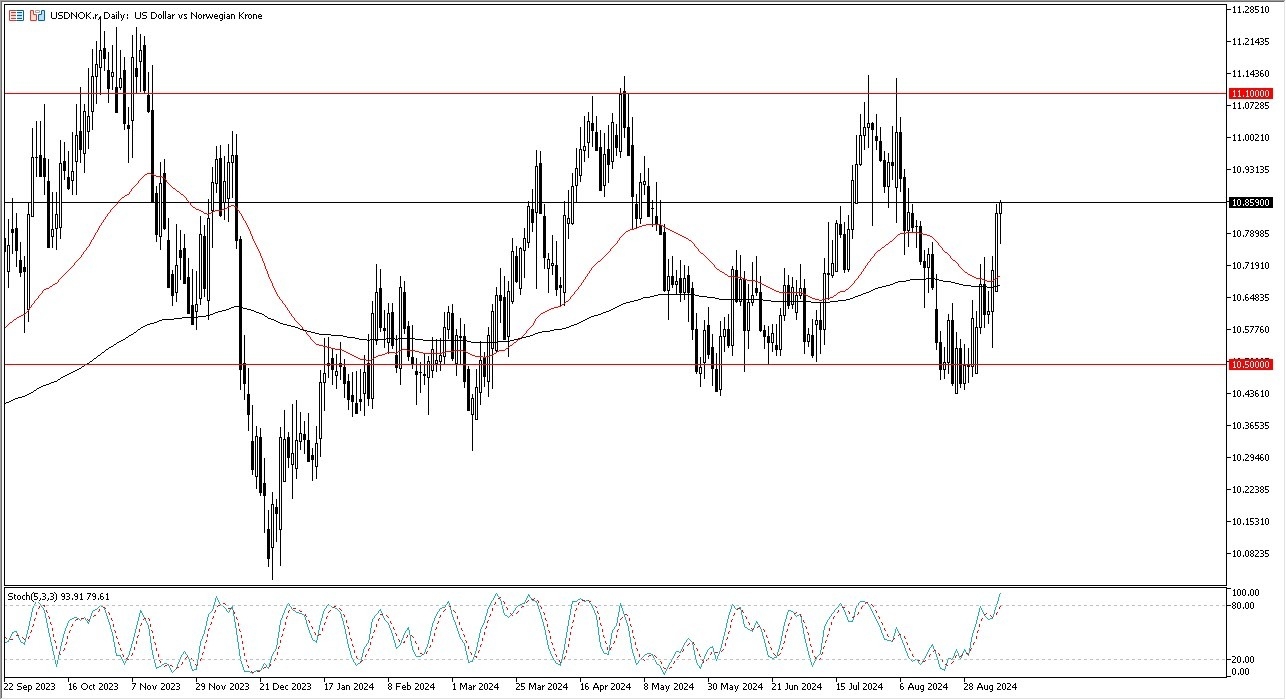

- The US dollar initially pulled back just a bit during the trading session here on Tuesday, but then it continued the bullish pressure that we had seen from Monday.

- This is a market that looks like it's going to try to get to the top of the overall consolidation range, which means it could go looking to the 11.10 level.

- That is an area that a lot of people were looking at previously as a ceiling.

At this point in time, the market probably sees a lot of resistance all the way to the 11.2, five level, the candlestick turning around the way it has and the fact that oil is falling apart probably continues to send the U S dollar, much higher. Even if we do pull back from here, it's likely that the 50 day EMA will come into the support of this US dollar. Then after that, we have the 10.50 level as a floor.

Top Forex Brokers

Consolidation Range Holds?

In general, I think this is a market that probably stays within the overall consolidation range. But if we get some type of panic in the market, and let's be honest here, there's much more likelihood of a panic than a melt up in risk appetite. Then the US dollar can really start to put a beating on the Norwegian krone. We are quite some ways away from that, but it is worth noting that the dollar is rallying quite significantly even though the world pretty much knows that the Federal Reserve will be cutting later this month. That tells me that there is quite a bit of underlying fear out there.

If that ends up being the case, then I think we have quite a bit of volatility coming, and in these smaller currency pairs, you could see a lot of dangerous moves, which if you are not careful with your position size, you could be punished for becoming a bit too aggressive.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.