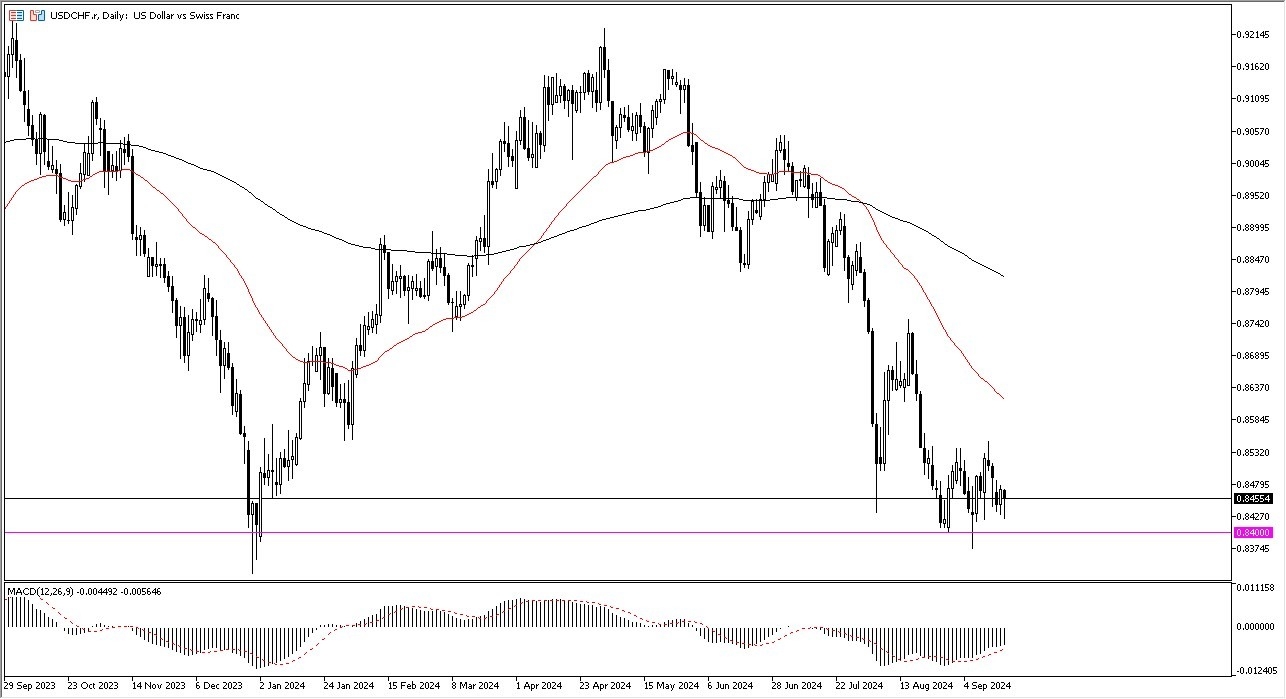

- The US dollar pulled back slightly during the early hours on Wednesday as we continue to hang around the 0.84 level.

- But more importantly, we wait for the federal reserve to make its interest rate decision, its monetary policy statement, and deliver its press conference.

- These things are all going to be crucial and important for trader decisions.

So, all of this ties together for a market that is testing a major low. In fact, we could, at least in theory, be in the process of forming a massive double bottom on the weekly and monthly charts. The 0.84 level is obviously an area that has mattered for a while, and it'll be interesting to see whether or not we can break down below there. Interest rate cuts have already been priced into the market, and the Fed funds futures rates market, the futures market is actually about 50-50 as to whether or not it will be a 25 basis point cut or if it will be a 50 basis point cut. If they cut 50 basis points, this could be a situation where things get ugly, and fast.

Top Forex Brokers

The Real Question Going Forward

The real question is going to be whether or not people look at this as a risk on or a risk off event. It's worth noting that the US dollar is holding its own going into this announcement. So really, I think if the Federal Reserve cuts 25 basis points, it probably doesn't change much.

If that's the case, then we start to look to the upside and perhaps think that maybe the US dollar can rally against other currencies such as the Swiss franc and go higher. We'd need to daily close above the 0.8550 level to get some type of signal to confirm this. But for what it's worth, the MACD is diverging from price, so it could be interesting times ahead.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.