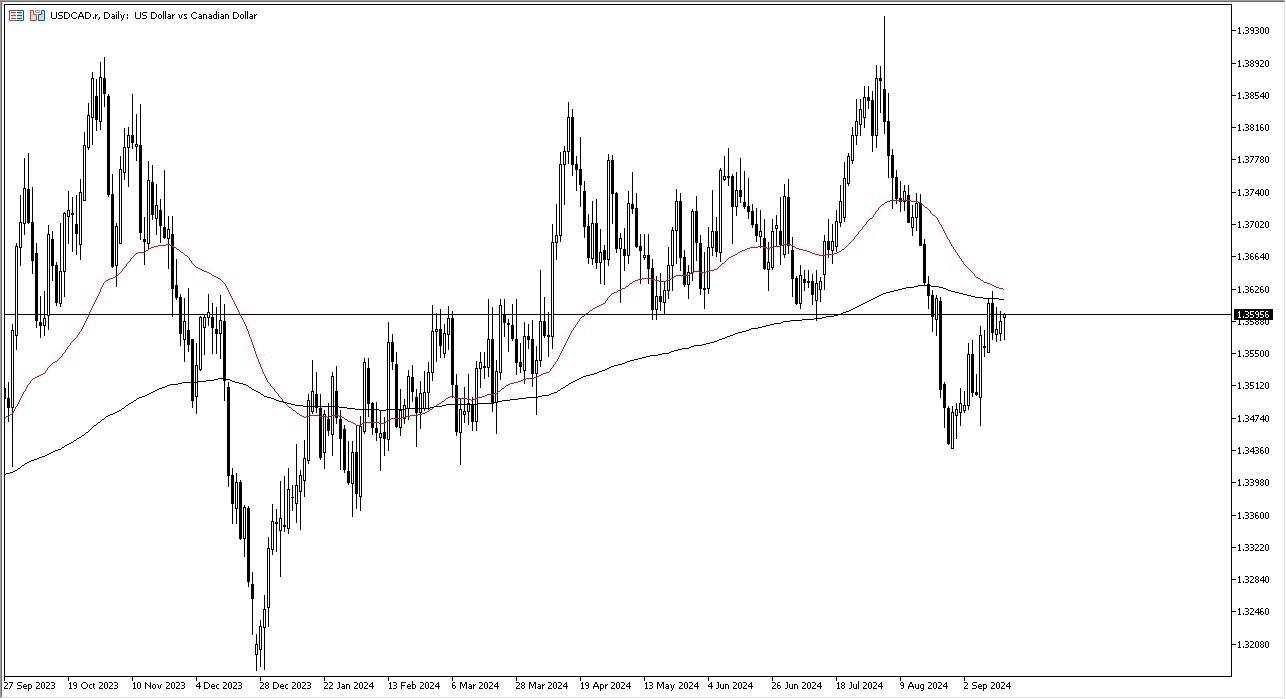

Potential signal:

- I am a buyer on a daily close above the 200 Day EMA, with a potential target of 1.3740 above, and a stop loss of 1.3450 below.

At this point, it looks like the US dollar will end up trying to continue to fight against the 200 day EMA. The 200 day EMA of course is an indicator that a lot of people pay close attention to as it is a longer term support or resistance and trend defining indicator for a lot of algorithms. With this being said, if the market were to break above the 200 day EMA or even the 50 day EMA as well, then we should see a bit of a melt up as it were for the US dollar.

Top Forex Brokers

Keep in mind that the market doing that opens up a move to the 1.3750 level. On the other hand, if we turn around and pull back, then we could see a move down to the 1.35 level, possibly even as low as 1.3450. You should also pay attention to the fact that there is an FOMC interest rate statement on Wednesday right along with a press conference. And I do think that the press conference is the bigger story here as it gives traders an idea as to what the Federal Reserve is seeing and what they will be doing in the near future.

Many Things Move the Loonie

Keep in mind that the Canadian dollar is highly sensitive to the US economy, probably more so than the Canadian economy at times, due to the fact that most of Canada's exports end up in the United States. So, if the US economy really starts to take it on the chin, that's very detrimental to the Canadian economy via lumber, oil and many other exports, especially in the automotive sector. So, with all of that being said, I do think you need to pay close attention to these moving averages and how the market reacts after the press conference on Wednesday coming out of Jerome Powell. Ultimately, this could be an interesting place to start trading in the next few days, and I will be watching very closely at this juncture.

Ready to trade our free Forex signals? Here are the best Canadian Forex brokers to start trading with.