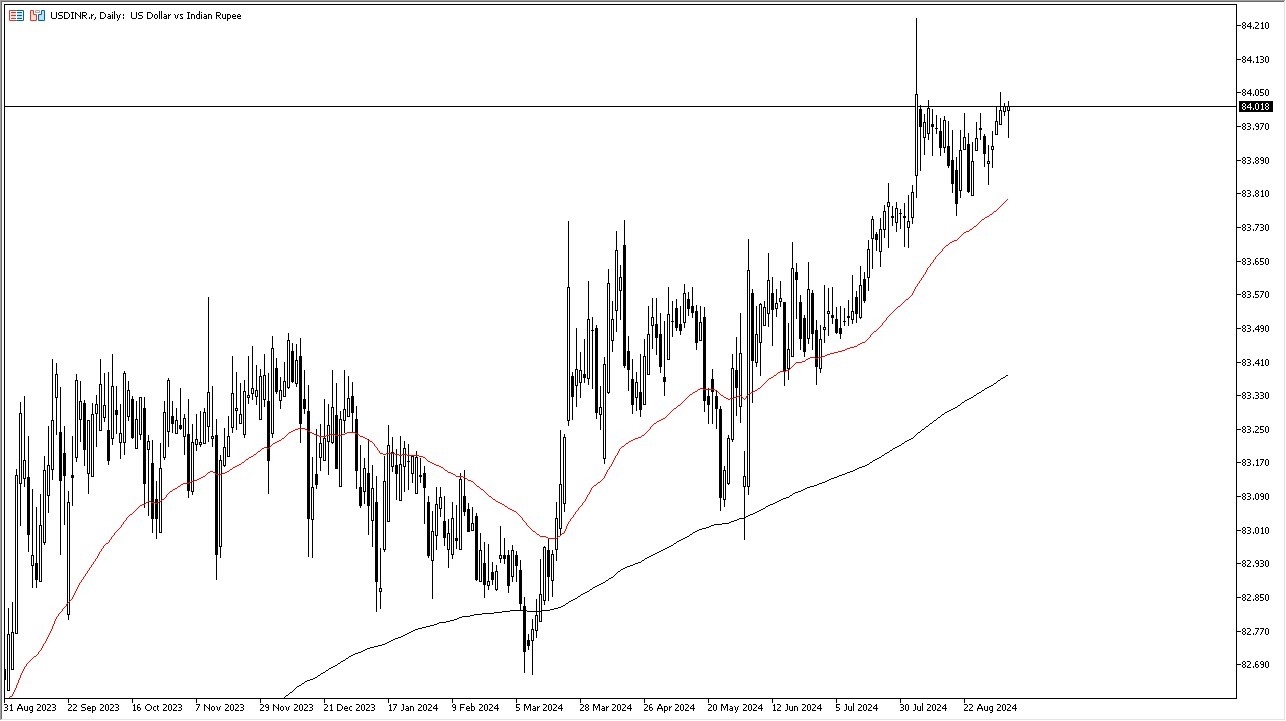

- We have seen a lot of volatility in this market.

- Keep in mind that the Indian rupee is highly manipulated by the Bank of India, so the fact that we had initially fallen during the trading session as jobs numbers in America came out rather anemic.

- But, we have seen the US dollar strength it makes a certain amount of sense as the Indian central bank is trying to walk the fine line between cheap enough currency to work for exports, but at the same time not let the Indian rupee collapse and therefore cause massive amounts of destruction to their domestic economy.

With all of this being said, it’s interesting that we find ourselves near the ₹84 level, because this is an area that’s been important multiple times. I do think that the USD/INR market is trying to squeeze higher, and if we can break above the Tuesday candlestick, it’s very possible that we could go looking to the ₹84.25 region, where we spiked to a couple of weeks ago. We did see the market gets slapped back down, but I think there’s only so much pressure that the Bank of India will be willing to absorb.

Top Forex Brokers

Buying on the Dips

At this point in time, it looks like traders are stepping into buy on the dips, which makes a certain amount of sense considering that the Bank of India does not want to rupee getting too strong, because it can cause quite a bit of noise and issues when it comes to exports. However, it’s also worth noting that they do not want the currency to get destroyed, despite the fact that there is a huge amount of demand for the US dollar in what looks like a very messy and negative turn of events globally. If that’s going to continue to be the case, then I think we will eventually see a massive breakout, but in the meantime, I think every time the pair drops, there should be plenty of buyers underneath, perhaps all the way down to the 50 Day EMA near the 83.80 level.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platforms in India to choose from.