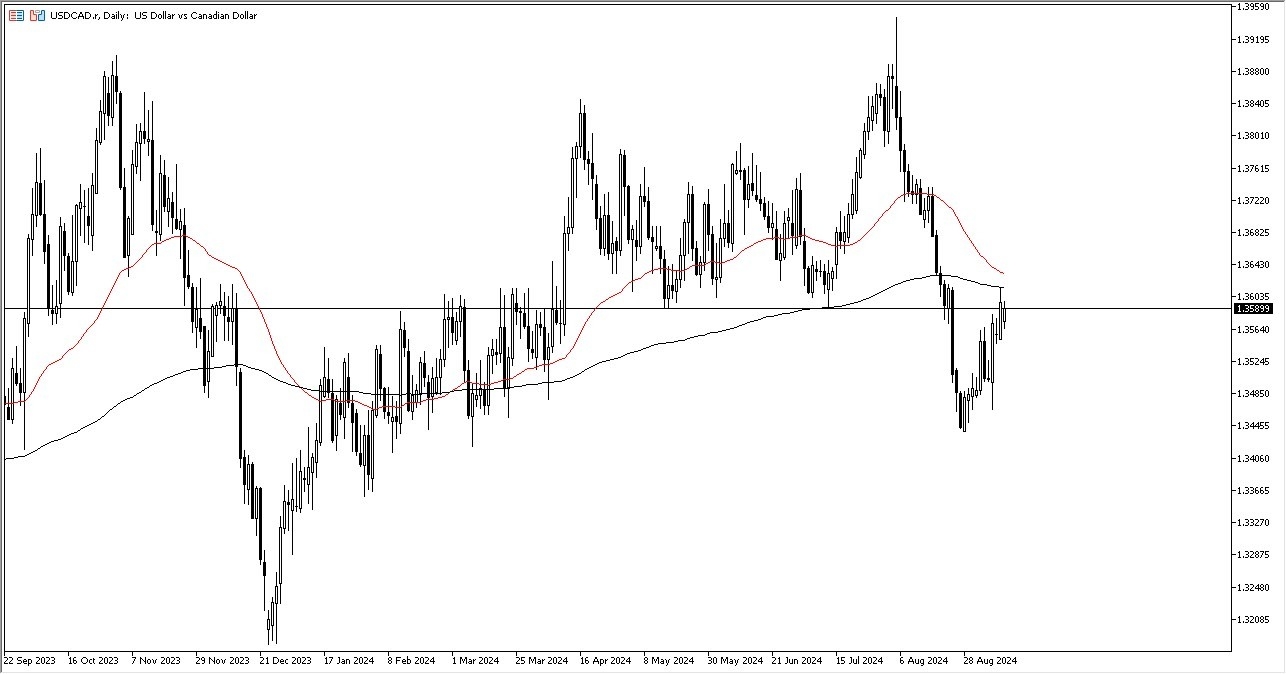

- The first thing I see is that the 1.36 level continues to be very resistive.

- Furthermore, we have the 200 day EMA above causing a certain amount of resistance.

If we can break above there, then it's likely that the market could really start to take off to the upside. This flies in the face of US dollar weakness, and this perhaps is more of an indictment on Canada, because quite frankly, the Canadian economy is weak, and it desperately needs the US economy to help prop it up.

Top Forex Brokers

After all, the United States is the number one destination for Canadian exports, such as oil and timber. If the US economy is starting to slow down, that is going to negatively impact Canada. That is the inverse correlation of the USD/CAD currency pair, it looks like the US dollar against the Mexican peso. While it is a bit counterintuitive, the reality is that the market is going to continue to try to determine whether or not the United States is shrinking or growing.

On a move to the upside

If we break above the 1.36 level, then it's likely that we will go looking to the 1.3750 level next. On the other hand, if we turn around and break down from here, perhaps breaking below the 1.3550 level, then we could see the US dollar slip to the 1.3450 level underneath, which is an area that has been significant support recently. In general, this is a market that I think continues to see a lot of volatility, and that does make a certain amount of sense considering that the oil market itself has been a big headache. And although the oil imports from Canada for the United States can be replaced with domestic supply, and sometimes this pair doesn't agree with the oil markets, the reality is that the overall attitude of the Canadian dollar is heavily influenced by that. So, with this, I'm looking to the upside, but we need to see the market again break above that 200 day EMA.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.