- The US dollar has seen a little bit of strength, which makes a certain amount of sense considering that the global economy is a bit questionable at the moment.

- All things being equal, the Russian ruble of course is highly sensitive to the crude oil markets, which have been suffering as of late.

- Because of this, I think you need to keep an eye on the crude oil market at the same time, but there are a lot of different things going on at the same time here.

Technical Analysis

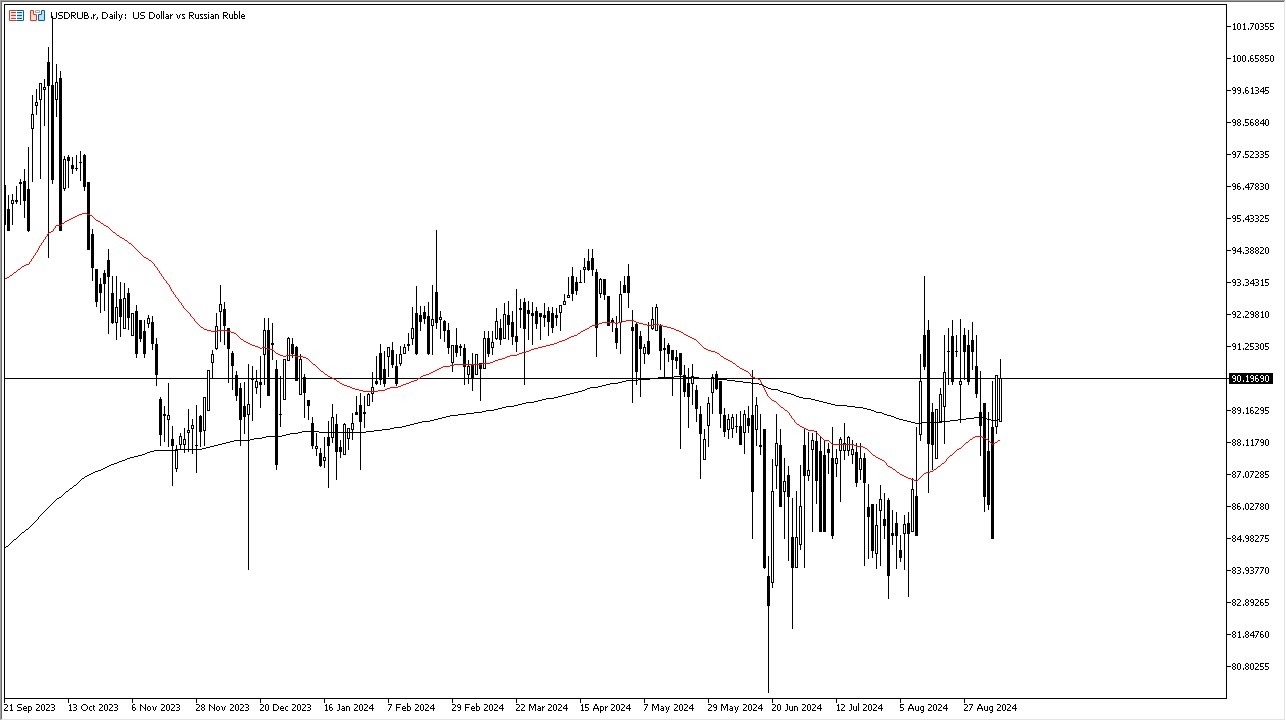

It’s worth noting that we are sitting on top of the 200 Day EMA indicator on the daily chart of the USD/RUB exchange rate, which of course is an area that a lot of people would be paying attention to from a technical analysis standpoint. It’s also worth noting that the 92.30 RUB area has been significant resistance in the past couple of weeks, so I will be paying close attention to it when we get there. If we can break above that level, then this is a market that could really start to take off to the upside.

Top Forex Brokers

On the other hand, if the market were to drop from here, I believe that the 200 Day EMA is going to continue to offer support, right along with the 50 Day EMA which sits just below there. It’s probably also worth noting that the 90 RUB level is right here as well, and that of course will cause a certain amount of interest. That being said, I think this is a market that continues to be somewhat range bound, so it would not surprise me at all to see the market continue to dance around between the 93 RUB level and the 85 RUB level underneath. All that being said, I think I would look for a bit of a consolidation play, and keep an eye on indicators such as the stochastic oscillator and of the range bound setups.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Russia to check out.