- During my analysis of the AUD/USD pair, it seems the market is attempting to form a bottom in this region.

- The Australian dollar is influenced heavily by commodity trends and global risk appetite.

- As these factors fluctuate, the AUD/USD could move in response.

- Keep an eye on these key indicators to assess the pair's direction.

Technical Analysis

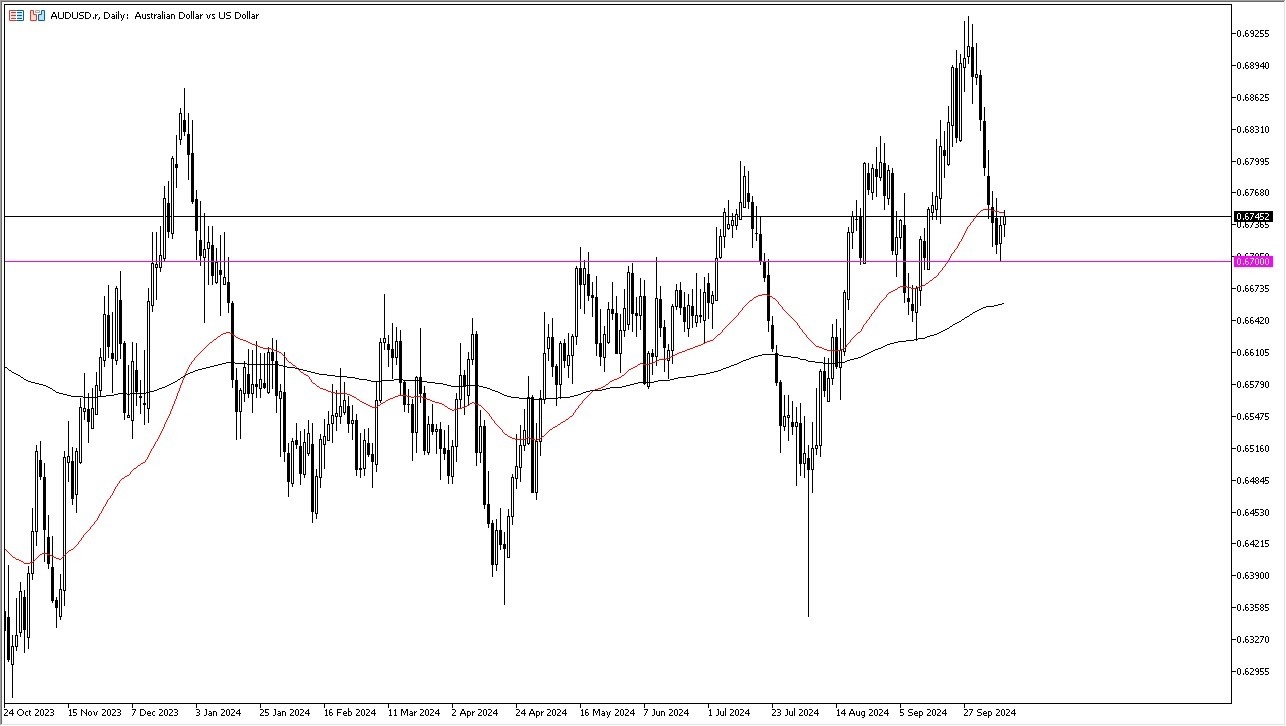

The technical analysis for the AUD/USD pair is a bit mixed, but I do think that we have quite a bit of support in this region. The 0.67 level is an area that a lot of people will be paying close attention to due to the “market memory” that is to be found there. All things being equal, it’s also worth noting that the 50 Day EMA above sits just above and offers a significant amount of resistance near the 0.6750 level. If we were to break above there, I think at that point in time you would get a lot of “FOMO trading” where traders would be jumping into take advantage of “cheap Australian dollars.”

Top Forex Brokers

Underneath, we have the 0.67 level offering support, but below there, we also have the 200 Day EMA near the 0.6660 level. Regardless, this is a market that sees most moving averages rising over time, and that of course is the very essence of the longer term uptrend. Ultimately, we will have to figure out whether or not there is value to be had here, but more importantly, I think we need to pay close attention to whether or not there is actual momentum. Momentum is going to be the missing ingredient, so it’s worth noting that if we get some type of fundamental event, or if traders start to get excited about owning assets again, the Australian dollar will be a beneficiary as the US dollar would probably be sold off in that environment.

Ready to trade our AUD/USD Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.