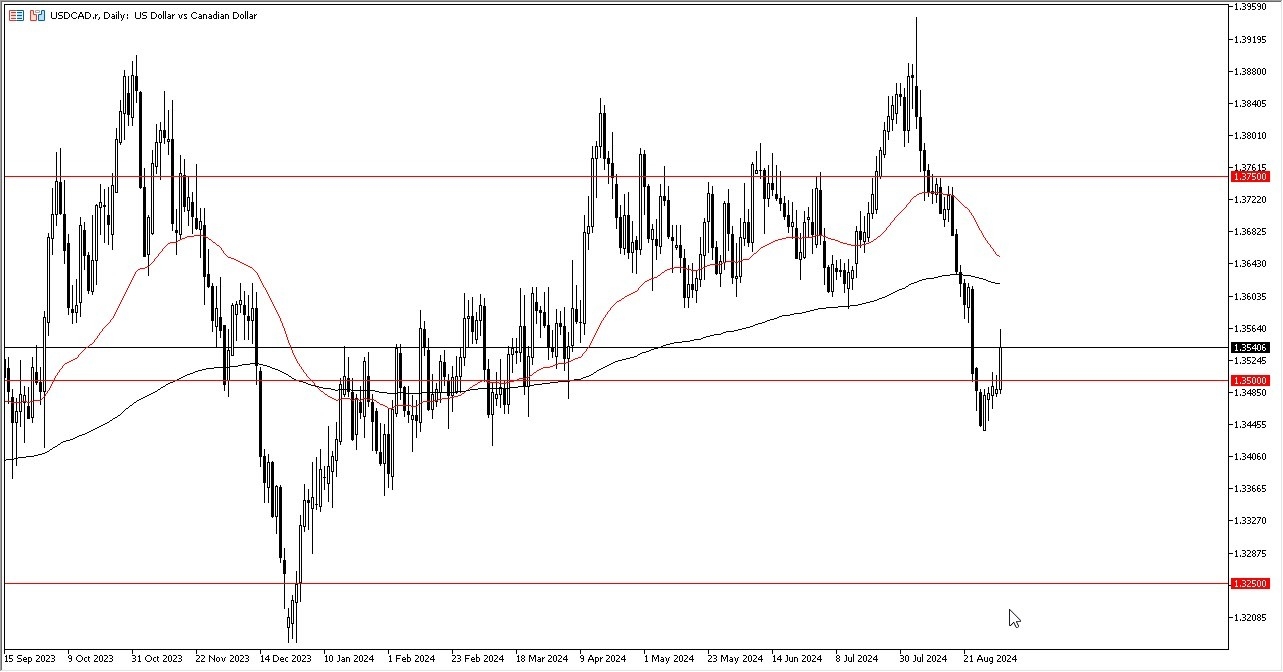

- The US dollar rallied a bit during the course of the trading session on Tuesday and we have launched from the 1.35 level, and it looks like we are trying to recover.

- This does make a certain amount of sense due to the fact that the 1.35 level of course is a large round psychologically significant figure.

- It is also an area where we would see a lot of options, barriers being laid out, and a lot of interest via algorithms.

All things being equal, this is a market that I think eventually goes looking to the 200 day EMA, possibly even the 1.3750 level. The Canadian dollar is taking it on the chin a little bit during the trading session due to the fact that crude oil has been hammered.

Top Forex Brokers

China Causing Issues for Canada? Maybe.

Chinese demand or perhaps I should say Chinese lack of demand for crude oil certainly has had its influence on the market. Short-term pullbacks probably continue to see plenty of buyers as well. I think there is a lot of support just below the 1.35 level that extends down to the 1.3450 level. The market, of course, did fall rather precipitously recently. So, I think this is a situation where the market is going to continue to see a lot of choppiness. And if we do see a lot of US dollar strength, then it's likely that this will be one of the first places you need to go looking. Ultimately, this is a situation where market participants continue to see a lot of volatility, but I do think we are trying to find its floor.

If we do find our floor, it is likely that we will see a significant increase in the value of the US dollar against Canadian dollars, as the Canadian economy has been struggling for a while, and the US economy at least can pretend there is a significant amount demand. With this, it makes a bit of sense the USD continues to see momentum.

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.