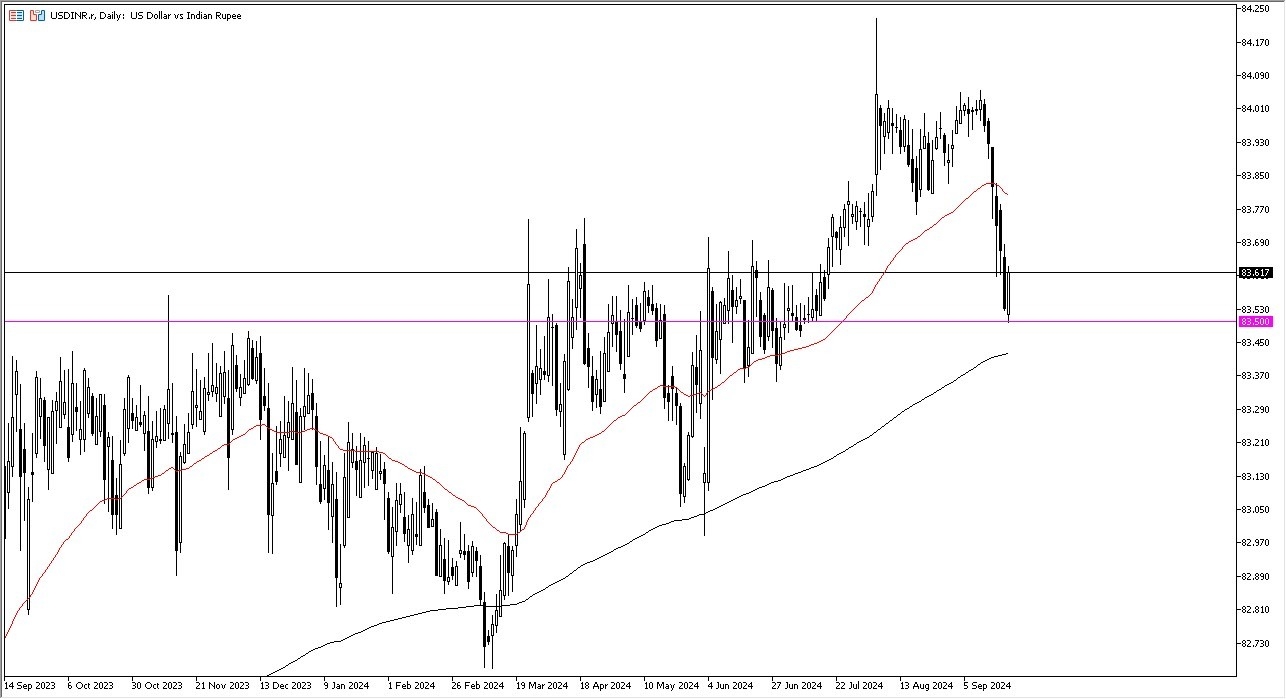

Potential signal:

- I am a buyer of this pair at 83.65, with a stop loss at the 83.55 level.

- The target is 84.

US dollar has bounced a bit during the early hours against the Indian rupee on Monday as the 83.50 rupee level is an area of significant support. And it's also worth noting that bouncing from there suggests that there are people out there willing to get involved. This represents value in the minds of some traders, which of course will be focused on the idea that the trend is very much still intact at this point in time.

Top Forex Brokers

The 200 day EMA underneath should continue to be a major support level as well as technical traders pay close attention to it. Keep in mind that the US dollar falling against the Indian rupee is a risk on move in general because it shows that people are willing to put money in emerging markets. However, we have been in an uptrend for quite some time, as you can see on the weekly chart, and it does suggest that we have much further to go, and this could be an area that we have seen a little bit of value offered and people seem to be more than willing to step in and take advantage of that. With all that being said, I do believe that we will continue to go higher, perhaps trying to get back to the 84 level. You should also keep in mind that the Bank of India of course has major influence on this pair because they don't necessarily let the rupee float freely.

Controlled Demolition of the Rupee Longer-Term?

So, in this situation, it's been a controlled demolition of the rupee. If that ends, it's going to have to see a lot of US dollar destruction around the world. And we'll just have to wait and see if that ends up being the case. As things stand right now, I don't know about that, but I do think you've got a scenario where traders will continue to look at this as a buy on the tip market.

Ready to trade our daily Forex signals? Here’s a list of some of the top forex brokers in India to check out.