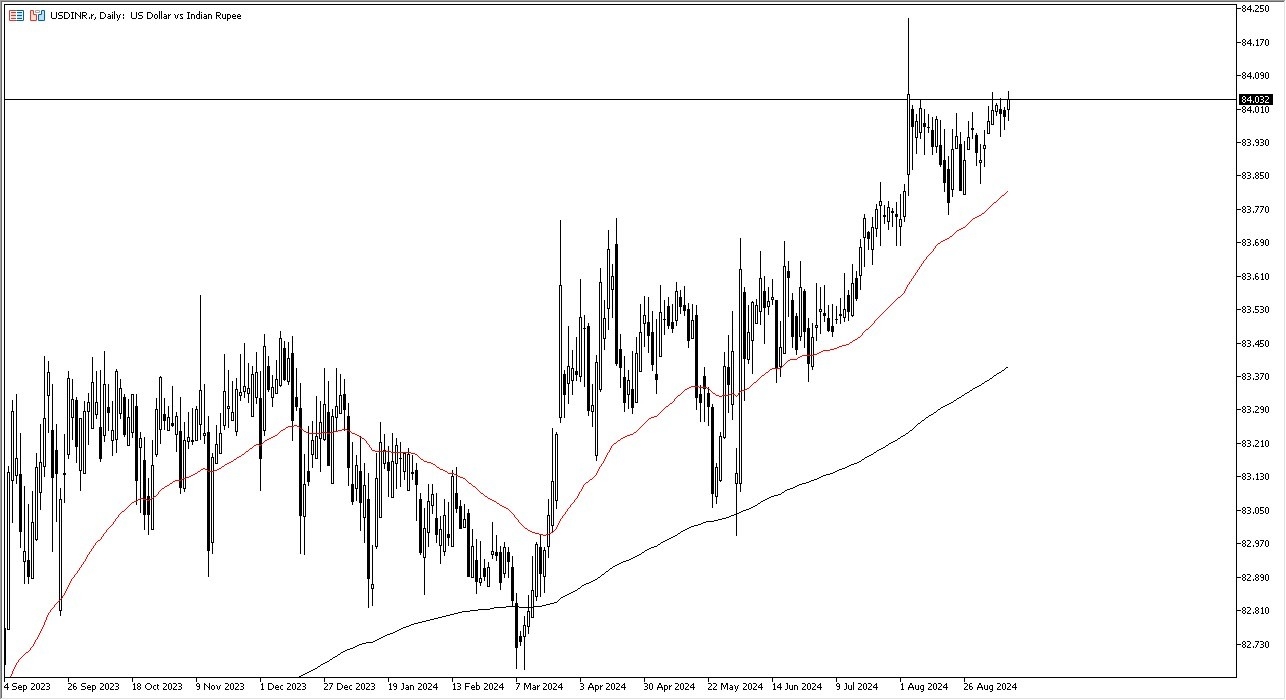

- The USD/INR pair is still a very bullish market.

- At this point in time, I see that we are struggling to get above the ₹84 level, but I also recognize that it’s only a matter of time before we will more likely than not smash through this region.

- After all, this is a market that continues to be bullish and continues to see buyers jumping into the market on each and every dip.

That in mind, you should also keep in mind that the Bank of India is highly influential in the USD/INR market, and it does keep a bit of a thumb on the scales as it were and does not allow the market to get too far out of control. In other words, they don’t want the rupee to get crushed. With that being the case, I think you have got a situation where market participants continue to look at this as a market that will eventually grind it’s way to the upside, but also has to deal with a lot of questions about the US dollar itself. After all, earlier in the day we had seen the Consumer Price Index numbers come out hotter than anticipated in the United States, and that of course has the US dollar rallying. Whether or not that continues to be the case against the Indian rupee remains to be seen, but I think you also have to keep in mind that there is a bit of a “risk off scenario” brewing out there as well.

Top Forex Brokers

Technical Analysis

The technical analysis is extraordinarily bullish, but we also see the ₹84 level acting like a bit of a brick wall. As long as it continues to cause issues, I think you will see the occasional pullback. However, those pullbacks will end up being buying opportunities that people are more than willing to take advantage of. The 50 Day EMA is all the way down at the ₹83.80 level, and I think as long as we stay above that indicator, there should be plenty of people willing to get involved. And in this environment, I think you have to look at any pullback as potentially offering “cheap US dollars.”

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading apps in India to choose from.