Signals for the Lira Against the US Dollar Today

- Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 33.95.

- Set a stop-loss order below 34.15.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 33.75.

Bearish Entry Points:

- Place a sell order for 34.25.

- Set a stop-loss order at or above 34.34.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 34.00.

Turkish lira Analysis

The Turkish Lira gained slightly in Asian trading on Monday morning, stabilizing above the 34-lira level. The pair had previously hit an all-time high of 34.40 lira per dollar in the previous week. Clearly, the lira suffers now from significant pressure after global financial market fluctuations about four weeks ago caused some hot money to exit Turkey. Also, the Turkish Central Bank supported the lira by injecting large amounts of dollars into the markets, which relatively slowed down the lira's decline. Data released by the Central Bank of Turkey revealed the extent of the pressures facing the Turkish currency, as the bank's net reserves recorded a significant decline.

Top Forex Brokers

Last Friday, data from the Central Bank of Turkey showed that the bank's reserves recorded a significant decline last week, reaching $90.7 billion, a decrease of about $2.5 billion. At the same time, foreign assets recorded a decline of about $2.5 billion to reach $150.4 billion. Not all the data was negative, as the Central Bank's gold reserves recorded a slight increase to $59.6 billion, compared to about $58.7 billion in the previous week. Also, the data included a decline in net international reserves of $4.1 billion.

In other news, the end of last week saw optimistic forecasts from the International Monetary Fund regarding inflation rates in Turkey. Furthermore, the fund's report praised the monetary tightening policy pursued by the Central Bank of Turkey.

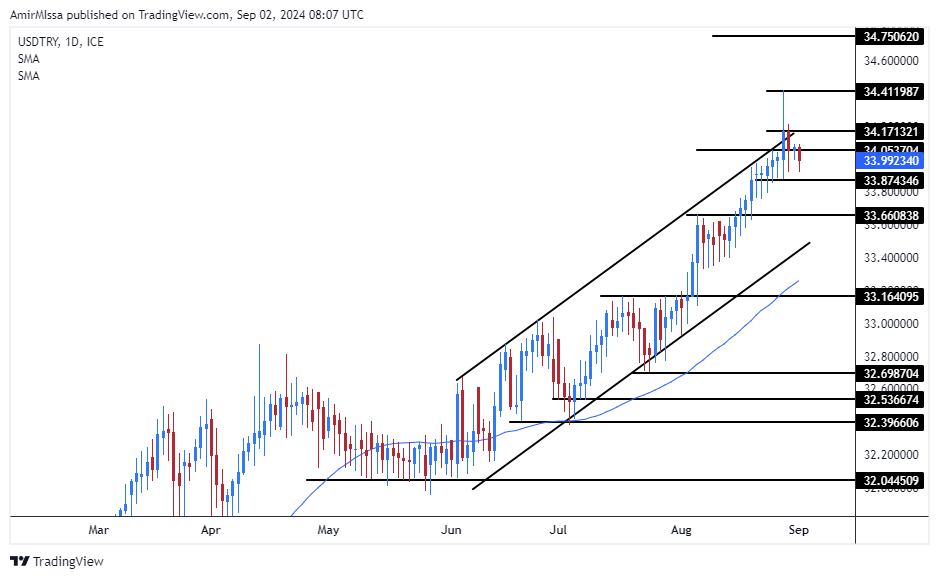

TRYUSD technical Analysis and Expectations Today:

Technically, the price of the US Dollar against the Turkish Lira (USD/TRY) declined while the pair maintained its trading around the 34-lira integer. The price is trading around the upper limit of the ascending price channel on the daily timeframe, amidst the dominance of the overall upward trend in the dollar against the lira. Moreover, with the price moving above the 50 and 200 moving averages, respectively, which intersect positively on the daily timeframe, as well as on the four-hour timeframe. If the price rises, it targets resistance levels cantered at 34.40 and 34.50 lira, respectively. Meanwhile, if the pair declines, it targets support levels at 33.80 and 33.70 lira, respectively. The Turkish Lira price forecast includes a rise in the pair, especially as it stabilized above the upper limit of the shown price channel.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from.