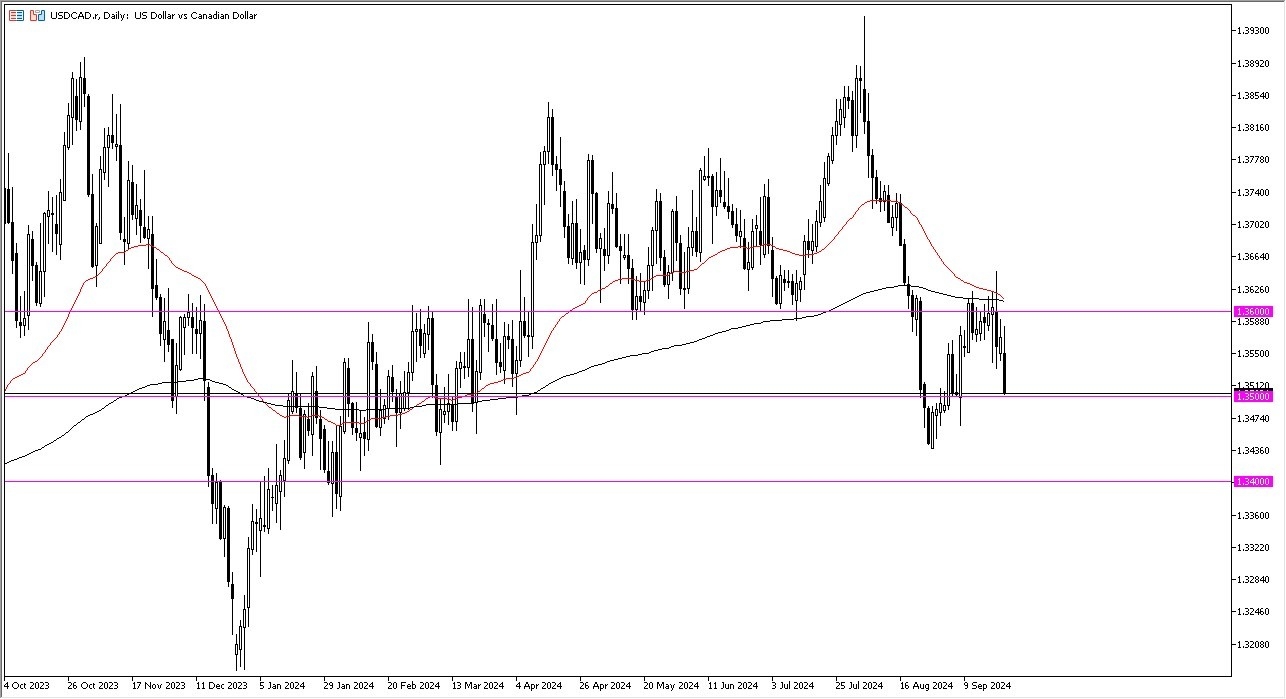

- The US dollar initially did rally a bit during the trading session on Monday, but it turned around rather aggressively to slam into the 1.35 level against the Canadian dollar.

- The PMI numbers came out lower than anticipated as far as manufacturing is concerned, but the services PMI number actually came out ever so slightly better than anticipated.

This is against the backdrop of multiple PMI numbers around the world falling short, but at the same time, the question then becomes whether or not the US dollar continues to take it on the chin due to the Federal Reserve interest rate cuts last week. If that's the case, then we could push this market back down to the 1.34 level. That's an area that I would expect to see a lot of support for this pair at the moment.

Top Forex Brokers

If We Turn Around and Bounce

On a turnaround and a bounce, we could see this market try to get to the 1.36 level, which is an area that has been important multiple times, and also features both the 200-day EMA and the 50-day EMA indicators, which look like they're ready to cross to form the so-called death cross. Keep in mind this pair is highly choppy under the best of circumstances, so I think at this point you have to look at it through the prism of whether or not we're actually going to break out of one of these short-term ranges.

I don't think we are, although it certainly looks like there's a lot of downward pressure on the greenback at the moment. Does the Canadian dollar suddenly start taking off and become one of the strongest currencies in the world? Probably not. So, because of that, I think we stay in this same range that we have been in for some time, as the markets are going to eventually look at this from the prism of both economies being so heavily intertwined.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.