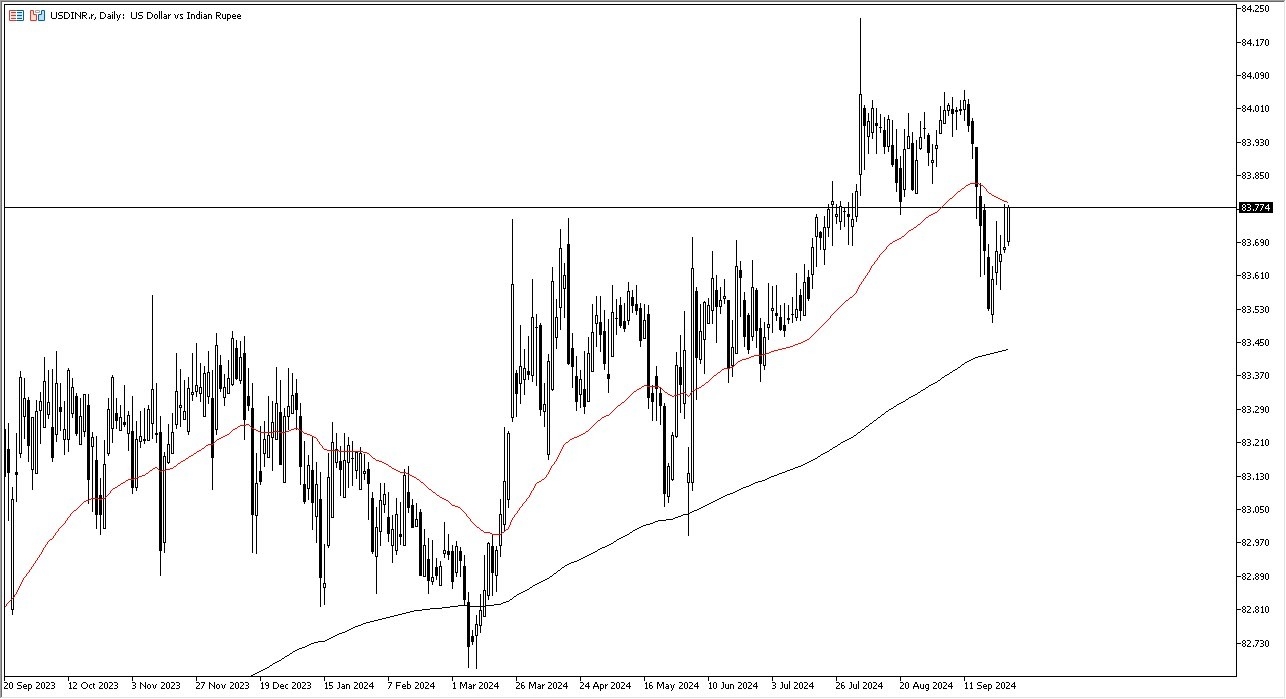

- The US dollar has rallied a bit against the Indian rupee to challenge the 50-day EMA during the Friday session, which of course is a risk-off sign.

- It's very interesting as it looks like we are trying to get back to the 84 rupee level after the recent sell-off, but we need to get through that 50-day EMA first.

If we can break above the 50 day EMA, then it's likely that we will in fact try to go looking towards the 84 level. Short term pullbacks at this point in time should continue to see plenty of support near the 83.5 rupee level, which is also backed up by the 200 day EMA. In general, I think you've got a situation where we will continue to see a lot of noisy behavior is one that is going to be highly sensitive to not only the US dollar, but how people feel that global trade is going to go.

Top Forex Brokers

After all, India is an emerging market, so it's a bit riskier to put your money there. We've been in an uptrend for some time and the recent sell-off I think was a little overdone, and now we have a scenario where we might get a bit of a recovery. You're seeing this in a lot of exotic markets where the US dollar is starting to pick up strength again.

The Dollar May Continue to Strengthen Against Indian Rupee

While the US dollar might struggle against some of its major competitors, the minor ones it's done fairly well against, and I think the Indian rupee will fall in that category before it's all said and done. If we were to break down below the 200-day EMA, that would be a major risk on signal, because people would be willing to throw money into markets like India. I think this is a steady as she goes, kind of just buy the dip behavior that we should be taken advantage of.

Ready to trade our daily USD/INR Forex analysis? Here’s a list of some of the best forex brokers in India to check out.