Potential Signal:

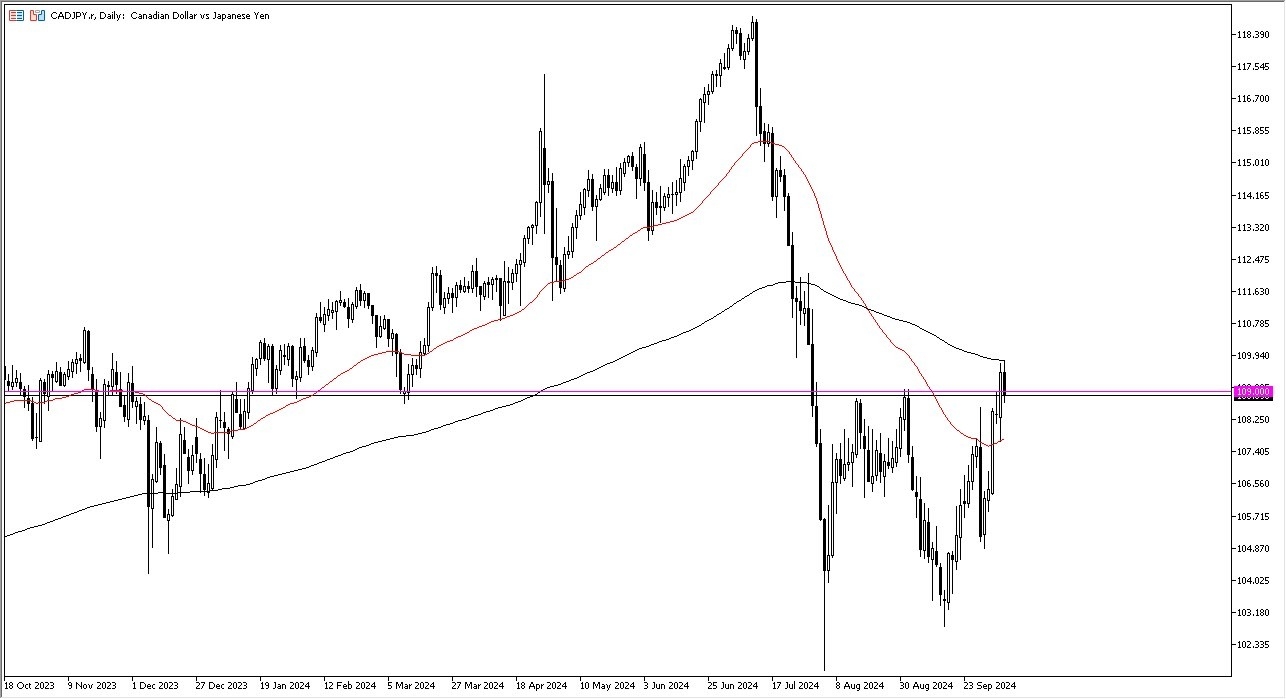

- At this point in time, I think that if the market closes above the 200 Day EMA, breaking above the ¥110 level, it’s time to start buying.

- I would put a stop loss at the ¥108.40 level.

- There are a lot of different things coming around at the same time when it comes to technical analysis of the CAD/JPY pair, and therefore I think it’s worth noting that the market is at an interesting place that a lot of people will be paying close attention to.

- After all, a lot of “market memory” can be found in this general vicinity.

Top Forex Brokers

Fundamental Reasons for this Market to Move

At this point in time, the most important thing to pay attention to is the idea of how crude oil moves the Canadian dollar. After all, the Canadians are well known to be major exporters of crude oil, but at the same time the market is likely to continue to see a lot of questions asked about that overall trend. After all, this is a pair that is highly sensitive to crude oil due to the fact that the Japanese import 100% of their crude oil, while of course Canada is a major exporter of that asset. Because of this, it does tend to move with the crude oil markets overall, so I always watch one before trading the other.

Another thing to pay attention to is the interest rate situation between the 2 economies. After all, Japan continues to have extraordinarily loose monetary policy, and the Bank of Japan has recently admitted that they cannot raise interest rates any further. On the other hand, the Canadians have cut interest rates, but it is still infinitely more profitable to hold onto the interest in Canada in comparison to Japan.

Furthermore, we pulled back from the 200 Day EMA, which is an indicator that a lot of people will be paying close attention to. Furthermore, we also have the 50 Day EMA underneath offering significant support, and therefore it’s likely that we have to see a lot of support in that area as well. As we are between these 2 indicators, I suspect that we will continue to see a lot of noise, but I am looking for short-term pullbacks in order to start buying.

Ready to trade our daily Forex signals? Here’s a list of some of the best currency trading platforms in the industry for you.