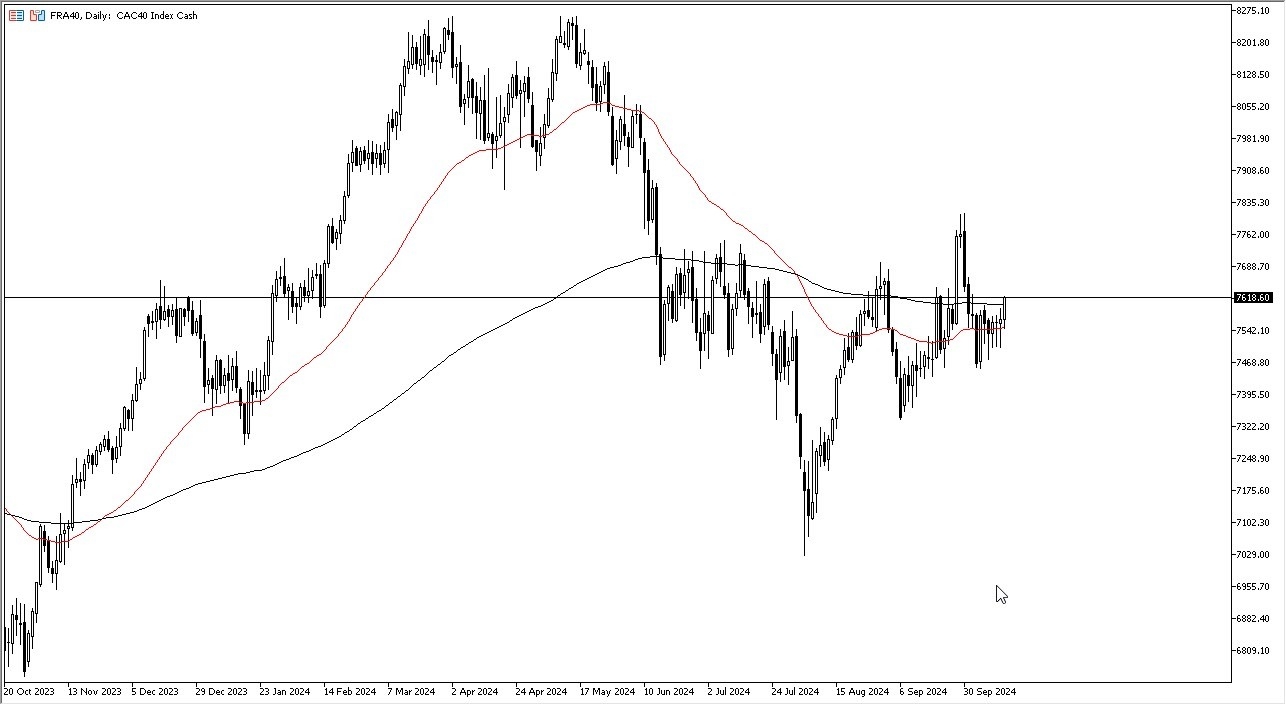

- The Parisian index initially pulled back just a bit during the early hours on Monday, but it seems like it continues to find support near the 50 day EMA.

- The market pulling back the way it has only to turn around and show signs of strength tells me that it's very likely that the CAC 40 will continue to rally.

- Because of this, I am looking to all EU markets for a chance to take advantage of momentum, as they all tend to move in the same direction over the longer term.

If We Can Break Higher

If we can break above the 7,650 euro level, then it's possible that the market goes looking to the 7,750 euro level. We are in the midst of perhaps forming some type of bottoming pattern as we are in the midst of trying to form an inverted head and shoulders.

Top Forex Brokers

All things being equal, this is a market that I think continues to be very noisy, but we'll probably take its cues from Germany and the decks. The CAC 40 of course is highly sensitive to the value of the euro because there are a lot of exports coming out of this index. And that of course is something that you need to be very cognizant of, all things being equal.

This is a market that I think is trying to turn things around, but it might be noisy for a while. With this being said, I don't have any interest in shorting the CAC anytime soon, mainly because there's so much liquidity that is going to be pumped into the markets by the Federal Reserve and the European Central Bank. So, with all of this, I'm looking at short-term dips as potential buying opportunities, but I also recognize this is a market that's probably going to be choppy on the way higher, so a little bit of patience probably goes a long way here, as it might be a slow move higher.

Ready to trade the daily analysis & predictions? We’ve made a list of the best online CFD trading brokers worth trading with.