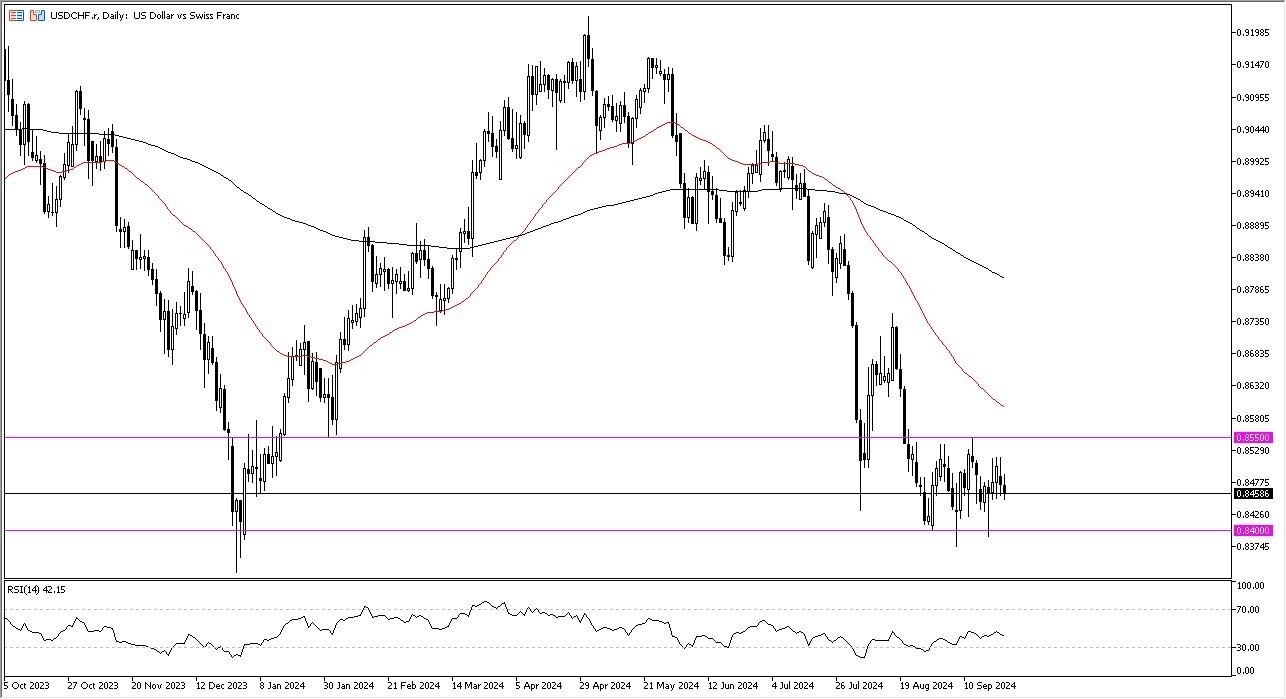

- The USD/CHF pair continues to show itself as being very negative from a longer-term standpoint, but the last month or so has been a bit about stability.

- Because of this, it’s likely that we could continue to see a lot of sideways action, and I think that’s actually good for the US dollar due to the fact that it had been sold off so drastically.

Federal Reserve and Swiss National Bank

The Federal Reserve and the Swiss National Bank both have been cutting rates, although the Federal Reserve shocked the market cut 50 basis points recently, and the Swiss National Bank has been cutting rates in the past, and of course it keeps its interest rate low. Because of this, it comes down to the idea of whether or not the US dollar selling off will continue to influence this pair, or will we turn around and show signs of risk on behavior due to the US dollar is a bit “riskier” than the Swiss franc itself.

Top Forex Brokers

All things being equal, this is a market that I think will continue to be very noisy, with the 0.84 level underneath offering a short-term floor, with the 0.8550 level above offering a ceiling. I do think that what I will be paying close attention to is whether or not we can break above the 0.8550 level, and perhaps the 50 Day EMA, which would be an extraordinarily bullish sign. On the other hand, if we were to turn around and break down below the 0.84 level, then the market is likely to continue to see downward pressure in the US dollar, not only here but probably even against other currency pairs in general. At that point in time, the Swiss franc will continue to be bought in order to find a bit of safety. In general, this is a market that I think continues to be noisy, so you need to be cognizant of your position size.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.