- The US dollar is drifting a little bit lower. This is particularly interesting considering just how positive the Monday session was.

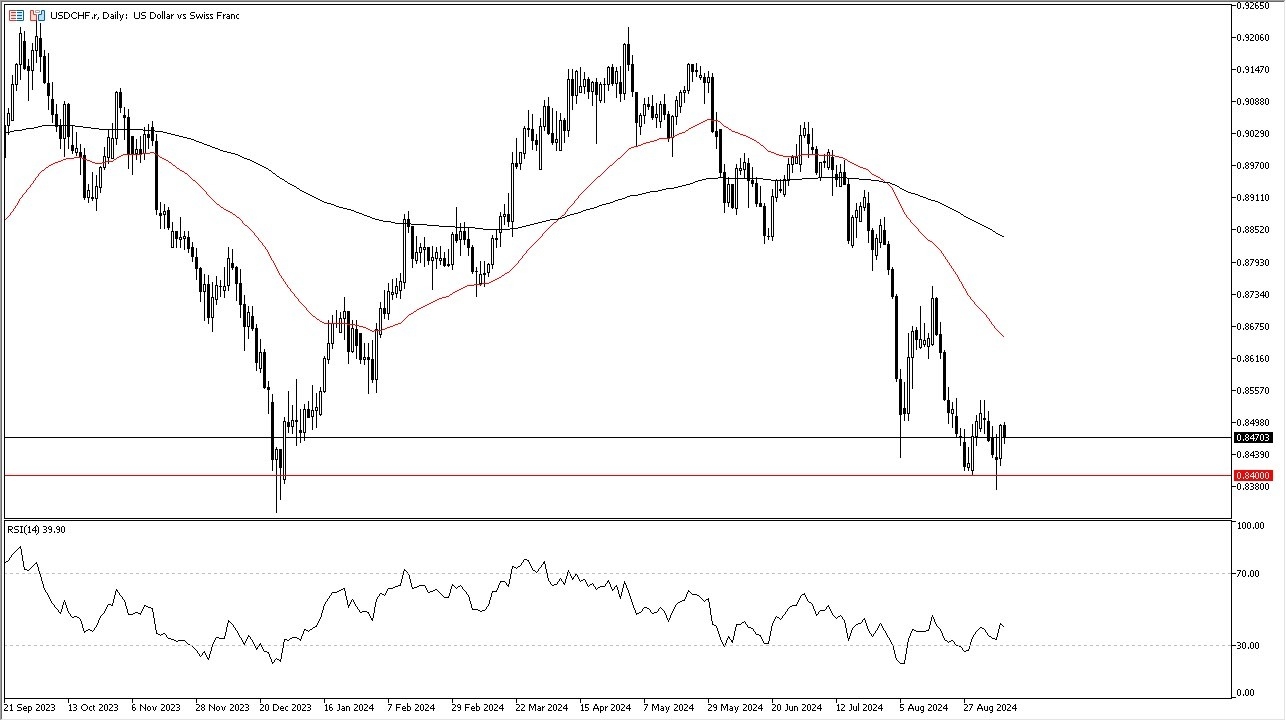

- It’s also worth noting that the 0.84 CHF level is being heavily defended, so it’s worth paying close attention to this pair because a breakdown below that level would signal a fresh move in the shrinking greenback.

Keep in mind that the Swiss aren’t particularly amused with the idea of an extraordinarily strong Swiss franc and have been known to get involved in the markets. I don’t think they are anywhere near doing that right now, but if we do start to break down rather rapidly, which I think you move below the 0.84 level with any sustainability would kick off, then we could see the Swiss National Bank start tinkering around with the currency markets like they have done so many times in the past.

Top Forex Brokers

Technical Analysis and the SNB

The technical analysis for this pair of course is rather negative, but it is worth noting a few things. As I mentioned previously, the 0.84 level is important, going back several months. It’s also worth noting that if there is a global “risk off scenario”, that might actually help the Swiss franc, and the Swiss might have to intervene due to the Swiss franc strengthening against almost everything, not just the US dollar. While the Swiss franc is most commonly quoted in US dollars for international markets, it’s actually how it trades in the EUR/CHF pair that Swiss central bankers are particularly sensitive to. In other words, this pair could be a bit of a casualty of any action in that pair. That being said, I don’t expect any intervention in the short term.

On the upside, if the market were to break above the 0.8550 level, then it’s likely that we will go looking to reach the 50 Day EMA indicator, presently trading near the 0.8650 region. Anything above that level would be extraordinarily bullish and could have traders chasing the greenback higher. While the US dollar is often thought of as a safety currency, in this currency pair it’s the exact opposite relation most of the time.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.