Potential Signal

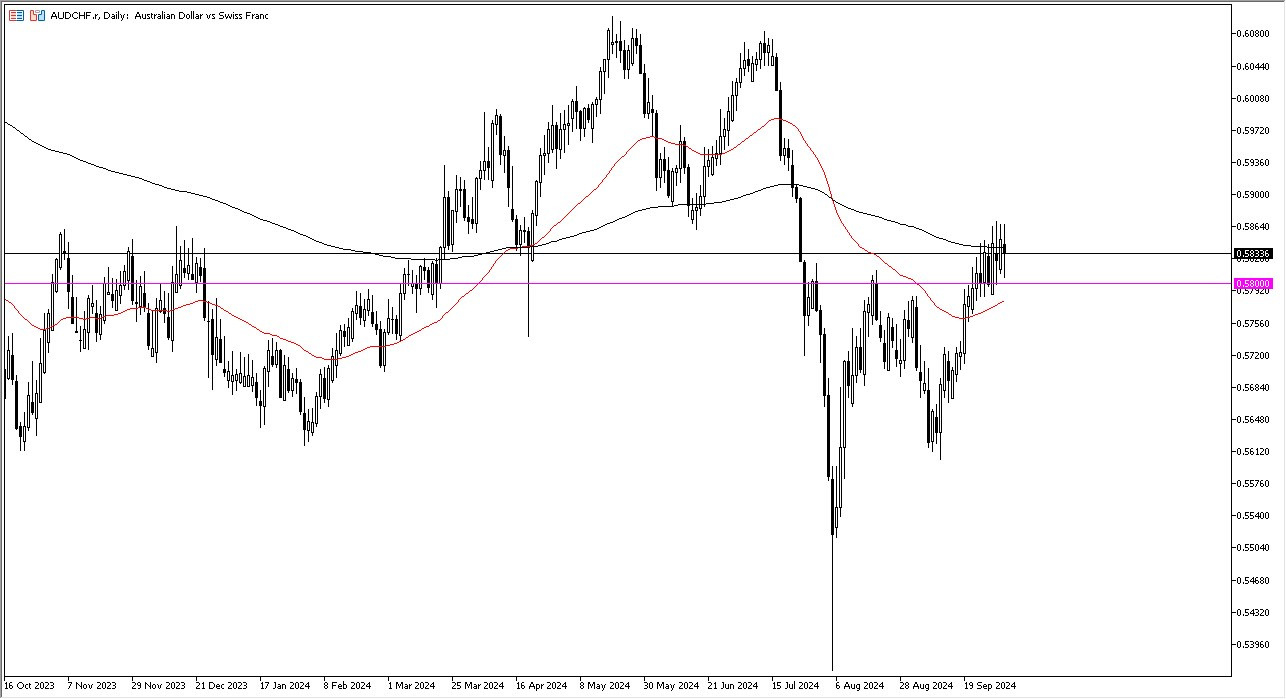

- I’d be more apt to buy this currency pair if we can touch the 0.59 level.

- At that juncture, I would have a stop loss right at the 50 Day EMA, and I would be aiming for a short-term move toward the 0.6020 level.

During my daily analysis of minor currency pairs, the AUD/CHF pair has captured my attention. The market continues to see a lot of noisy behavior, and I think what we have is a scenario where people are using this as a proxy for risk appetite, which of course is something that you would anticipate. After all, the Australian dollar is considered to be a major “risk on currency”, as it is attached to commodities, while in contrast, we have the Swiss franc that represents safety and “risk off behavior.”

Top Forex Brokers

All things being equal, this is a pair that I think continues to be noisy as traders just don’t have any real clear vision as to where things are going to be going over the next couple weeks. With this, I would have to look at the technical analysis to try to sort everything out, because quite frankly the fundamental analysis is all over the place and will continue to be difficult to get a grasp on as there are multiple things going on at the same time that can move the overall attitude of traders.

After all, we have several areas of conflict going on at the same time, and of course commodity markets are all over the place. The gold market in particular, has been very interesting and of course it has a direct influence on the Australian dollar as Australia is a major exporter of gold. With that being said, we also have to keep an eye on what’s going on around the world from the geopolitical sense, as it can have a major influence on both of these currencies.

Technical Analysis

The market currently sits right around the 200 Day EMA and has seen the 0.58 level offer support. At this point, I think you’ve got a scenario where traders will be watching to see whether or not we can continue to go higher in order to start buying. On the other hand, if we were to turn around and break down below the 50 Day EMA, which is currently near the 0.5780 level, then we could see the market really start to fall apart at that point, perhaps showing a major “risk off” attitude that would show itself in other markets as well.

Ready to start trading our free daily Forex signals? Get our top rated Forex brokers to open a demo account with.