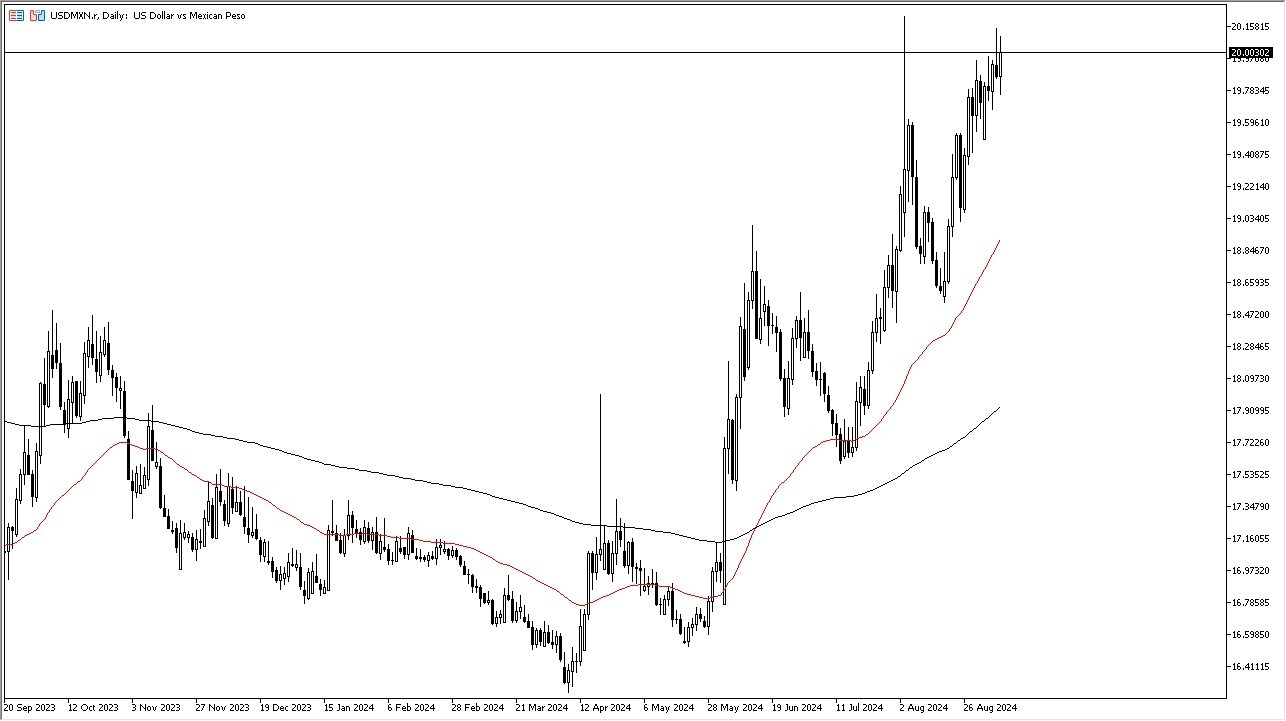

- The US dollar has rallied again against the Mexican peso, breaking above the 20 pesos level for the third time now.

- It looks like the jobs numbers in America coming out softer than anticipated has really turbocharged the “risk off” trade.

- That of course works against currencies such as the Mexican peso.

Ultimately, I do think this is a market that will eventually break out to the upside, based upon a lot of concerns around the world. If we can bring the 20.15 level, then I think the Mexican peso is in real trouble and we continue to grind much higher. Regardless, even if we pull back from here, that should end up being a buying opportunity as the 19.50 Mexican pesos level will attract a lot of attention, followed by the 50 day EMA, which sitting right at the 19 level as well. This of course will be an area that a lot of people will pay close attention to.

Top Forex Brokers

The Lack of Clarity

So, all of this being said, I think we've got a situation where people are starting to get very concerned about the global economic situation and the economic situation in the United States. Remember Wall Street and trading houses around the world have no idea what's really going on because most people who live in the United States could have told you nine months ago that something wasn't right. However, when money is concentrated in small places like Manhattan, they have no idea what goes on beyond the East River. We are now seeing the carry trade unwind further, as the interest rates in Mexico remain significantly higher than in the United States. It was essentially a free ride while those rates stayed wide apart, and currency markets were relatively stable. I expect a minor pullback, but it will likely be seen as a buying opportunity.

Ready to trade our daily Forex forecast? Here’s a list of some of the top Mexican forex brokers to choose from.