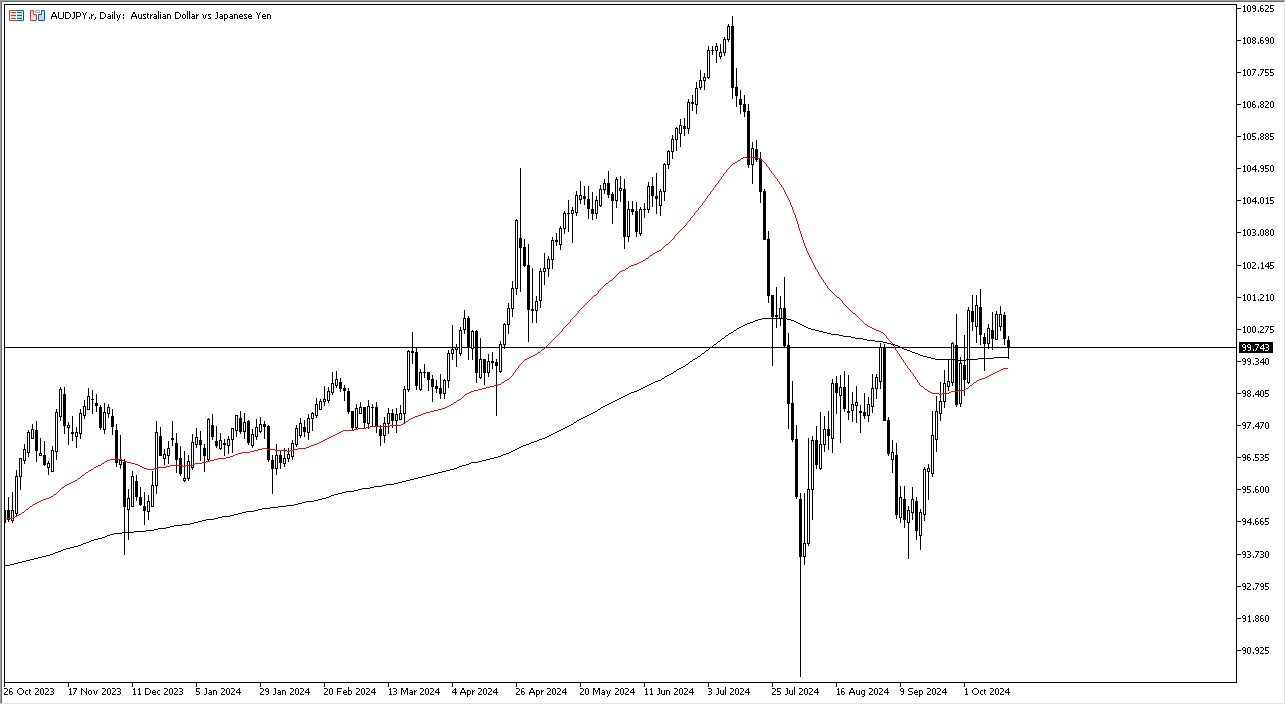

- The Aussie dollar initially pulled back just a bit during the trading session on Wednesday to test the 200 day EMA.

- The 200 day EMA, of course, is a long term indicator that a lot of people pay attention to and therefore, it's not a huge surprise to see a little bit of a bounce from there.

- This would be the exact kind of action I would be watching, as the carry trade could be coming back at this point.

That being said, the 100 yen level just above is an area that I think continues to attract a lot of attention. So, with that being said, if we turn around and rally above there, then I think we have a real shot at heading back to the 101 yen level. If we get back above there again, then I think it's time for the Australian dollar to finally take off against the Japanese yen. Yet again, we recently have broken out above a little bit of resistance and formed a massive W pattern, so now I think we are in a consolidation phase in order to build up the necessary momentum to keep going higher.

Top Forex Brokers

On a Move Higher

If and when we break above the 101 yen level on a daily close, we could find ourselves going as high as 108 yen before it's all said and done. Simply put, it would be a massive move waiting to happen. If you just take the measured move from the W pattern, you could be looking at about a 7% move, which puts you right around 107 yen. So, either way, it looks extraordinarily bullish. Furthermore, keep in mind that the interest rate differential continues to favor the Australian dollar, so you get paid at the end of every day to hold this pair anyway. And I think that's what a lot of people are looking at in this market, as well as other “yen-related pairs.”

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.