Potential Signal

- I am a buyer of this pair at 102 yen, with a stop at 101.30 yen, aiming for 105 yen.

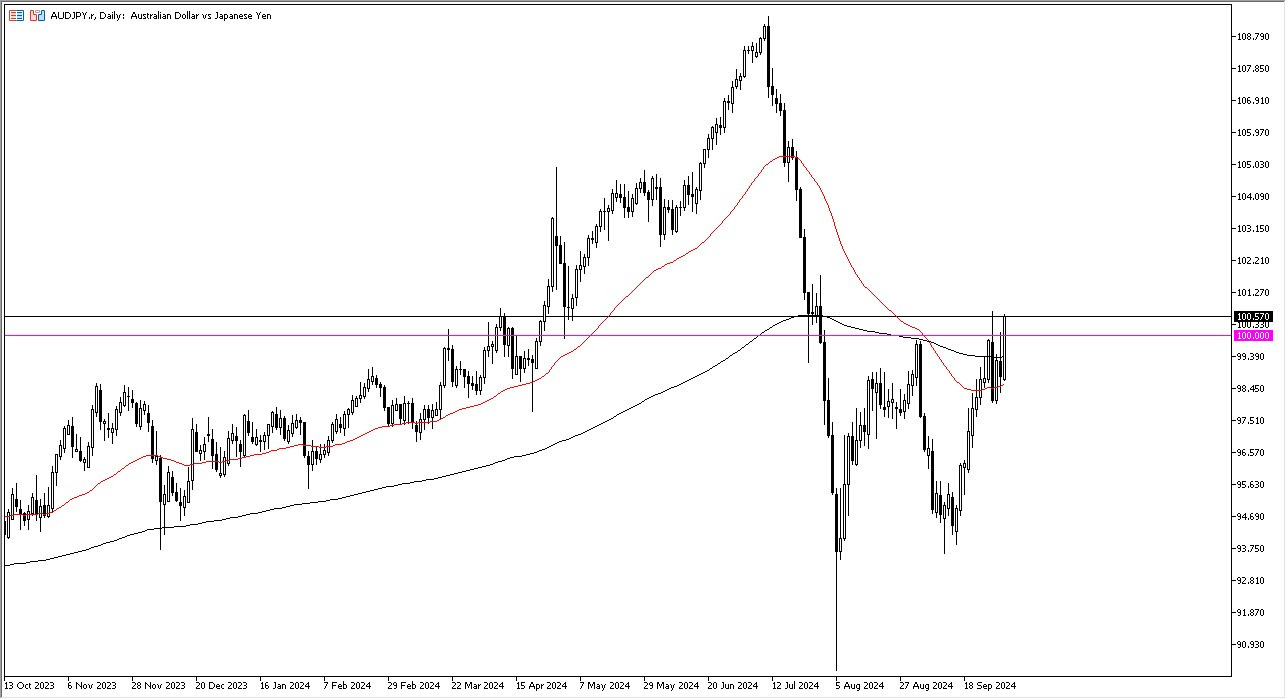

On my daily analysis of the yen -related currency pairs, I noticed that the AUD/JPY pair has rallied rather significantly to reach above the ¥100 level. At this point in time, I think the market is trying to do everything it can to break out to the upside and go reaching to much higher levels. The ¥102 level is an area that a lot of people would be watching, because it does have previous resistance in that region. That being said, we also have seen such a massive candlestick form that showed signs of life to go higher.

Top Forex Brokers

It’s worth noting that the Australian dollar has broken above the 200 Day EMA indicator, which of course is important, and breaking above that indicator does suggest that we are going to continue to see the market try to break to the upside and enter a longer-term bullish run. This makes a certain amount of sense, considering that the Bank of Japan has given up on the idea of raising rates any further, and therefore I think the carry trade will probably come back with a massive bang.

Technical Analysis and Fundamental Analysis

Both the technical analysis and the fundamental analysis lines up to show signs of strength in this pair, and I do think it’s probably only a matter of time before the Australian dollar goes much higher, as we have seen a lot of “risk on behavior” coming back into the market on Wednesday, and I do think that it is probably only a matter of time before we see more of a “buy on the dips” mentality, as the interest rate differential between Australia and Japan continues to be a major driver. At this point, I can see a massive longer-term move just waiting to happen, and therefore I like the idea of being long.

Short-term pullbacks continue to get bought into and I think there is plenty of support all the way down to at least the 50 Day EMA, near the ¥98.50 level, and therefore I think this is a market that you cannot be short anytime soon.

Ready to trade our free Forex signals? Here are the best Forex brokers to choose from.