- It's easy to see that the US dollar falling against the Hungarian forint is something worth paying attention to, as it gives us a bit of a heads up as to how the US dollar is behaving against some of the more exotic currencies out there.

- The Hungarian foreign, of course, is an Eastern European currency that a lot of people will pay attention to due to the fact that Hungary is on the forefront of growth.

That being said, the Hungarian interest rate is currently at 6.75% and therefore it does make a certain amount of sense that the US dollar would struggle as we are seeing the Federal Reserve likely to cut rates later this month. If we do see the Federal Reserve aggressively cut, we could really start to see this pair take off to the downside.

If that were the case, it's very likely that we would see the US dollar shrink against almost everything else, not just the Hungarian forint. The market of course has been very choppy and volatile, but that might be just due to the natural rhythm of exotic currency pairs such as this one.

Top Forex Brokers

Technical Analysis

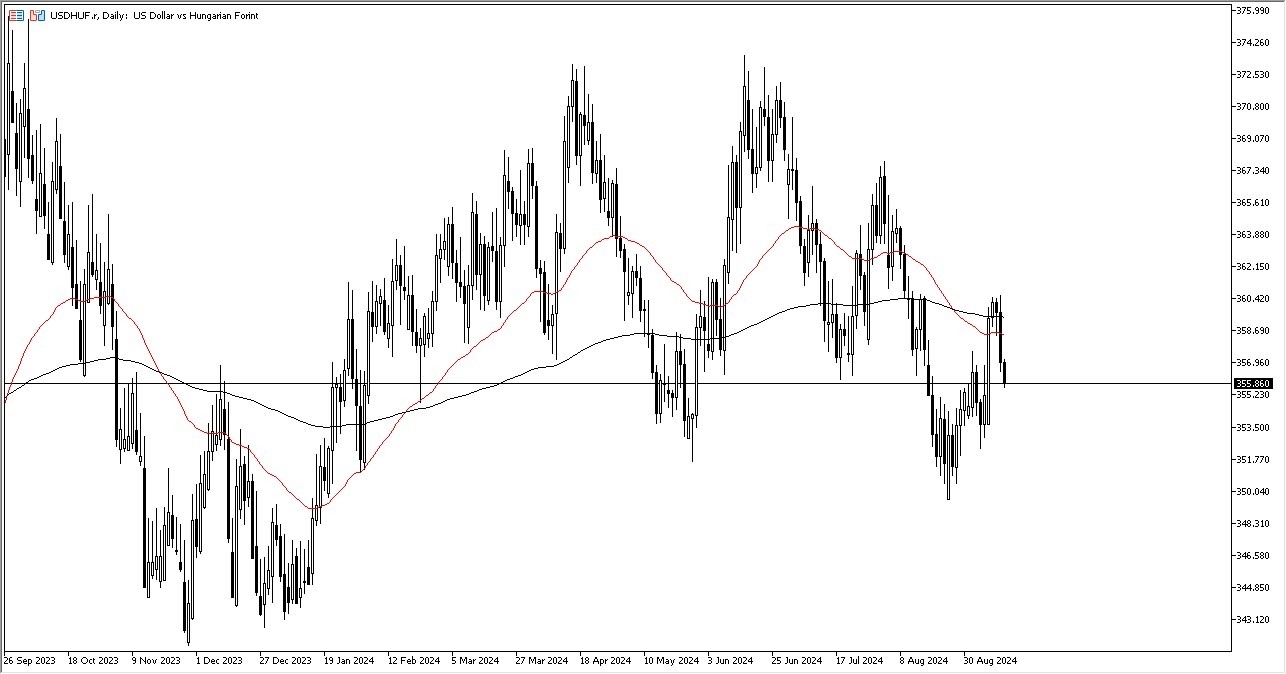

From the technical analysis standpoint, this is a market that I think continues to see a lot of noise right around the 360 level, where the 200 day EMA currently resides, right along with the 50 day EMA. If we were to continue to break down from here, the 350 level of course is an area of massive support that would make for a decent target, but it's probably worth noting that the market is going to continue to be very noisy and choppy. And with that being said, it would just be a continuation of what we have seen for quite some time in this pair on the way down from the 374 foreign region. We are in a downtrend, but I think given enough time, we could very well continue this.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.