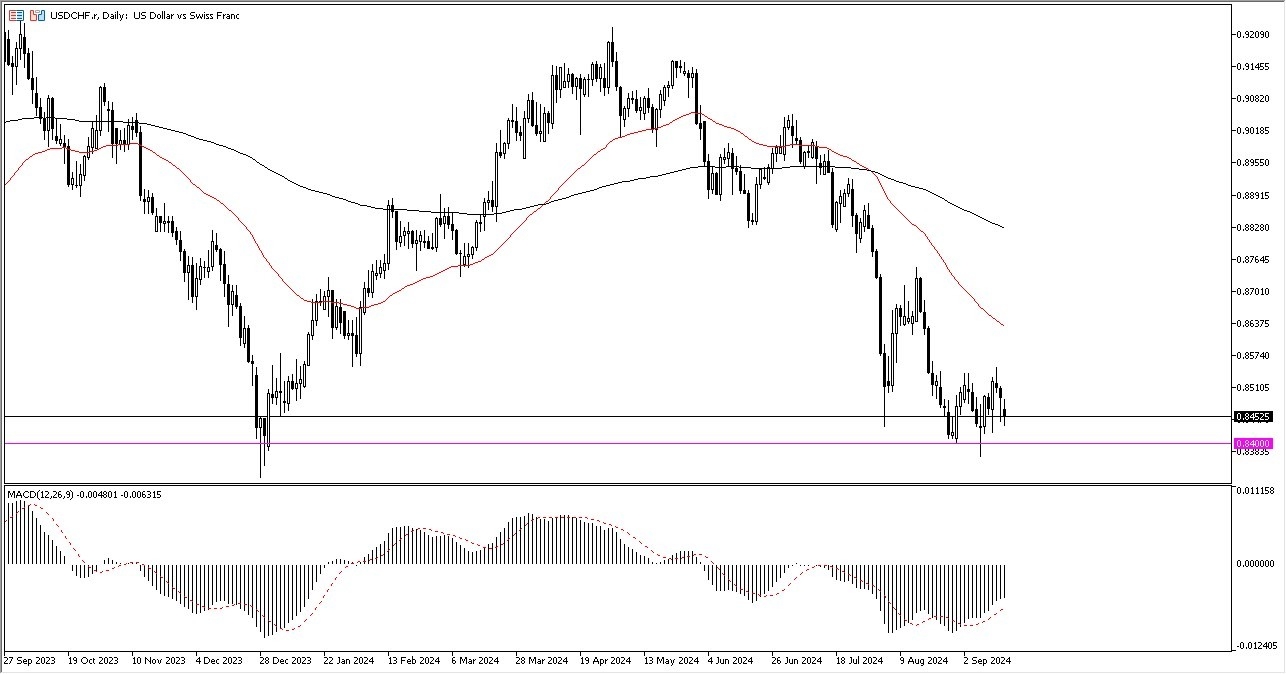

- The US dollar has been a little bit soft against the Swiss Franc again during the trading session on Monday, but we continue to pay close attention to the 0.84 level.

- This is an area that's been important multiple times and therefore we do need to pay close attention to it.

- It's also an area that historically speaking has been important as well. So, I think we are in a holding pattern.

This does make a certain amount of sense considering that the FOMC interest rate decision and of course the press conference comes out on Wednesday and people will be parsing that information to see where the dollar goes next. The moving average convergence divergence indicator is starting to diverge a little bit from price action.

Top Forex Brokers

Are We Forming a Bottom?

So, we could be in the process of perhaps forming some type of bottom. I think it's a little early to get excited about that, but if we were to turn around and recapture the 0.8565 level, I think at that point we could see a significant bounce in the US dollar. On the other hand, if we get a daily close well below the 0.84 level, I think that would be a very ominous sign and would send the dollar plunging.

I do believe that the press conference will have a lot to say as to where we go next with the greenback, and I do think that you will see it here just as you will see it in multiple other currency pairs. Keep in mind though, the central bank in Switzerland is known to jump into the fray and start causing issues if the Swiss franc starts to strengthen far too quickly. After all, a lot of times traders will see the SNB get very aggressive in trying to drive down the value of the Swiss franc as it makes Swiss exports far too expensive. That being said, it’s also worth noting that the EUR/CHF pair is the main driver of what the SNB does, but it does tend to move in the same way as this pair does.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.