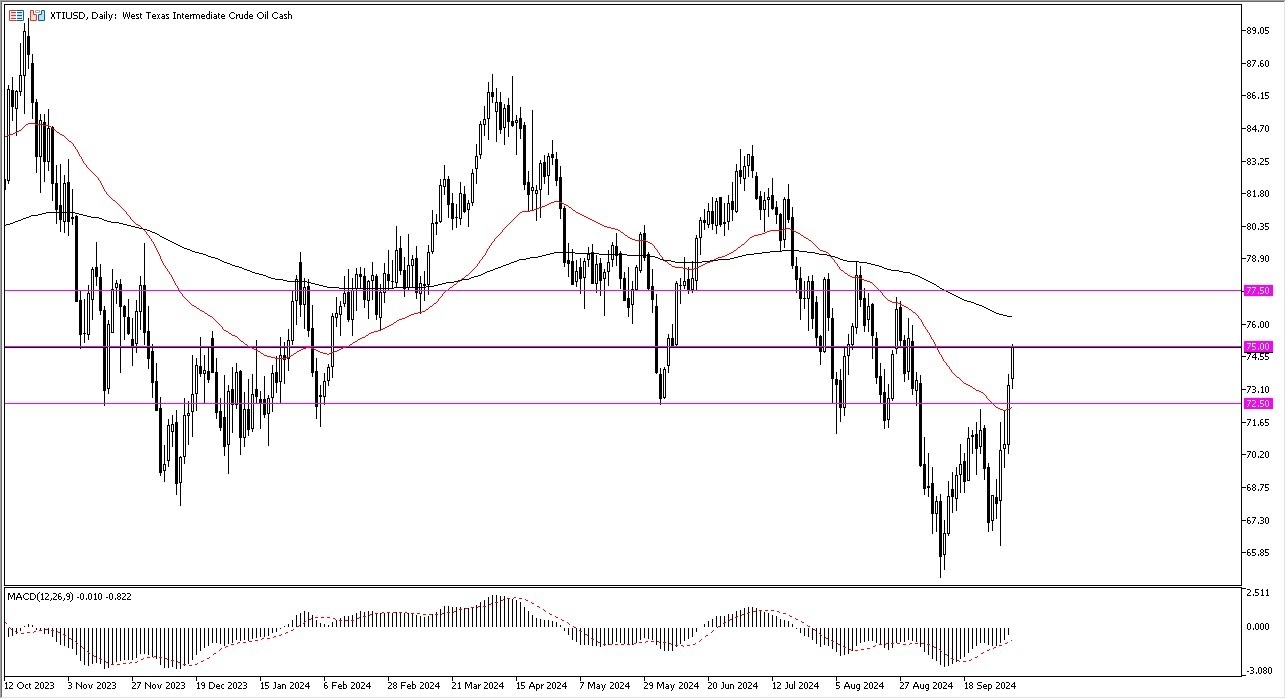

- The West Texas Intermediate Crude Oil market has been very noisy, but mainly just to the upside.

- With this being the case, the market is likely to continue to see a lot of buyers on short-term pullbacks, as the market is likely to continue to see a lot of value hunting after what we have seen as far as momentum is concerned.

All things being equal, the market breaking out to the upside is driven by a lot of different things, not the least of which would be the fact that the Middle East is essentially on fire at the moment. If that’s going to continue to be the case, that obviously will be reflected in the price of crude oil, and furthermore we have a lot of interest shown in this market due to the fact that the Non-Farm Payroll announcement came out hotter than expected, which does suggest that perhaps demand will continue to pick up. Between demand picking up, inventory numbers dropping, and then of course the fact that the Middle East continues to see a lot of conflict is going to continue to be an upward back draft.

Top Forex Brokers

Crude oil is the lifeblood of economic activity

Keep in mind that crude oil is the lifeblood of economic activity, and there is going to be a certain amount of reaction to what’s going on in the overall economy shown in the oil market. The fact that people are willing to jump in and buy crude oil after forming a massive “W pattern” suggest that we are going to continue to see economic growth, and I think at this point in time you would be looking to buy dips in order to pick up bits and pieces of value in this market. The $72.50 level should be a significant support level, as it was previously a resistance barrier. Ultimately, this is a market that continues to see a lot of volatility, but I still think you are looking for upward momentum before it’s all said and done.

Ready to trade our Forex daily analysis and predictions? Here’s a list of some of the best Oil trading platforms to check out.