threaten the 1.36 level.

- The 200 day EMA is just above the 1.36 level, so I think there is a certain amount of technical trading that needs to be looked at in that region.

- This is a market that tends to be very technical and choppy, so this would make a lot of sense if it were to be the case.

If we can break above there, then I think it would be a very positive sign for the greenback. Keep in mind that the Canadian dollar is highly sensitive to crude oil, so it'll be interesting to see where that comes into the picture. The jobs report, being so weak on Friday has ran the market into safety, which means it runs it into the US dollar.

Top Forex Brokers

On a move higher…

A move above that 1.36 level and the 200-day EMA, it's possible that we could go look into the 1.38 level after that. Short-term pullbacks I think will continue to be looked at as potential buying opportunities as long as we can stay above the crucial 1.3450 level. That is an area that is extraordinarily important and breaking down below that could really open up a trapdoor for serious US dollar weakness.

That being said, despite the fact that the Federal Reserve is almost certainly going to be cutting rates, the reality is that Canada already has a few times, and the Canadian economy is extraordinarily sensitive to the U S economy. Think of it as U S markets being the biggest consumers of Canadian goods. So, if the U S slows down, it has an extraordinary negative for Canada. With this being said, I do think that we need to watch the 1.36 level, but if we can get above there, the market can continue to go higher.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.