The USD/MYR remains within a bearish trend that has been able to produce fresh lows and is near values last seen in June of 2021, this as day traders consider their next wagers.

- For an extended amount of time the USD/MYR exchange rate had been traversing record highs and the 4.7800 vicinity was a resistance level that was being challenged.

- As late as April of this year some investors were speaking about dangers the Malaysian Ringgit faced, and if the loss of value in the currency would ignite further troubles in Malaysia.

- However, since the highs reached in April the USD/MYR has begun a steady bearish cycle, which has generated increased speed downwards. As of this writing the USD/MYR is near the 4.1235 ratio.

The move lower in the USD/MYR has been rather incredible since the first week in July when a value of nearly 4.7000 was being tested. Even on the 5th of August, particularly because it is a dynamic currency within Asia, the USD/MYR continued to show bearish momentum even when nervous financial institutions were buying the USD in mass in other currency pairs on that day. The USD/MYR has shown a steady turn lower.

Early September Highs Appear a Distance Away for the USD/MYR

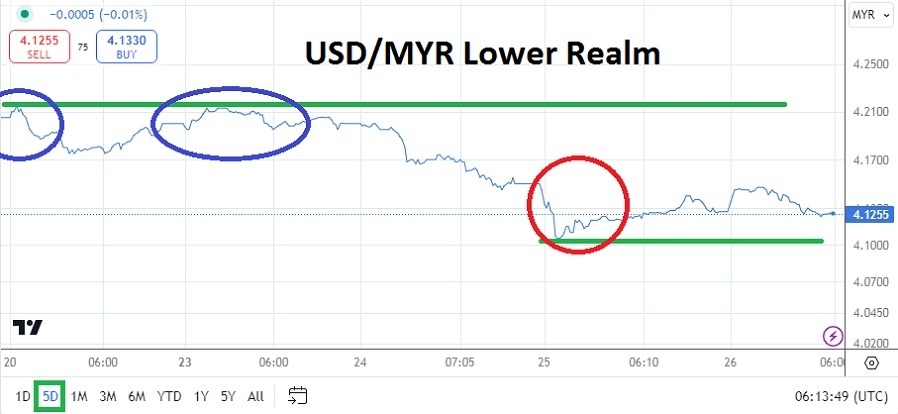

Price velocity lower has continued to be demonstrated in the USD/MYR consistently. On the 9th of September the currency pair was near the 4.3700 level. On the 19th of this month the USD/MYR was around 4.2700, this even after a slight reversal higher when lower depths had been traded the day before. Traders reading this should not get overly excited and start betting on lower USD/MYR price action without careful consideration. However, in the past week the USD/MYR has sustained lower momentum.

While the USD/MYR is certainly displaying a correlation to USD centric weakness that has been seen since July, the ability of the currency pair to traverse lower since April shows financial institutions were also reacting to fundamental economic shifts within Malaysia. But traders should also look at the USD/SGD which has had almost an identical run lower, except the USD/SGD began its bearish trend in May via technical charts.

Today’s U.S Growth Numbers and Inflation Reports

The USD/MYR will be affected perhaps by the GDP reports from the U.S later today. The reaction in the currency pair may not really take force until early Friday when Malaysian financial institutions open in the morning. If the U.S growth numbers come in weaker than expected this could set the table for additional selling in the USD/MYR.

- At some point financial institutions may believe the USD/MYR is oversold.

- Yet, and this is where it grows even more interesting, as the USD/MYR test values not seen in three and a half years, technical traders and financial institutions also know the currency pair has traded at lower depths via technical charts.

- Day traders need to be careful, chasing lower depths may feel alluring in the USD/MYR but risk management is needed.

USD/MYR Short Term Outlook:

Current Resistance: 4.1310

Current Support: 4.1200

High Target: 4.1560

Low Target: 4.1050

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.