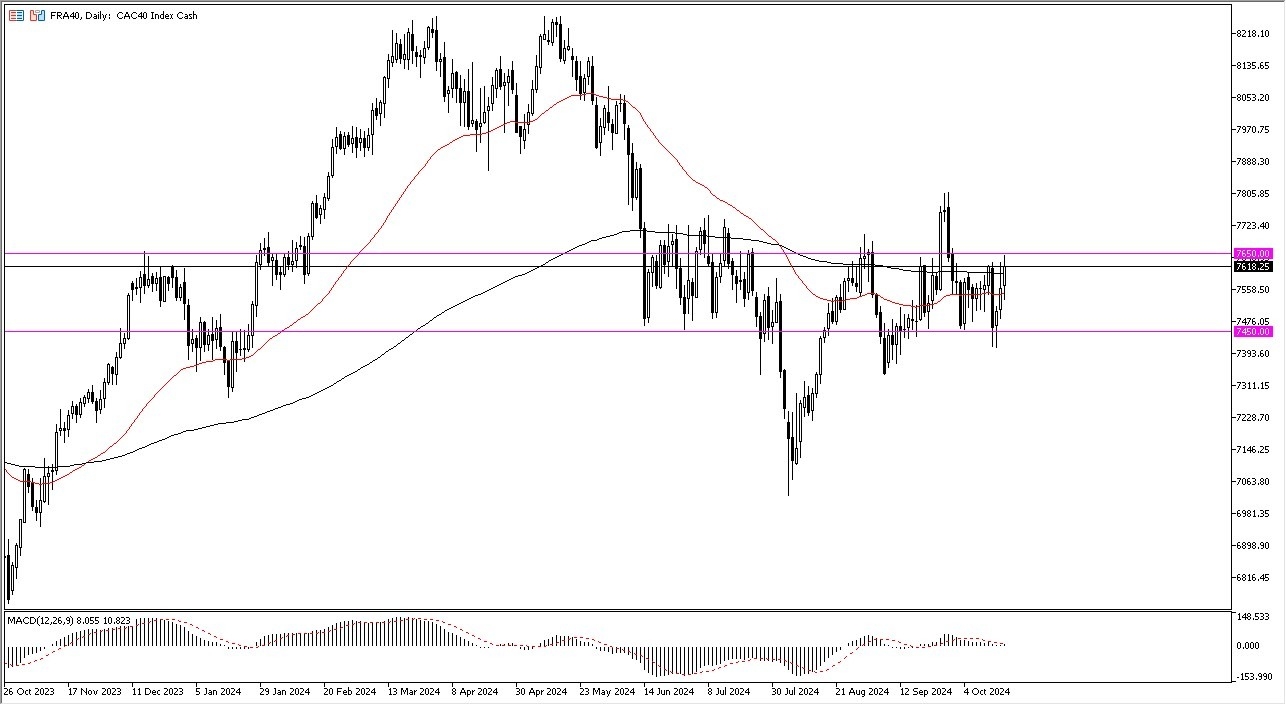

- The Parisian index rallied a bit during the course of the trading session on Friday after initially dipping below the 50-day EMA.

- This is a market that I think continues to see a lot of noisy behavior, but it is probably the Euro level has offered resistance yet again.

- Therefore I think we've got a situation where we are building up the necessary pressure to perhaps finally take off to the upside.

The momentum is a situation where we have a lot of questions to ask about the potential exports of France. The value of the euro is also a major part of what happens next.

Top Forex Brokers

On Pullbacks

On each and every pullback, I think there are plenty of buyers willing to get involved in the CAC as they are betting on the idea of the ECB interest rates becoming more and more accommodative and therefore stocks continue to gain ground. Underneath the 7,450 euro level I think is a ton of support just waiting to happen. So, it's not until we break through that area that I'd be concerned about this market. In the short term I think it's probably a sideways market that again is just building up the necessary inertia to go higher.

In fact, when you look at the 200 day EMA and the 50 day EMA, they are both flat and just simply going sideways. That tells you that we are more likely than not to consolidate further, but I think it's only a matter of time before we break out to the upside, assuming there isn't some kind of major issue when it comes to risk appetite globally. With this, I believe that short-term dips offer short-term buying opportunities. This is probably going to be the most important thing to remember about this pair, as the market continues to see a lot of questions about the overall European economy, and the French one as well.

Ready to trade our daily forex forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.