Signals for the Lira Against the US Dollar Today

Risk 0.50%.

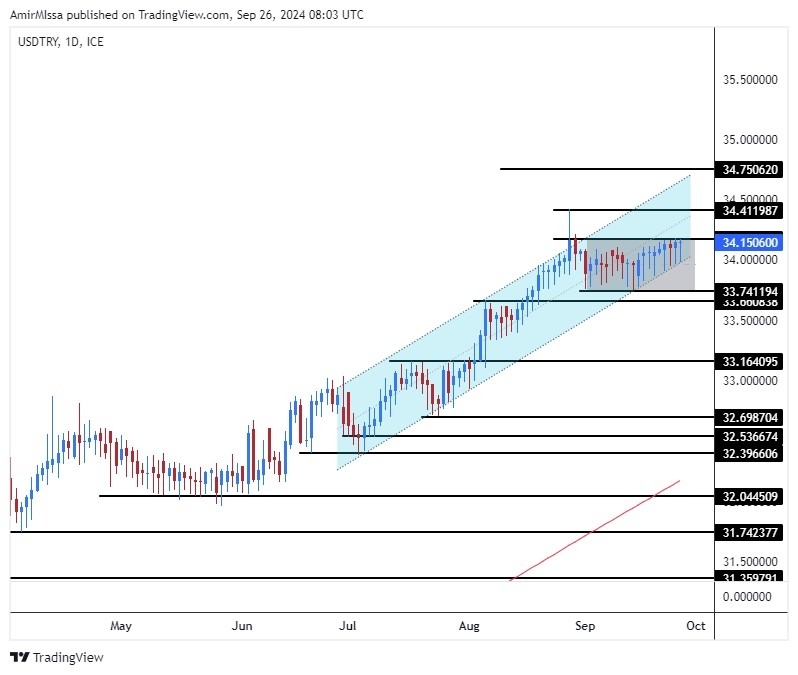

Bullish Entry Points:

- Open a buy order at 33.90.

- Set a stop-loss order below 33.75.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 34.15.

Bearish Entry Points:

- Place a sell order for 34.30.

- Set a stop-loss order at or above 34.45.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 33.80.

Turkish lira Analysis:

The dollar has remained stable against the Turkish lira, which continues to trade in the same range around the 34-lira level for the past few weeks. This stability is supported by interventions from financial institutions in Turkey, which have managed a controlled movement of the lira.

Investors followed the remarks of Turkey's Finance Minister Mehmet Şimşek during his meeting with a group of investors in the United States, where he revealed that the current economic measures, described as "austerity," will continue. Obviously, these include controlling public spending, which he emphasized as essential for the government's plans to curb inflation. Also, Şimşek stressed the importance of bringing the shadow economy into the official system and ruled out the possibility of introducing new taxes in the near term. Lastly, he rejected comparisons of the effects of tight monetary policy, noting that while it reduces inflation, it also pressures growth rates.

According to observers, the primary aim of the meeting was to reassure markets about the continuation of the current monetary policy in the country, which has succeeded in attracting foreign capital. Moreover, in contrast to the unconventional monetary policies pursued by President Recep Tayyip Erdoğan before the last presidential elections, which favoured lowering interest rates despite rising inflation.

The Central Bank of Turkey, through a series of interest rate hikes, has managed to control inflation to some extent after it approached 52% in August. Interest rates have reached 50% and have been kept steady over the past six consecutive meetings. The high-interest rate has attracted foreign investors seeking to profit from the carry trade by borrowing in low-interest currencies and using the funds to buy the lira, taking advantage of the high rates. In the first six months, foreign inflows amounted to around $2 billion.

Top Forex Brokers

USD/TRY Technical Analysis and Expectations Today:

The USD/TRY exchange rate remains stable in a sideways range represented by a rectangular pattern, with prices fluctuating between its boundaries. Also, the price is supported by the lower boundary of an upward price channel on the daily chart, which supports the dollar's rise. Additionally, the pair continues to trade above the 50-period moving average on the four-hour chart. The overall trend remains dominant, with every pullback seen as a buying opportunity. If the pair rises, it targets the 34.20 and 34.50 levels, respectively. Conversely, if it declines, it targets the 33.90 and 33.70 levels, respectively. Ultimately, the forecast for the Turkish lira indicates a fluctuating trend as long as the price remains within the outlined rectangular range.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.