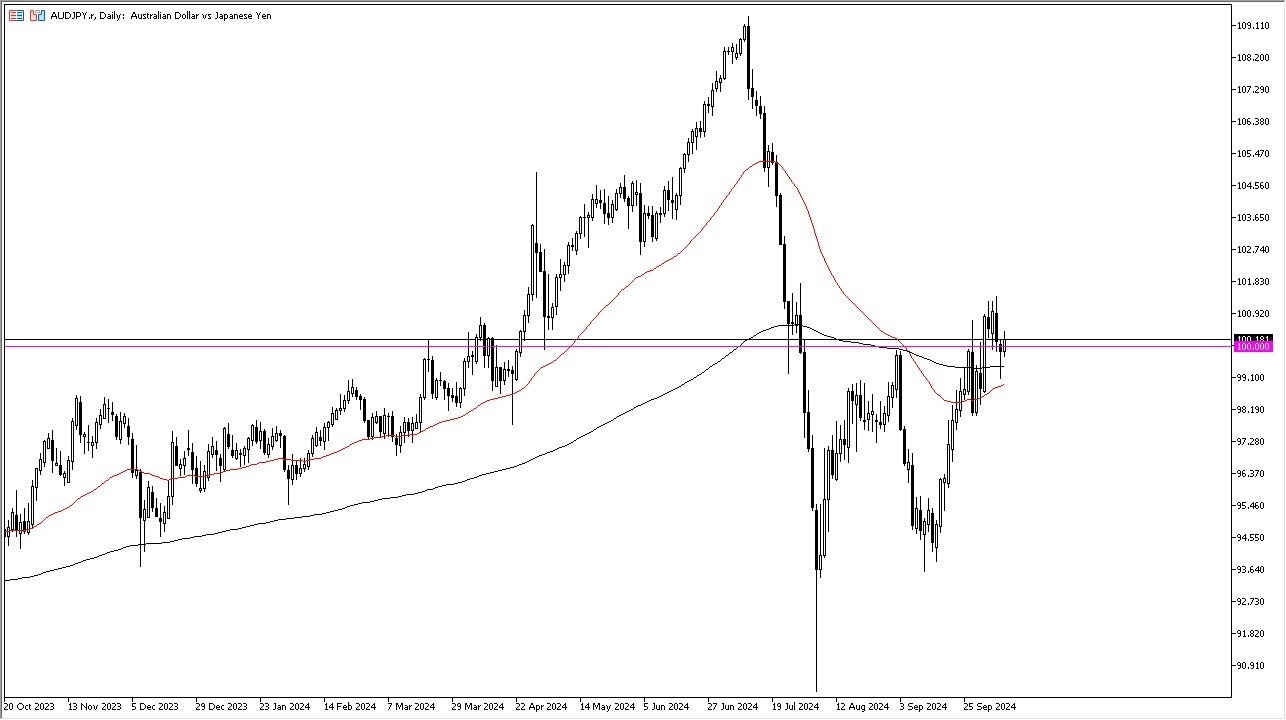

- In my daily analysis of yen related pairs, the AUD/JPY pair continues to be one that I watch, especially as we are hanging around in a massive, large, round, psychologically significant figure in the form of the ¥100 level.

- The ¥100 level will attract a lot of attention by itself, but we also have some amount of interest due to the options markets as these big figures tend to be attractive to those traders.

New Zealand Cuts Rates

Despite the fact that we are looking at the Australian dollar, you need to keep in mind that the central bank in New Zealand cut interest rates by 50 basis points overnight, so that has a bit of a knock on effect on the Australian dollar.

Top Forex Brokers

While the interest rate differential still favors the Aussie dollar, that might have traders questioning whether or not Austria will be next to cut rates. Because of this, although I am bullish of this market, I recognize that you may have to temper some of your expectations, at least as far as momentum is concerned.

If we were to break above the ¥101.75 level, then I think he gives us the “all clear” to continue going higher. At that point in time, the Aussie could go looking to the ¥105 level. In general, we are going back and forth in a relatively tight range, and it’s probably worth noting that the 200 Day EMA sits just below, and also has the 50 Day EMA approaching it, and getting ready to cross it, kicking off the so-called “golden cross.”

Because of this, longer-term traders might be paying close attention to this pair through the prism of the carry trade, as you get paid at the end of every day to hold onto the Aussie dollar in relation to the Japanese yen, which is backed by the Bank of Japan and its altar loose monetary policy. I remain bullish, but I also recognize that it could be noisy overall.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using.