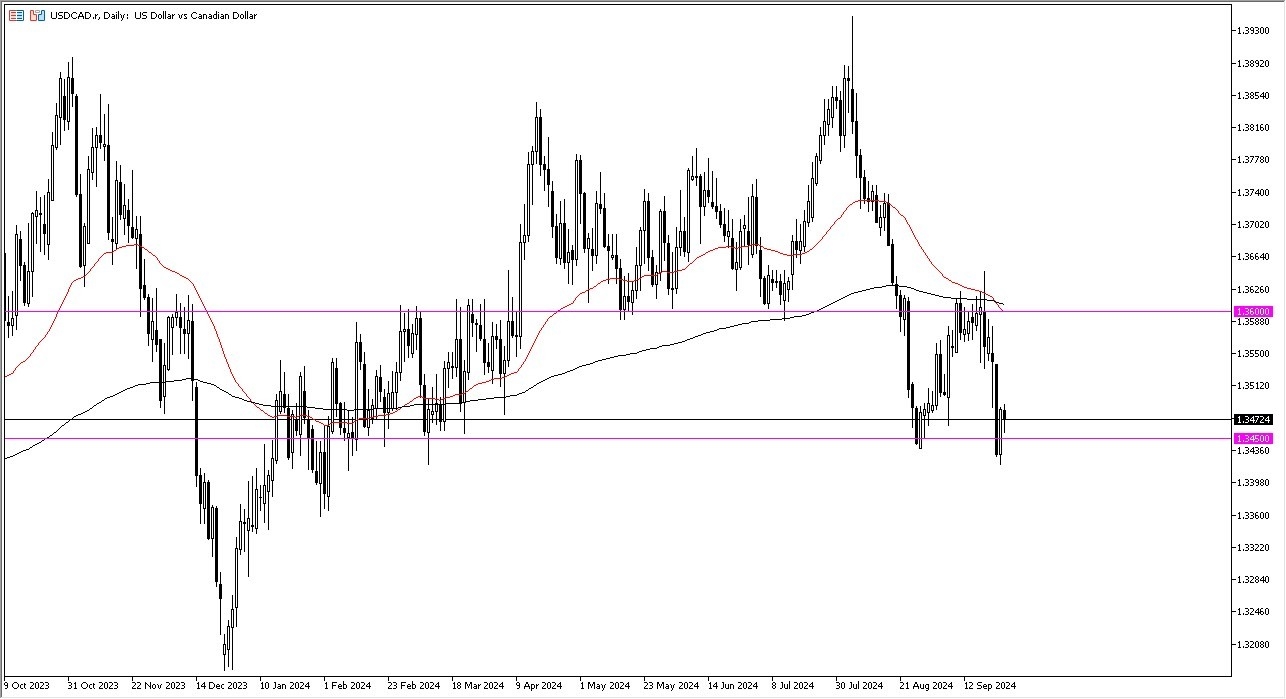

- During the trading session on Thursday as I look around the various large currencies and main currency pairs, the US dollar looks as if it is trying to do everything it can to stabilize a bit against the Canadian dollar.

- This does make a certain amount of sense, considering that we reached the 1.34 or 5 zero level during the trading session on Wednesday, as we are more likely than not to try to form a little bit of a double bottom.

If we can turn around and break above the 1.35 level, then it's possible that we could go looking to the market, reaching the 1.36 level. At that point, we also have the 50 day EMA and the 200 day EMA crossing right around that area. If we do break above there, then I think the US dollar could go looking to the 1.3750 level.

Top Forex Brokers

The Last Couple of Days are Important

In general, I think this is a scenario that if we were to break down below the low of the last couple of days, then we could see the US dollar drop down to the 1.3250 level. Keep in mind that the US dollars oversold against almost everything. And then of course the Canadian dollar is highly sensitive to oil. Plus, the Bank of Canada which of course has cut rates a couple of times.

On the other side of that coin, of course, is the fact that the Federal Reserve just cut interest rates by 50 basis point. It's very likely that what we will see is the Canadian dollar react to the US economy more than anything else. If the US economy really starts to tank, the Canadian dollar will get eviscerated as Canada sends almost all of its exports into the United States. In other words, if America falls, it is the same thing as Canada’s greatest customer walking away from the store.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.