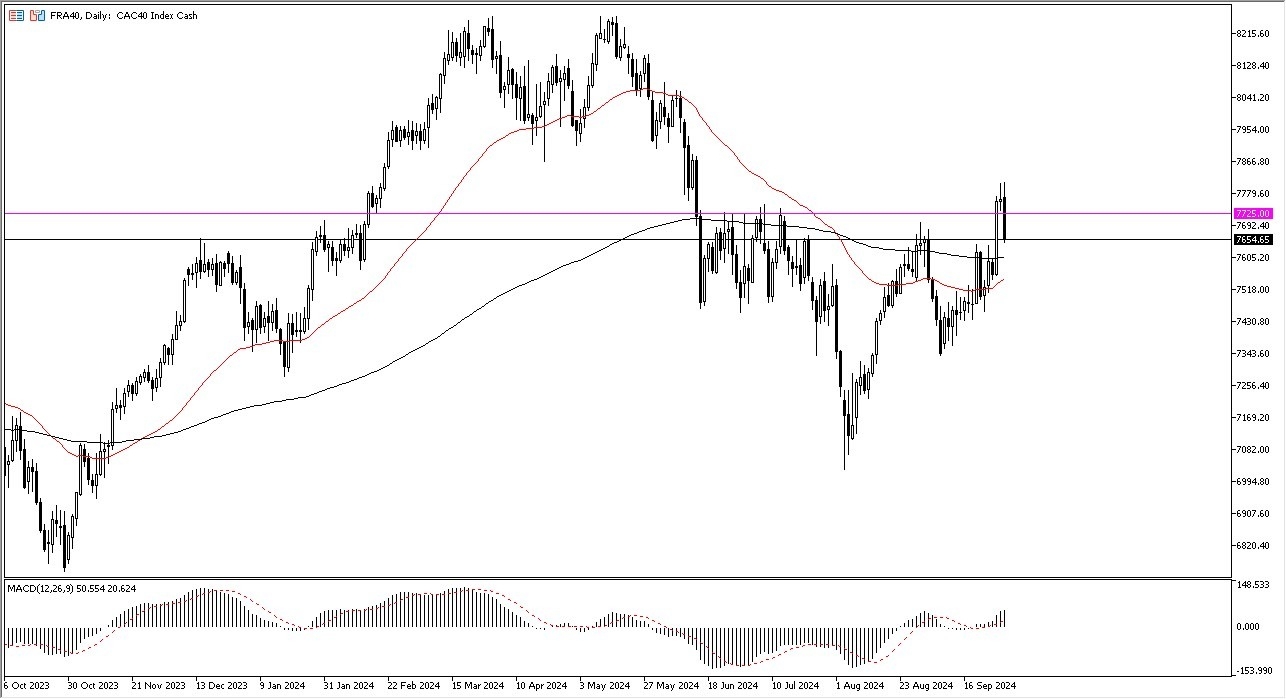

- The Parisian 40 fell pretty significantly during the early hours on Monday after initially trying to rally.

- We are back below the crucial 7,725 euro level, an area that previously had been a major resistance, and now we are approaching the 7,650 euro level.

- When I look at this chart, you can make an argument for a bit of an inverted head and shoulders, but the Parisian CAC will continue to move right along with other indices, as risk behavior seems to be a one to one correlation between multiple markets anymore.

Candlestick Size Matters

The size of the candlestick is very large, and I do think that turning around to send this market higher is eventually what could happen just due to the fact that the market is likely to continue to favor the overall attitude of buying indices based on loose monetary policy. That being said, this is a market that may have been a little bit overdone. So, it's not a huge surprise to see how this has played out. Furthermore, keep in mind that France is second fiddle to Germany when it comes to economic growth.

Top Forex Brokers

So, Germany more or less will lead the way. The market being able to break above the 7,800 euro level would be a variable sign. And at that point, I would think that we would continue to go perhaps to the 8,500 euro level. At this point, I have no interest in trying to short the market, at least not until we break down below 7,350 euros, something we're nowhere near.

I do think this will end up being a buy on the dip opportunity. That is more likely than not going to continue to be the case for a lot of equity markets around the world, and I don’t expect that France will be any different going forward. In general, this is a market that I think has plenty of support underneath to keep markets afloat.

Ready to trade our daily stock market analysis? Here are the best CFD brokers to choose from.