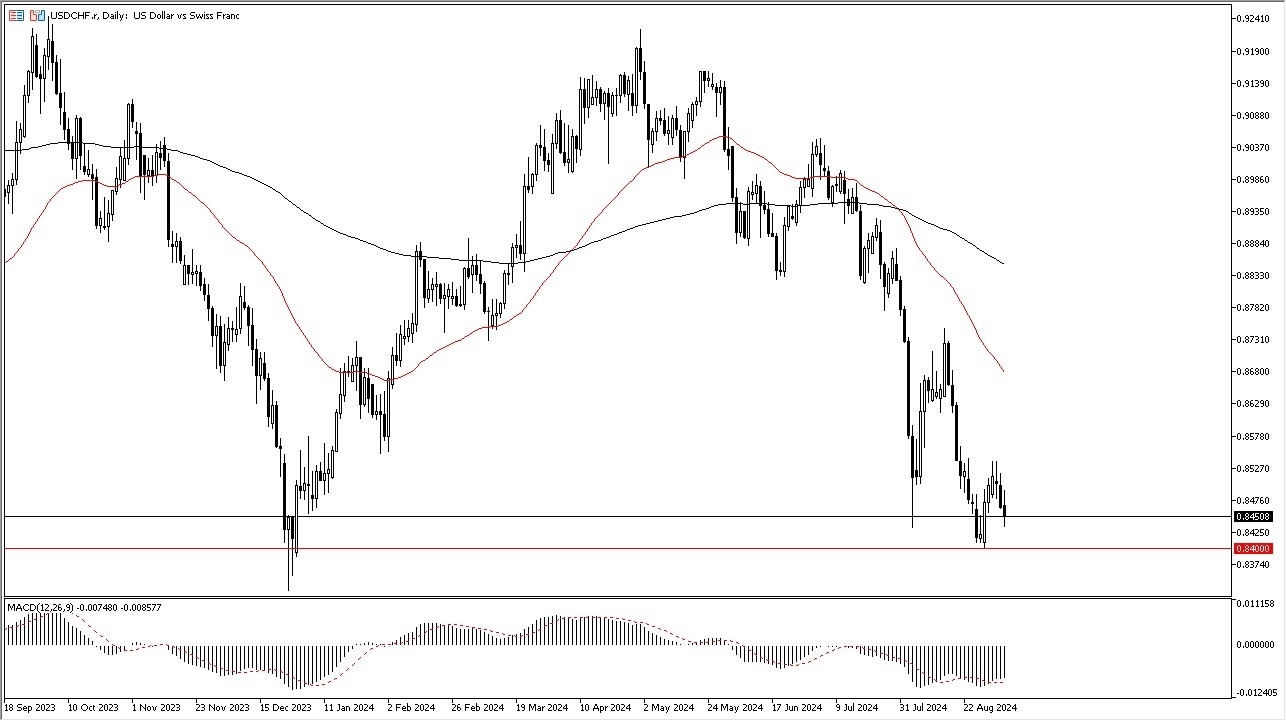

- The US dollar has gone back and forth during the course of the trading session on Thursday, as we continue to see a lot of support just below.

- It'll be interesting to see how the market behaves from here due to the fact that both of these currencies are most certainly considered to be safety currencies, but perhaps the Swiss franc is a little bit safer.

The idea of what the Federal Reserve is going to do as the Federal Reserve is almost certainly going to be cutting rates sooner rather than later. The question at this point isn't so much whether or not they're going to cut but how often and how deep will it cut? The first cut in September is probably going to be 25 basis points.

Top Forex Brokers

We Know 25 Basis Points Are Coming

At this point in time, I think everybody knows that and it doesn't really have much of an effect on the market. The question now is whether or not they continue to cut drastically because the Fed funds futures markets are pricing in. 2.25% by the end of next year, that's a pretty rapid expansion on cuts. Central banks historically get behind the curve and start cutting wildly and then it inflates assets, they are trying to inflate dead away. And that might be what we are getting ready to see.

If that's the case, we could see the Swiss franc pick up a bit of steam against not necessarily just the greenback, but against a lot of things. If this pair does break down significantly below the 0.84 level, then it leads to a deeper drop. That being said, this is an area we had bounced from pretty significantly previously. And it's worth noting that the moving average convergence divergence indicator is currently double bottoming as well. So, I definitely think this is a pair to watch. I'm neutral on it at the moment, but I'm waiting to see some type of impulsive move that I can start trading.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.