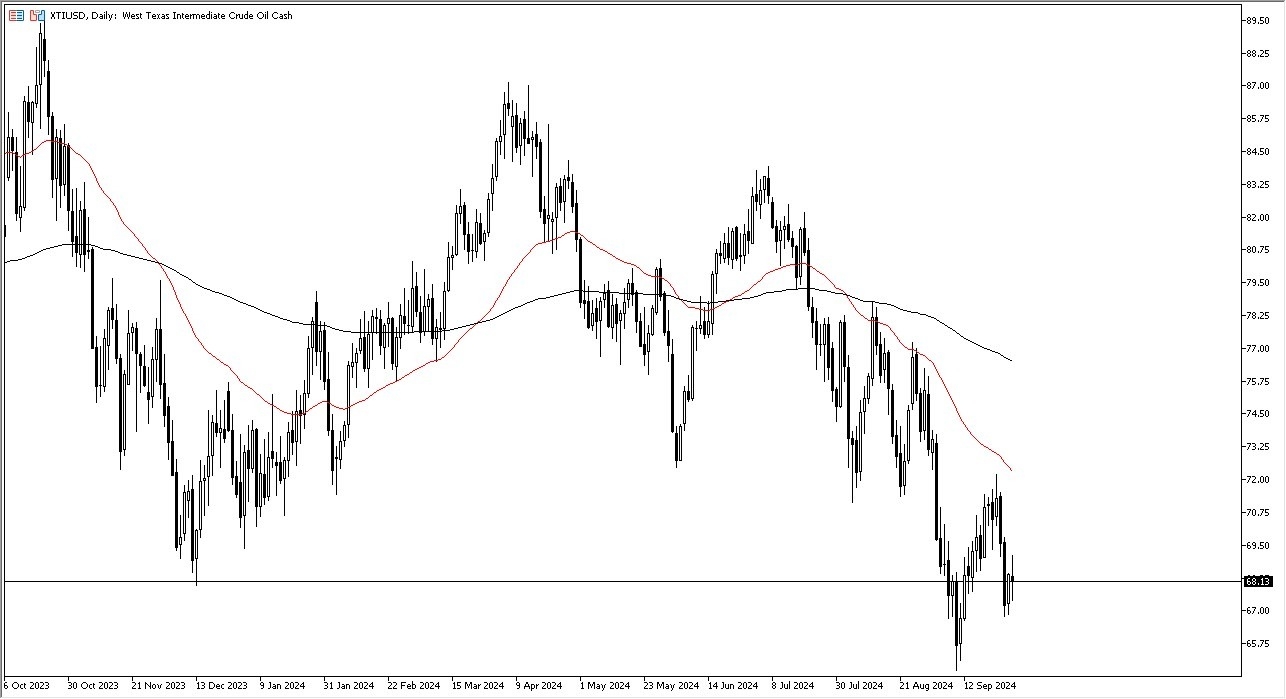

- The crude oil market is doing everything it can to possibly stabilize.

- That being said, you need to be very cautious in trying to get overly aggressive in this market, and I think at this point in time we are getting closer to the bottom than the top.

- After all, when you look at the longer-term charts, the $65 level has been crucial over the last couple of years, offering a massive amount of support.

- We had recently bounced from there, but then again, we had collapse from that bounds and the subsequent attempt to break above the 50 Day EMA.

Technical Analysis

The technical analysis for the crude oil market is absolutely miserable, but you also have to keep in mind that the $65 level is going to continue to be crucial. The fact that we are close to that region suggest that perhaps there should be a certain number of buyers willing to jump in. If we were to break down below the $65 level, the market is likely to completely crater, and at that point time it would probably signal that perhaps we are heading into something rather ugly from an economic standpoint.

Top Forex Brokers

On the other hand, if we can break above the $69.50 level, then I suspect that WTI goes looking to the 50 Day EMA, sitting right around the $72 level. The $72 level is an area that has been important multiple times, and if we can break above that level then it’s possible that we could see crude oil goes looking to the 200 Day EMA, sitting right around the $76 level. Ultimately, this is a market that I think continues to see a lot of volatility, and therefore you need to be cautious with your position sizing.

The position size is absolutely everything when it comes to trading this market, due to the fact that we have seen a lot of violent moves, and of course we have a lot of geopolitical concerns in the Middle East, as well as Russia being involved in a hot war, we could see a sudden spike in oil, but quite frankly after this past weekend’s news, I think the world is willing to look past all of this, at least for the short term.

Ready to trade daily Forex analysis? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.