- During my analysis of major currency pairs during the trading session on Thursday, the US dollar looks very weak as traders are starting to punish the greenback due to the fact that the Federal Reserve cut interest rates by 50 basis points during the session on Wednesday.

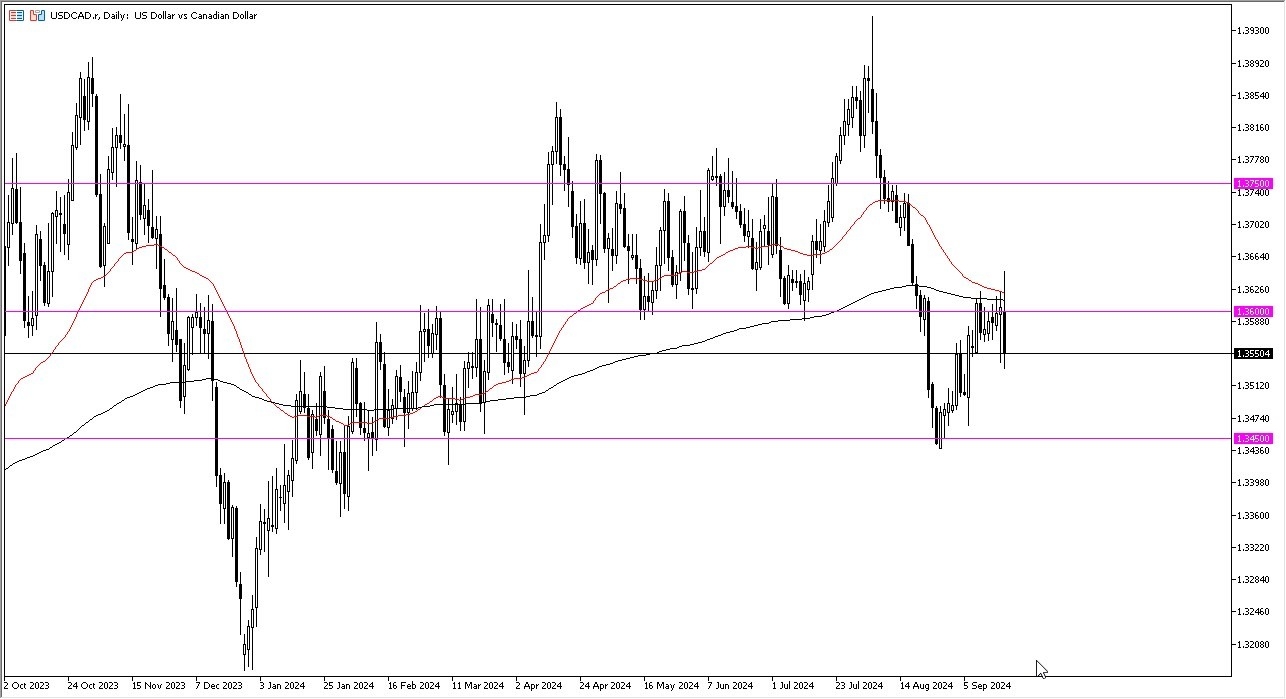

- The Thursday session has seen the US dollar break above the 200 Day EMA, as well as the 50 Day EMA against the Canadian dollar.

- However, we have also seen the market turned around rather viciously, as we have fallen to test the bottom of the hammer from the previous session.

In other words, I think we have a situation where traders will continue to see a lot of volatility, and therefore you need to be very cautious with putting a huge position on as the market is obviously not in the mood to be anything remotely close to being stable. Because of this, we need to pay close attention to both of these currencies against multiple currencies, because it can give you an idea as to how people view the US dollar, or the Canadian dollar, depending on which direction you are looking to trade. Beyond that, you also have to pay close attention to the crude oil market, because it has a major influence on the Canadian dollar in general.

Technical Analysis

Top Forex Brokers

By piercing the 50 Day EMA, as well as the 200 Day EMA indicators, it looks very bullish, but then we turned around to collapse, showing quite a bit of negativity. At this point, the market were to break down below the low of the trading session on Thursday, that could open up the US dollar to drop toward the 1.3450 level, an area where we had overextended ourselves and bounced from. On the other hand, if we were to turn around and break above the top of the candlestick for the Thursday session, that would obviously be extraordinarily bullish for the greenback, perhaps sending it to the 1.3750 level above.

Either way, I’d be cautious because we obviously have a lot of volatility just waiting to happen, as traders are trying to sort out whether or not the 50 basis point interest rate cut is a good or a bad sign, because historically it’s been a very bad sign.

Ready to trade our Forex daily analysis and predictions? Here are the best Canadian online brokers to start trading with.