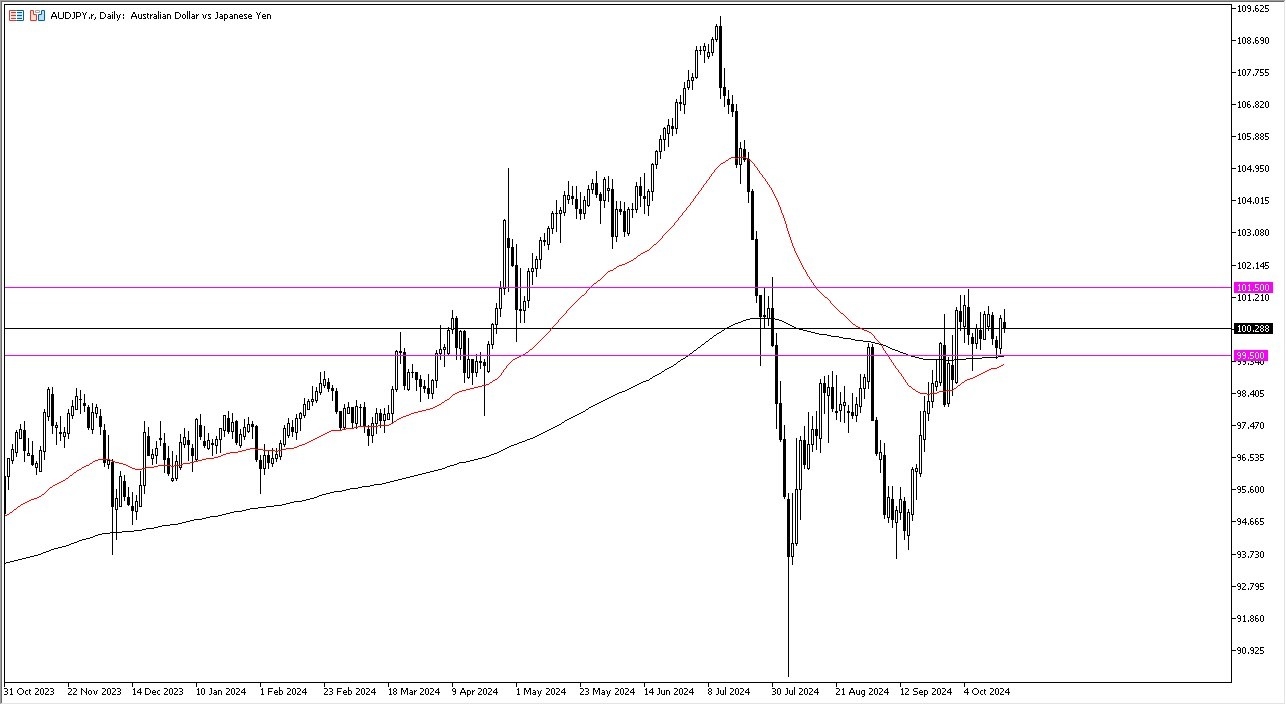

- The Australian dollar attempted to rally against the Japanese yen during Friday’s session but continues to consolidate sideways.

- This isn’t surprising, as the market is heavily influenced by risk appetite, which remains uncertain.

- The interest rate differential favors the Australian dollar, and Australia’s economy is highly sensitive to global risk appetite and commodity prices.

- As a result, the consolidation reflects the market’s broader indecision in response to these factors.

Risk Appetite Continues to Be Important

So, with all that being said I think you've got a situation where we need to see more risk on behavior and then we would go higher. The technical analysis suggests that the 101.5 level being broken to the upside opens up the possibility of a much bigger move, perhaps to the 105 yen level. Underneath we have a lot of support at the 99.5 yen level underneath, not only due to previous action but also the 200 day EMA and the 50 day EMA indicators.

Top Forex Brokers

All things being equal, this is a market that I think continues to be noisy, but I do favor the upside just simply due to the fact that you get paid at the end of every day to hold this market.

I have no interest in trying to short this market, but if we broke down below the 98 yen level, you would have to start to consider it. Until then, I think you look at dips as potential buying opportunities in a market that should continue to be very noisy, but I think favor pretty much anything but the Japanese yen, as we have seen multiple times in the past. This market will be noisy under the best of circumstances, but it look like we are going to see positivity.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using