Bearish view

- Sell the AUD/USD pair and set a take-profit at 0.6585.

- Add a stop-loss at 0.6755.

- Timeline: 1-2 days.

Bullish view

- Buy the AUD/USD pair and set a take-profit at 0.6750.

- Add a stop-loss at 0.6585.

The AUD/USD pair’s crash continued its downward trend ahead of key US economic data. It retreated to a low of 0.6665, its lowest level since September 11 and by over 4% from its highest point this year.

The pair dropped after the latest Australian jobs numbers. According to the statistics agency, the unemployment rate remained at 4.2% in September as the economy created over 40k jobs during the month.

Top Forex Brokers

These numbers, together with the next inflation data, will provide more information on what the Reserve Bank of Australia (RBA) will do when it meets on November 5.

Analysts expect the bank will also leave interest rates unchanged and then cut rates in its December meeting. The RBA will be one of the last major central banks to slash interest rates since inflation has remained above its 2% target.

Australia’s bond yields have continued rising in the past few weeks. The ten-year yield has risen from 3.76% on September 17 to 4.32%. Similarly, the five-year yield rose from 3.38% to 3.9%, respectively.

The AUD/USD pair will next react to the upcoming economic data from the United States. Core retail sales are expected to come in at 0.1%, while the headline sales rose from 0.1% in August to 0.3% in September.

The US will also publish the Philadelphia Fed manufacturing index. Analysts expect the data to show that the index rose from 1.7 in September to 4.2. The industrial and manufacturing production are expected to drop by 0.1%.

These numbers will provide more information about the strength of the economy as the Fed considers the next moves. Stronger-than-expected numbers will raise the possibility of a more hawkish Federal Reserve.

AUD/USD technical analysis

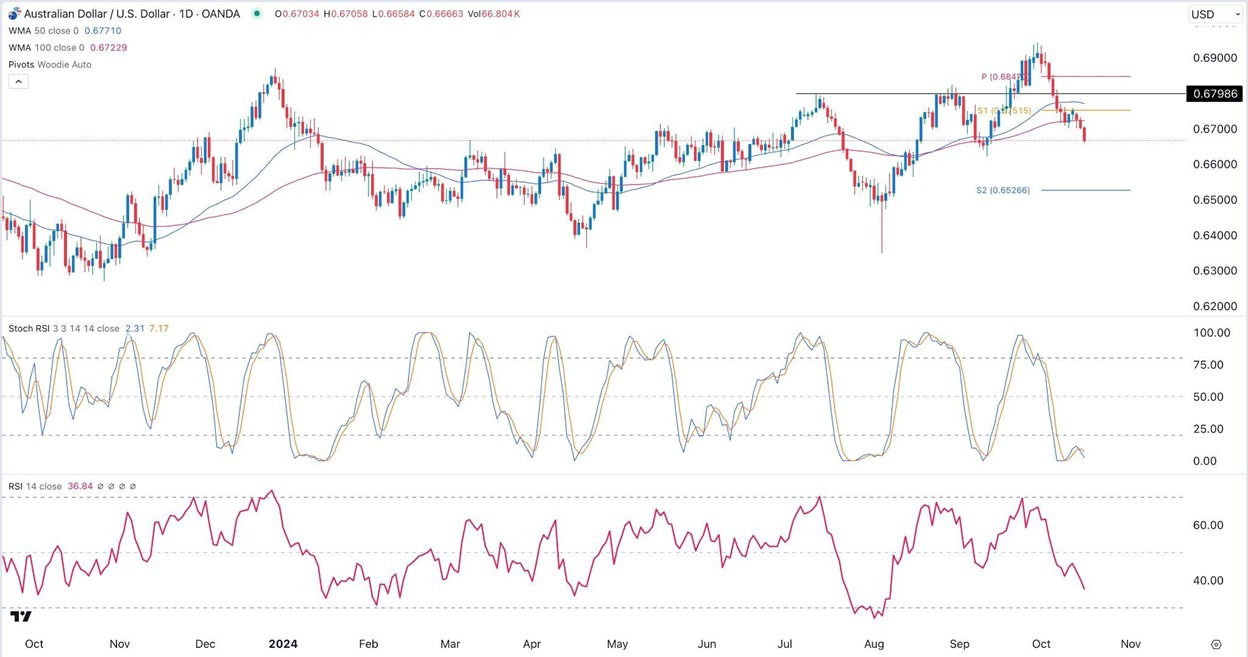

The AUD/USD exchange rate continued falling this week, reaching a low of 0.6665, its lowest level since September 12. It has crashed by about 4% from its highest level this year.

The pair moved below the 50-day and 100-day Weighted Moving Averages (WMA). Also, the Relative Strength Index (RSI) has moved below the neutral level of 50. The Stochastic Oscillator has dropped below the oversold level.

The pair dropped below the first support of the Woodie pivot point. Therefore, the AUD/USD pair will likely continue falling as sellers target the next support at 0.6600. The stop-loss of this trade will be at 0.6750, the first support of the Woodie pivot point.

Ready to trade our free trading signals? We’ve made a list of the top forex brokers in Australia for you to check out.