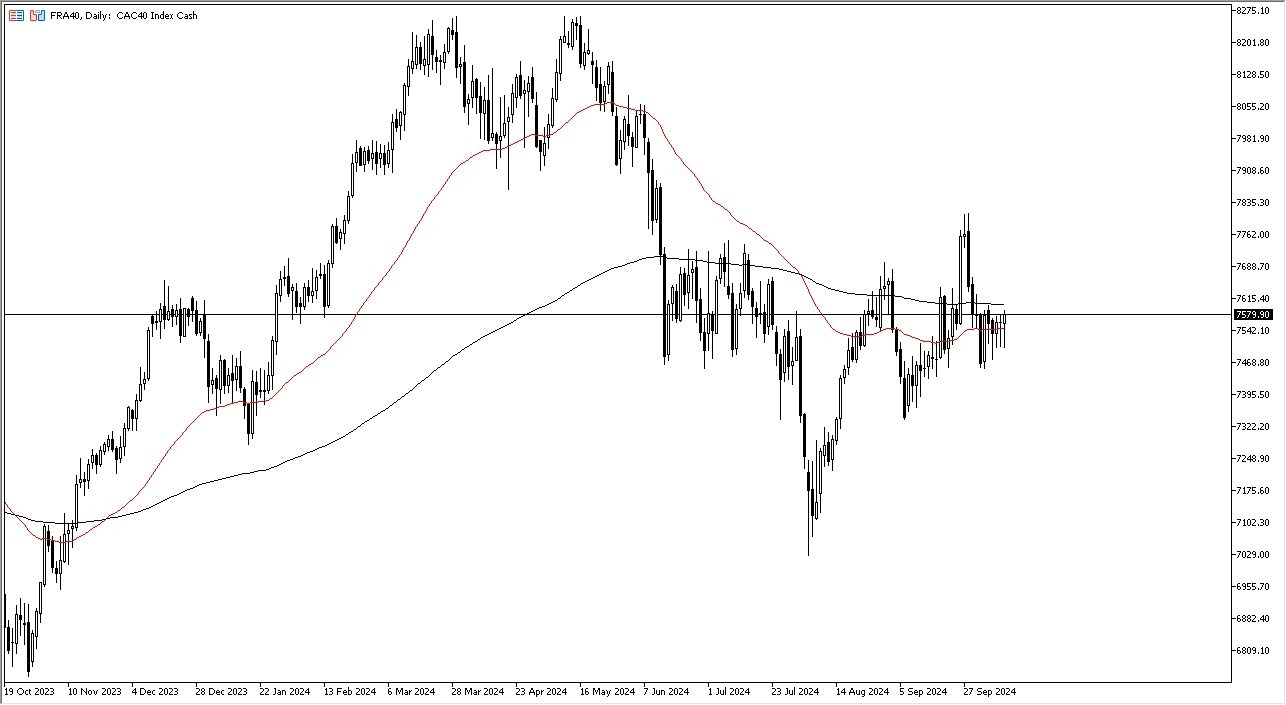

- During my daily analysis of European indices, the CAC 40 caught my attention because it has formed such an interesting and obvious set of candlesticks worth paying attention to.

- Over the last several days, we have seen this market drop, only to turn around and show signs of life again. After all, the market has formed 5 hammers this week, which of course suggests that there is a lot of support underneath just waiting to push this index up in the air.

Technical Analysis

The technical analysis of course is worth paying close attention to, due to the fact that the 5 hammers in a row is something that you just don’t see every day. Furthermore, it’s probably worth noting that the market is currently trading between the 50 Day EMA and the 200 Day EMA indicators, which of course is an area that you typically see some type of squeeze occur.

Because of this, I’d be very interested in a breakout here, and it certainly looks like the market is trying to lean in that direction. If we can break above the 200 Day EMA, then I think you’ve got a situation where market participants continue to see the need to drive this market higher, perhaps as high as €7750.

Top Forex Brokers

If we turn around a breakdown below the €7500 level, then the market is likely to go looking to the €7350 level, which of course is an area of interest, as it has shown itself to be important more than once. Furthermore, you also have to keep in mind that we had shot straight up in the air from there last week, so it all ties together.

In general, this is a market that I’m looking to get long of, but I also recognize that we need to see a little bit in the way of momentum in order to make that happen. Stocks in the European Union continue to move in the same general direction overall, so if we see Germany start to take off, you could see France follow right along.

Ready to trade the daily forex analysis? Here are the best CFD brokers to choose from.