Bullish view

- Buy the AUD/USD pair and set a take-profit at 0.6785.

- Add a stop-loss at 0.6650.

- Timeline: 1-2 days.

Bearish view

- Sell the AUD/USD pair and set a take-profit at 0.6650.

- Add a stop-loss at 0.6785.

The AUD/USD pair held steady at 0.6700 on Monday morning as US and Australia government bond yields continued rising. It remains significantly lower than the year-to-date high of 0.6942.

US and Australia bond yields rise

The AUD/USD exchange rate held steady as the US and Australia government bonds continued rising.

Data shows that the ten-year government bond yields rose to 4.10%, its highest point since July 31st. It has risen from the year-to-date low of 3.596%. Also, the 30-year yield rose to 4.40%, while the five-year rose to 3.90%.

The Australian 10-year bond yields rose to a high of 4.362%, its highest point since June 11. Similarly, the five-year yield jumped to 3.956%.

The US bond yields continued rising as investors reacted to the strong economic numbers like retail sales, inflation, and jobs.

Data released earlier this month showed that the American economy was doing well. The unemployment rate dropped from 4.2% in August to 4.1% in September.

Another data showed that the headline Consumer Price Index (CPI) retreated from 2.5% to 2.4% in September, while core inflation remained at 3.2%.

Top Forex Brokers

Data released last week also showed that the country’s retail sales held steady in September in a sign that the American consumer is strong. Weekly jobless claims unexpectedly dropped a week earlier. Therefore, there are odds that the Federal Reserve will be less dovish as it was a few weeks ago.

The AUD/USD dropped after the Australia Bureau of Statistics (ABS) published strong jobs numbers.

The data showed that the economy has filled 290k jobs full-time jobs in the first nine months of the year while the participation rate rose to a record high of 67.2%. The jobless retreated slightly to 4.1%. As such, traders expect that the RBA will not cut interest rates in December.

AUD/USD technical analysis

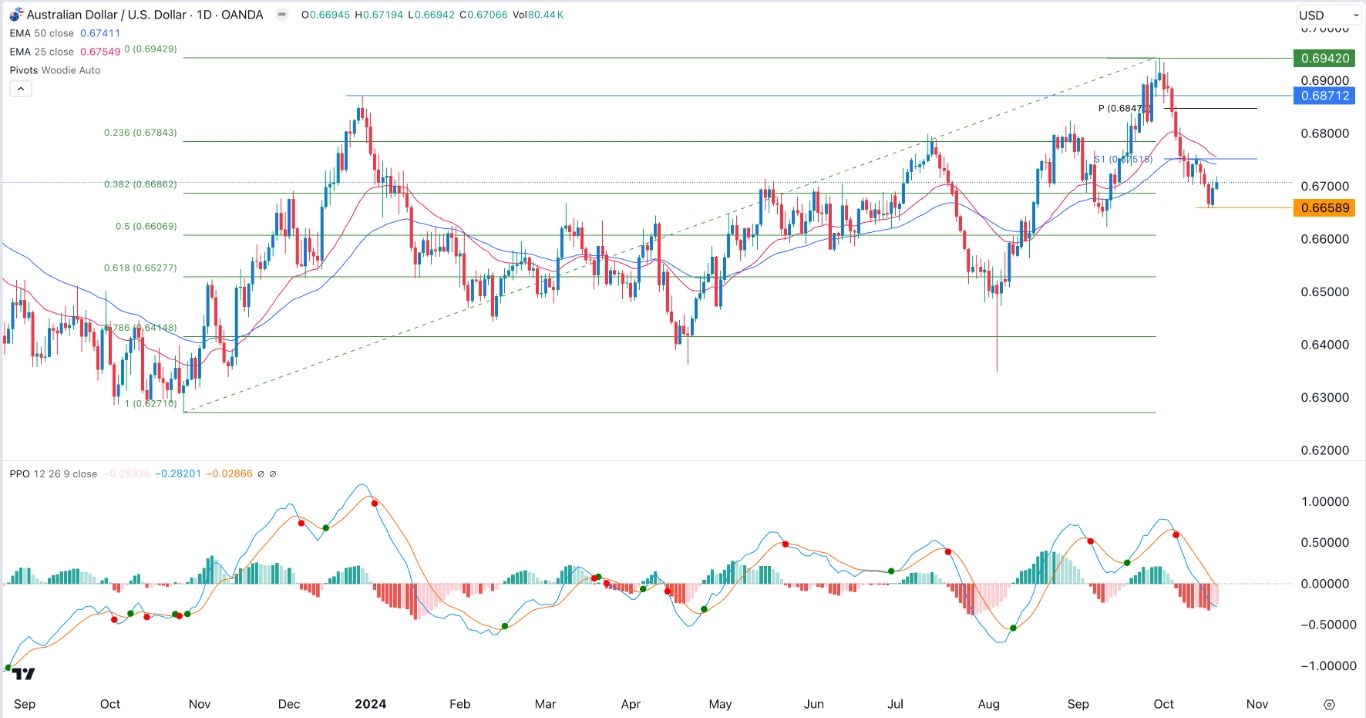

The AUD/USD exchange rate has sold off in the past few weeks as the US dollar index has rebounded.

It dropped and bottomed at 0.6658 last week and then crawled back to the psychological point at 0.6700.

The pair has remained below the 50-day and 25-day moving averages, which are about to form a bearish crossover pattern.

It is also hovering slightly above the 38.2% Fibonacci Retracement point. The Percentage Price Oscillator (PPO) have dropped below the zero line.

The pair will likely bounce back and retest the first Woodie Support level at 0.6755 and then resume the downward trend.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex platforms Australia to check out.