- This asset looks as if it is still stuck in the consolidation move.

- That’s not a huge surprise, this pair does tend to be very noisy and choppy at times, but ultimately, I think you’ve got a situation where traders are going to look at the global risk appetite profile more than anything else.

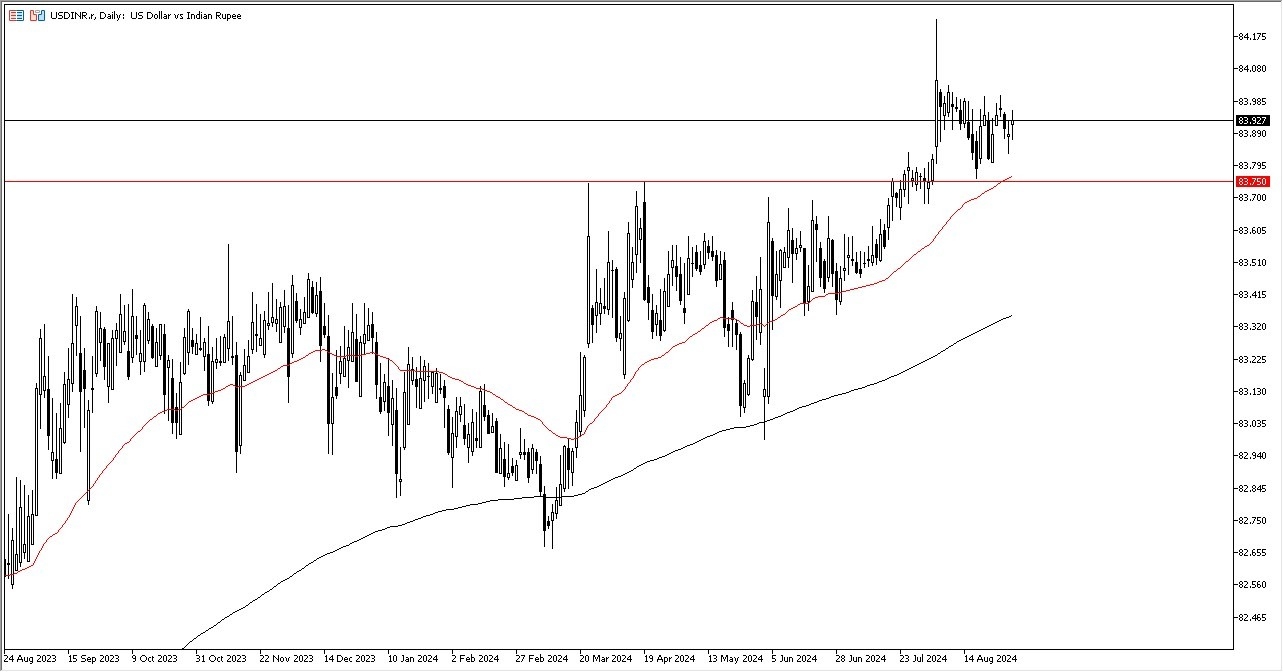

Looking at this, it’s obvious that the market has been going sideways for a while, with the ₹83.75 level underneath being a short-term support level. It also is where we see the 50-Day EMA currently residing, so that of course is an area where people will be looking at as a technical support level, plus it’s also an area that we have seen important more than once.

Top Forex Brokers

Bank of India

Keep in mind that the bank of India does not allow this market to trade freely, and therefore we’ve got a situation where traders are looking at the central bank as controlling a range that they will be dealing with, but ultimately it’s obvious that we are going to see plenty of support underneath, and it does make a certain amount of sense considering that the world is full of all kinds of geopolitical concerns, and therefore does make a certain amount of sense that the US dollar would be thought of as much more attractive than emerging market currencies. Ultimately, I do think that the USD/INR market goes higher.

On a move above the ₹84 level, then I think it allows the US dollar to go looking to the ₹84.25 level, which is where we had peaked previously. Anything above there then allows a much bigger move, perhaps to the ₹85 level. On the other hand, if we were to turn around a break down below the ₹83.75 level and therefore the 50-Day EMA, then we have a shot at dropping all the way down to the ₹83.50 level where there has been a lot of noise in the past.

In general, this is a situation where traders will continue to see a lot of volatility but ultimately if we do rally from here, I think it’s a sign that traders will continue to favor the United States over riskier economies such as India.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platform in India to choose from.